Employment Situation

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.

Price action the last couple days has been encouraging with the bulls defending against pullbacks. If the Employment Situation report shows inflation is in check, the bulls appear to have the upper hand. Expect fast price action after the open and keep in mind whipsaw are possible due to the overall market volatility.

On the Calendar

We have the biggest report of the week on the Economic Calendar before the market open. The Employment Situation comes out at 8:30 AM may provide clues that will influence the FOMC coming decision on interest rates. According to consensus, February non-farm payrolls are expected slightly higher at 205,00 vs. the 200,000 reading in January. The unemployment rate is expected to tick down to 4.0%, but hourly earnings, rising only by a modest 2% in the month with year-on-year holding at 2.9%. We have one Fed Speaker today that is speaking three times 8:40 AM, 10:45 AM and finally 12:45 AM. There are two other non-market moving reports such as Wholesale Trade at 10:00 AM and the Oil Rig Count at 1:00 PM.

On the Earnings Calendar, we have just 73 companies reporting results today.

Action Plan

Once again it was encouraging to see the bulls hang in there yesterday and not give in to all the hype over trade wars. In fact, if you judge by the market reaction, the President’s plan thus far was a non-event. This morning it’s all about the Employment Situation report. Unfortunately, all we can do as retail swing traders is to deal with the gap up or gap down that it’s capable of producing at the open. As I write this, futures markets are essentially flat as the market waits.

A report that does not display inflationary pressures could move the market higher which the price action seems to favor at the moment. Of course, if inflation is seen raising its ugly head enough to cause an FOMC reaction the market tone could quickly shift bearish. Only time will tell, and all we can do is patiently wait for the open. I wish you all a great day and a fantastic weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/UGrhS6yZs6Y”]Morning Market Prep Video[/button_2]

Battle for Control

Yesterday’s defense of support was indeed a very welcome sight. Price action would suggest that the bulls may be gaining the upper hand, but this battle for control will still require a significant effort. Although the QQQ and IWM are above the 50-day average, the SPY and the DIA are still below giving a reason for caution. As this battle for control plays out, keep in mind that the VIX is still indicating significant volatility. It would also be wise to remember that the Employment Situation number Friday morning has the potential to move the market substantially. The market seems to be very sensitive to any hint of inflationary pressures. Friday’s report could provide and important clues to the next FOMC action.

Yesterday’s defense of support was indeed a very welcome sight. Price action would suggest that the bulls may be gaining the upper hand, but this battle for control will still require a significant effort. Although the QQQ and IWM are above the 50-day average, the SPY and the DIA are still below giving a reason for caution. As this battle for control plays out, keep in mind that the VIX is still indicating significant volatility. It would also be wise to remember that the Employment Situation number Friday morning has the potential to move the market substantially. The market seems to be very sensitive to any hint of inflationary pressures. Friday’s report could provide and important clues to the next FOMC action.

On the Calendar

There is a full Economic Calendar today, but there is only one report that’s likely to move the market. At 8:30 AM the Jobless Claims number came in at a 49-year low last week should rise slightly to 220,000 according to consensus. We will also hear from the Challenger report, Consumer Comfort, Services Survey, Nat. Gas Report, Fed Balance Sheet and Money Supply and several bond events throughout the day.

Today is the biggest day of the week on the Earnings Calendar with 236 companies expected to report. Make sure to check reporting dates on the companies you hold and those you’re considering to purchase.

Action Plan

After gapping sharply lower, Wednesday proved to be a roller coaster ride as the bulls and bears fought for control. By the end of the day, the bulls had the upper hand with the SPY once again testing the 50-day average from below. The QQQ held firmly as the market leader, and in a surprising show of strength the small caps confidently broke resistance levels as well as defeating the downtrend. The Dow is the market laggard still more than 400 points below its 50-day average and 200 below the big round number of 25,000.

Futures this morning are currently suggesting a flat to slightly bullish open with the VIX hovering around a 17 handle. With bulls showing a strong willingness to defend price supports I’m cautiously optimistic that they are gaining the upper hand. However, with the DIA and SPY still below the 50-day and important clues on inflation coming in Friday morning Employment Situation report, anything is possible. Stay focused on price and remain flexible. Don’t buy anything that you are not willing to hold through some volatile swings. Smaller than normal position sizes can be a good way to plan for the additional volatility.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/fTQnIdLZE3w”]Morning Market Prep Video[/button_2]

Hypersensitive

I must admit after the close yesterday I was encouraged that daily range of price action seemed to be calming slightly. I was also happy to see the bulls ability to defend the big Tuesday gains as the SPY tested the 50-day average from below. Sadly after the close, news of the Cohn resignation, reignited the volatility of this hypersensitive market. Currently, the futures are pointing to a substantial gap down at the open. If selling persists after the open, we could see another failure of the 50-day average and another lower high. We should prepare for very fast price action at the open and the possibility that last Friday’s low might see a retest. Buckle up it could be a bumpy ride today.

I must admit after the close yesterday I was encouraged that daily range of price action seemed to be calming slightly. I was also happy to see the bulls ability to defend the big Tuesday gains as the SPY tested the 50-day average from below. Sadly after the close, news of the Cohn resignation, reignited the volatility of this hypersensitive market. Currently, the futures are pointing to a substantial gap down at the open. If selling persists after the open, we could see another failure of the 50-day average and another lower high. We should prepare for very fast price action at the open and the possibility that last Friday’s low might see a retest. Buckle up it could be a bumpy ride today.

On the Calendar

A big day on the Economic Calendar begins at 8:15 AM with the ADP Employment Report which is expected to show 195,00 gain in private payrolls. At 8:30 AM the International Trade deficit is expected to widen to 55.1 in January vs. February’s 53.1 reading. Also at 8:30 is the Productivity and Costs report which according to consensus rose at an annualized 3.2% rate. 10:30 AM brings the EIA Petroleum Status Report which is not forecast forward but has recently supported oil prices showing supply declines. The Beige Book which is used by the FOMC when making a rate decision is out at 2:00 PM today. If it shows, inflationary pressures are rising the interest rate hypersensitive market could react. Also on the Calendar this morning are three Fed Speakers on the speaking tour ahead of the FOMC meeting later this month.

On the Earnings Calendar, there are just over 150 companies expected to report results today. By in large earnings continue to come in mostly positive with earnings growth projected this year.

Action Plan

The price action yesterday was very 2-sided, but at the close, I was happy to see the range of the day finally staring calm down a little. Unfortunately, after the close, a sucker punch came flying in as the Wall Street-friendly Cohn resigned. Futures moved sharply lower on the news and this morning as I write this a gap down of about 300 Dow points look likely. So much for calming down! Technically speaking this new could not have come at a worse time with the major indexes testing the 50-day moving average. The big question to be answered now is; will last Friday’s low hold as support? Let’s hope cooler heads prevail.

Expect very volatile price action this morning as the market works through the emotion of the morning gap down. Intraday whip-saws are likely, and price action could be very fast. Anything is possible so remain flexible and avoid making decisions based on your particular bias. Focus on price and the clues it will provide.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/9wnkMWndqnQ”]Morning Market Prep Video[/button_2]

Symmetrical triangle

Yesterday follow-through bullishness was a welcome sight, but at the same time, it raised additional caution flags as we approach the 50-day average resistance on the SPY and the IWM. The DIA still has to rally significantly just to reach its 50-day with the QQQ’s remain the dominant market leader. Looking at the index charts, we now see the possibility of a tricky symmetrical triangle pattern. The Symmetrical triangle pattern gives us about 50/50 odds of it breaking higher or breaking down. The large range between the high and low makes the current pattern particularly challenging.

Yesterday follow-through bullishness was a welcome sight, but at the same time, it raised additional caution flags as we approach the 50-day average resistance on the SPY and the IWM. The DIA still has to rally significantly just to reach its 50-day with the QQQ’s remain the dominant market leader. Looking at the index charts, we now see the possibility of a tricky symmetrical triangle pattern. The Symmetrical triangle pattern gives us about 50/50 odds of it breaking higher or breaking down. The large range between the high and low makes the current pattern particularly challenging.

If you recall it was just one week ago when the Dow rallied 400 points in a single day. The next day it gave it all back, and that was when the index had managed to break above the 50-day. Now the dilemma we face is that the big rally yesterday only brought is back to test the underside 50-day average. Fortune may favor the bold if your right on direction but the bold could also lose a fortune if they happen to be wrong. Volatility remains high so plan your risk accordingly.

On the Calendar

Today’s Economic Calendar begins and ends with Fed Speakers today on the lead of the FOMC announcement on March 21st. Dudley speaks at 7:30 AM, Brainard at 7:00 PM and Kaplin at 8:30 PM. The Redbook number is out at 8:55 AM as well as a couple of bond events which are very unlikely to move the market. However, the Factory Orders report at 10:00 AM can move the market and according to consensus will see a decline 1.2% in January.

On the Earnings Calendar today we have 142 companies reporting results. Stay vigilant as the first quarter earnings season drags on and on.

Action Plan

A very encouraging day yesterday as indexes followed through on from Friday’s bullishness. The higher low has now developed a potential wedge pattern or what many call a symmetrical triangle. The SPY and IWM are not testing their respective 50-day averages but still have the resistance levels above as well as the downtrend yet to conquer. Believe it or not, the Dow needs to rally 400 points more just to test its 50-day averages as resistance, so there is still a lot of work that needs to be done by the bulls. As of now, the Dow will have to prove it can get back over the big round number 25,000 which it could do battle with today.

A wedge pattern (symmetrical triangle) can be a tricky pattern to negotiate especially if that pattern has the huge range between the highs and lows we currently have on the DIA, SPY, and IWM. The current rally has produced a lot of good-looking charts. Keep in mind if the indexes fail to break-through the 50-day resistance the swing lower to test support again could be very punishing on any new entries. Plan your risk carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/KI8iCCc3f28″]Morning Market Prep Video[/button_2]

How clever are you?

The Friday was a welcome sight but was it truly a hold of price support. When the market is bearish, it’s easy to for traders to mistake a relief rally for bullishness. Please keep in mind that a one-day-rally does not reverse a downtrend. Remember to confirm a bullish candle price must follow through. Over the years I learned that lesson the hard way by jumping in thinking I was clever enough to catch the exact bottom. Although it would work every now and then, more often than not, I had my head handed to me with a big loss. Not so clever after all!

The Friday was a welcome sight but was it truly a hold of price support. When the market is bearish, it’s easy to for traders to mistake a relief rally for bullishness. Please keep in mind that a one-day-rally does not reverse a downtrend. Remember to confirm a bullish candle price must follow through. Over the years I learned that lesson the hard way by jumping in thinking I was clever enough to catch the exact bottom. Although it would work every now and then, more often than not, I had my head handed to me with a big loss. Not so clever after all!

I just like you am hopeful Friday’s rally will prove to hold price supports. The operative word is “prove.” One day of bullish price action is hopeful, but it is not proof! The truly clever have the patience and discipline to wait for some proof and consequently take much less heat on their trades.

On the Calendar

W begin this week on the Economic Calendar with only one important report. At 10:00 AM Eastern the IWM non-MFG index is expected to decline a bit but still very strong at 58.8 vs. January’s 59.9. There are two reports that are not expected to move the market as well three bond actions and a Fed Speaker at 1:15 PM.

On the Earning Calendar, we have just about 60 companies fessing up quarterly results. Make sure to keep checking as the earnings season continues to drag on for what seems forever.

Action Plan

After gapping down nearly 200 in at open, the bulls found some energy to rally off the lows in all four of the major indexes. With the fear of Trade Wars heating up the futures are holding up better than I would have expected this morning. As I write this, the Dow Futures on pointing to a 50 point gap down. Not great but better than the triple point gaps of late.

Volatility is likely to remain high, but the hope of the QQQ, SPY, and IWM holding support is encouraging. If we could get a little calming of the nerves and have price action take a little rest, perhaps better trader could be just around the corner. Don’t mistake hope for bullishness. Remember we are still in a downtrend and a hold near price supports may only be temporary. Stay focused on price action, stay disciplined to your rules and plan carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/lgiPnd7JaiI”]Morning Market Prep Video[/button_2]

Rules trump hope.

Even though the price action suggested more bearishness yesterday, I must admit I was hoping for a stalemate that would hold on to the 50-day average. Rules trump hope. Obviously, the market could care less about what we hope for and if we try to stand and fight the market will always win. For now, the market has chosen to remain in turmoil and fear is back on the rise. Stick to your trading rules they are there to protect your capital from you and your emotions. With the VIX rising price action will remain challenging with big opening gaps and violent price swings. Let the big boys fight it out and wait for your edge to return.

Even though the price action suggested more bearishness yesterday, I must admit I was hoping for a stalemate that would hold on to the 50-day average. Rules trump hope. Obviously, the market could care less about what we hope for and if we try to stand and fight the market will always win. For now, the market has chosen to remain in turmoil and fear is back on the rise. Stick to your trading rules they are there to protect your capital from you and your emotions. With the VIX rising price action will remain challenging with big opening gaps and violent price swings. Let the big boys fight it out and wait for your edge to return.

On the Calendar

On this first day March we again have a busy Economic Calendar day. At 8:30 AM the Jobless Claims are expected to come in at 230K as labor demand continues. Personal Income and Outlays also out at 8:30 AM this morning. The PCE price index is expected to rise 0.4% in January for a year-on-year rate of 1.7%. Consensus expects personal incomes to rise 0.3% but consumer spending is expected to pull back slightly only gaining 0.2%. 9:45 AM brings the PMI Mfg Index report is expected to come in at 55.7 in February vs. 55.5 in January. At 10:00 AM the ISM Mfg Index has a February consensus of 58.9 vs. the 59.1 January reading. Also at 10:00 AM is the Construction Spending report which consensus suggests should come in with a rise of 0.3% in January. Our new Fed Chairman Jerome Powell will speak the Senate Banking Committee at 10:00 AM and Dudley speak at 11:00 AM.

We have just over 225 companies reporting today according to the Earnings Calendar.

Action Plan

During the majority of the trading day yesterday the bulls and bears seemed equally matched, and we were chopping in a narrow range. I was hopeful we could hold in a small range and see some claiming in the market, but obviously, the bears had other plans. The last 30 minutes of the day the bears launch a full-on attack causing a failure of the 50-day average on both the SPY and the DIA. The VIX quickly rose closing just below a 20 handle as investor fear spiked. The Dow managed to hold on the psychologically important 25,000 level by just 29 points.

Unfortunately, the Dow Futures are currently suggesting a gap down of more than 100 points at the open piling onto the overall market fears. The DIA, SPY and the IWM are now technically set up for a possible retest of the February lows. Let’s hope the bulls call in some reinforcements draw a line in the sand and hold onto a higher low. Expect very fast price action today and be prepared with a plan to protect your capital.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/-HS-NhIAK6I”]Morning Market Prep Video[/button_2]

Adapt to the change.

Up 400 points Monday and reverse it on Tuesday is the very definition of extreme volatility in my opinion. Consequently, we must adapt to the change. I suggested that the February selloff would require weeks if not months to resolve itself before we could get back to normal activity. Traders often fail to recognize and adapt when the market suddenly changes character. We try to trade at the same level of intensity as when volatility was low, and the market was trending. Everything that had been working so well is now handing out losses and frustration. Long story short, adapt your trading to the new normal or continue to have you account chopped up and your confidence destroyed. You’re the boss; the responsibility rests with you.

Up 400 points Monday and reverse it on Tuesday is the very definition of extreme volatility in my opinion. Consequently, we must adapt to the change. I suggested that the February selloff would require weeks if not months to resolve itself before we could get back to normal activity. Traders often fail to recognize and adapt when the market suddenly changes character. We try to trade at the same level of intensity as when volatility was low, and the market was trending. Everything that had been working so well is now handing out losses and frustration. Long story short, adapt your trading to the new normal or continue to have you account chopped up and your confidence destroyed. You’re the boss; the responsibility rests with you.

On the Calendar

Wednesday is another big day on the Economic Calendar. It gets going at 8:30 AM Eastern with the latest reading on GDP which consensus suggests will decline slightly by 0.15 to 2.5% annualized. Consumer spending is expected to slip 0.1 percent to 3.7% with the GDP price index coming in at a 2.4% rate. At 9:45 is the Chicago PMI lead by a 6-year high for employment is expected to come in with a solid 65.0 reading. Pending Home Sales at 10:00 AM is expected to see a moderate gain of 0.3 percent today according to consensus. To round out the calendar for today, the EIA Petroleum Status Report at 10:30 AM is not forecast but had a nice decline in supplies bolstering oil stocks.

On the Earnings Calendar, we are expecting more than 190 reports today. I know this season seems to be dragging out forever but remain vigilant checking reporting dates and preparing a plan to deal with them professionally.

Action Plan

Yesterday I suggested preparing for the potential for a bumpy day and sadly that turned out to be correct. Our new Fed Chairman said the Economy is improving but suggested the possibility of adding one more rate increase is possible if the improvement continues. As a result, the Market reversed Monday’s nice bullish rally leaving behind some nasty looking bearish engulfing patterns. The VIX, in fact, did bounce off of the 50-day average and price support that I pointed out as possible yesterday.

A bearish engulfing suggests a lower low print is likely today however with the indexes all above the 50-day average it’s entirely possible they could soon find some support at least temporarily. Currently, futures are pointing to flat to slightly bearish open. I see that as a very good sign because we could have easily been staring at a large gap down at the open today. I’m expecting choppy price action today as the bulls and bears battle for control around the 50-day average. Remember with volatility, so high anything is possible.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/UjrjKcIn8pI”]Morning Market Prep Video[/button_2]

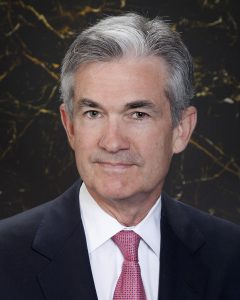

All Eyes on Jerome Powell

Today we get an introduction to our new Fed Chairman, Jerome Powell. Will he be hit the ground running hawkish on interest rates or will ease into the position with a bit more dovish approach? No matter what he says, we can expect the market to be sensitive to each of every word. With the market now showing such bullish strength even hint of dovishness could launch the market higher. Hawkish comments could easily have the reverse effect.

Today we get an introduction to our new Fed Chairman, Jerome Powell. Will he be hit the ground running hawkish on interest rates or will ease into the position with a bit more dovish approach? No matter what he says, we can expect the market to be sensitive to each of every word. With the market now showing such bullish strength even hint of dovishness could launch the market higher. Hawkish comments could easily have the reverse effect.

Couple that with a big day of earnings and a heavy economic calendar we should be prepared for an extra dose of volatility today. That means the potential for fast price action and whipsaws. Buckle up the ride could be thrilling but also very bumpy. Remember the 400 point rally from yesterday could be just as quickly reversed. Follow your rules and maintain your discipline and always remember that cash is position and that every day need not be traded to achieve success in the market.

On the Calendar

We get going at 8:30 AM Eastern on the Economic Calendar. First is the Durable Goods Orders which consensus is expecting a 2.0% decline with transportation seen up 0.3% and core capital goods orders rising 0.5%. Next is international Trade in Goods which is, of course, running in a deficit however it is expected to narrow with consensus expecting 71.3 billion vs. 72.3 billion in December. Also at 8:30 AM and 10:00 AM, our new Fed Chairman Jerome Powell will testify in Congress. The market could be very sensitive to anything he says. At 9:00 AM is the S& P CoreLogic Case-Shiller which forecasters see as rising 0.6% in December with a yearly increase seen at 6.3%. There are several other economic reports that are unlikely to move the market as well as a couple of bond events.

On the Earnings Calendar there more than 240 companies expected to report today. Stay on your toes.

Action Plan

Yesterday I mentioned to make sure and not chase but watch for the follow through bullish price action before entering anything. After the morning pop, the indexes did pause and pull back slightly before the bulls began a rip-roaring party that at one point had pushed the Dow up more than 400 points. It’s not all that surprising after a move like that the current Dow Futures are suggesting a gap down but only of about 50 points thus far. However, there is a big economic reports, a slew of earnings and our new Fed Chairman speaking that would shake this up before and after the open.

With the major indexes now solidly above the 50-day average a pullback to test it as support is not out of the question. On the other hand, if yesterday’s strong bullish attitude can continue to push us higher with little assistance from good earnings news and Jerome Powell not rushing into rate increases. It could be a very bumpy ride today with so much in the works. Remember what goes up can come down just as fast. Make sure you have an exit plan on all trades to either take profits or cut losses if a reversal does develop.

Trade Wisley.

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/NB22fcaIOtQ”]Morning Market Prep Video[/button_2]

Be careful not to chase.

Another day and yet another triple point gap indicated by to the Dow Futures. Be careful not to chase! One of the many issues I struggled with as an inexperienced trader was getting caught up in the drama of the market. I would watch all the financial news with the exaggerated headline graphics and talking heads touting their market greatness and lose all sense of discipline. Que the dramatic bumper music. I would see the futures pointing to a big gap up and jump headlong into the shark-infested waters.

Another day and yet another triple point gap indicated by to the Dow Futures. Be careful not to chase! One of the many issues I struggled with as an inexperienced trader was getting caught up in the drama of the market. I would watch all the financial news with the exaggerated headline graphics and talking heads touting their market greatness and lose all sense of discipline. Que the dramatic bumper music. I would see the futures pointing to a big gap up and jump headlong into the shark-infested waters.

After getting my fair share of shark bites and losing more capital than I care to remember if finally learned a few very painful lessons. Trading plan and trading rules are there to protect you from you. However, they only work if you learn to ignore the drama and develop the discipline to follow them. After 13 years of supporting my family as a full-time trader, I can confidently say it’s my discipline to follow my plan that has made me successful. Are you following your plan or are you allowing the drama of the market control your destiny?

On The Calendar

The last week of February begins with a busy week on the Economic Calendar. The very important New Home Sales number come out at 10:00 AM Eastern as is expected to weaken but matain its strong rising trend with at print of 600K. At 8:30 AM is the Chicago Fed National Activity Index and at 10:30 comes the Dallas Fed Mfg. Survey, but neither is expected to move the market. We round out the today’s calendar with three bond related events.

We also have another busy week on the earnings calendar as this earnings season continues to drag forever. Today there are over 12o companies expected to report earnings today. Always be prepared.

Action Plan

On Friday afternoon last week, the price action started to indicate improvement and give the appearance of holding support. The Dow managed to close above the psychological 25k level as well as hold above the 50-day average. The SPY also showed bullish strength above the 50-day average, and even the beleaguered IWM managed to close a few ticks above this important average. The QQQ continued to matain market leadership and closed Friday within striking distance of all-time resistance highs.

Unfortunately, it looks as if this gap-happy market will continue this morning as with the Dow Futures suggestion it will open about 150 points above Friday’s close. With VIX pulling back to test price support and the 50-day average be careful not to get caught of in morning drama and chasing into the gap. Keep in mind that price volatility remains high and the big intraday reversals we experienced last week are still possible. Stick to your plan and stay disciplined to your rules.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/oL4cv8hhgBE”]Morning Market Prep Video[/button_2]

Patience

We have all heard the phrase; Patience is a Virtue. For the swing trader patience is a difficult but very import skill that each of us must learn to master. To be successful in this business, we wait for the proper combination of patterns, price action, volume and volatility that provides us with an Edge. That sweet spot where risk is acceptable and probabilities move in our favor. Patience is also a test of endurance because the longer we wait, the harder it is to maintain the discipline of being patient.

We have all heard the phrase; Patience is a Virtue. For the swing trader patience is a difficult but very import skill that each of us must learn to master. To be successful in this business, we wait for the proper combination of patterns, price action, volume and volatility that provides us with an Edge. That sweet spot where risk is acceptable and probabilities move in our favor. Patience is also a test of endurance because the longer we wait, the harder it is to maintain the discipline of being patient.

The fact is traders just want to trade, but if we trade, without an edge, our capital is ripped from our accounts and given back to Mr. Market. I won’t speak for you, but I think I deserve my capital much more than that Mr. Market. Consequently, it’s essential that I master the skill of patience and develop endurance to wait for my Edge! Are you willing to endure the wait or will you turn your capital over to Mr. Market?

On the Calendar

It would seem this Friday on the Economic Calendar is an FOMC speaker day. At 10:15 AM Rosengren and Dudley speak with Mester at 1:30 PM and Williams ending the day at 3:40 PM. The Baker-Hughes Rig Count at 1:00 PM is the only economic report today, and it is not expected to move the market.

We also get a break on the Earnings Calendar today with only 56 companies reporting. The vast majority of the earnings reports occur before-the-bell.

Action Plan

We started the day with some bullish energy, but once again the bears mounted a counter-offensive that left all but one index seeing red. At one point during the day, the Dow was up more than 300 points but gave nearly half of it back and once again closing below that big round number 25,000. The SPY ended the day in the red, closing below the 50-day average as did the IWM. Yesterday was the 3rd attempt in as many days for the SPY and the DIA to break through the 50 but thus far been rejected. The IWM has experienced the rejection of the 50 SMA, 4-days in a row. Even the QQQ, the strongest of the four indexes could on hold on to a positive print at the close.

While all that seems pretty bearish, there is a glimmer of bullishness because all four of the indexes are at least for now holding above significant price support levels. The choppiness of the price action has made trading extremely challenging if on impossible except for the very fast intra-day traders. By in large earnings reports continue to come in positive as does most of the Economic Reports. As I write this, the Dow Futures are pointing to a gap up of more than 100 points, adding to the choppy confusion. What all this means to me as a swing trader is that I have to continue to patiently wait until the intra-day volatility subsides and a discernable edge can be defined. Long or short doesn’t matter just show me a direction. Have a great weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/tuM-WitH9JA”]Morning Market Prep Video[/button_2]

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.