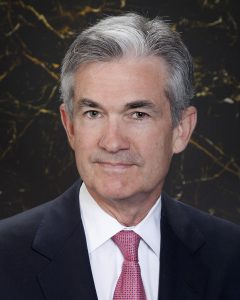

All Eyes on Jerome Powell

Today we get an introduction to our new Fed Chairman, Jerome Powell. Will he be hit the ground running hawkish on interest rates or will ease into the position with a bit more dovish approach? No matter what he says, we can expect the market to be sensitive to each of every word. With the market now showing such bullish strength even hint of dovishness could launch the market higher. Hawkish comments could easily have the reverse effect.

Today we get an introduction to our new Fed Chairman, Jerome Powell. Will he be hit the ground running hawkish on interest rates or will ease into the position with a bit more dovish approach? No matter what he says, we can expect the market to be sensitive to each of every word. With the market now showing such bullish strength even hint of dovishness could launch the market higher. Hawkish comments could easily have the reverse effect.

Couple that with a big day of earnings and a heavy economic calendar we should be prepared for an extra dose of volatility today. That means the potential for fast price action and whipsaws. Buckle up the ride could be thrilling but also very bumpy. Remember the 400 point rally from yesterday could be just as quickly reversed. Follow your rules and maintain your discipline and always remember that cash is position and that every day need not be traded to achieve success in the market.

On the Calendar

We get going at 8:30 AM Eastern on the Economic Calendar. First is the Durable Goods Orders which consensus is expecting a 2.0% decline with transportation seen up 0.3% and core capital goods orders rising 0.5%. Next is international Trade in Goods which is, of course, running in a deficit however it is expected to narrow with consensus expecting 71.3 billion vs. 72.3 billion in December. Also at 8:30 AM and 10:00 AM, our new Fed Chairman Jerome Powell will testify in Congress. The market could be very sensitive to anything he says. At 9:00 AM is the S& P CoreLogic Case-Shiller which forecasters see as rising 0.6% in December with a yearly increase seen at 6.3%. There are several other economic reports that are unlikely to move the market as well as a couple of bond events.

On the Earnings Calendar there more than 240 companies expected to report today. Stay on your toes.

Action Plan

Yesterday I mentioned to make sure and not chase but watch for the follow through bullish price action before entering anything. After the morning pop, the indexes did pause and pull back slightly before the bulls began a rip-roaring party that at one point had pushed the Dow up more than 400 points. It’s not all that surprising after a move like that the current Dow Futures are suggesting a gap down but only of about 50 points thus far. However, there is a big economic reports, a slew of earnings and our new Fed Chairman speaking that would shake this up before and after the open.

With the major indexes now solidly above the 50-day average a pullback to test it as support is not out of the question. On the other hand, if yesterday’s strong bullish attitude can continue to push us higher with little assistance from good earnings news and Jerome Powell not rushing into rate increases. It could be a very bumpy ride today with so much in the works. Remember what goes up can come down just as fast. Make sure you have an exit plan on all trades to either take profits or cut losses if a reversal does develop.

Trade Wisley.

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/NB22fcaIOtQ”]Morning Market Prep Video[/button_2]

Comments are closed.