Negative Territory

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Yesterday before the market had even closed there were traders predicting this is the bottom. Really? Yes, this could be a bottom, and this morning we are getting a nice oversold bounce but consider the fact it may be just a resting point before resuming the downtrend. See the price action for what it is not for what you want it to be! Gamble and you may win, but you have an equal chance of just providing liquidity. Remember volume is likely to decline sharply after the morning rush so plans your risk into the holiday carefully! I wish you all the very best and Happy Thanksgiving.

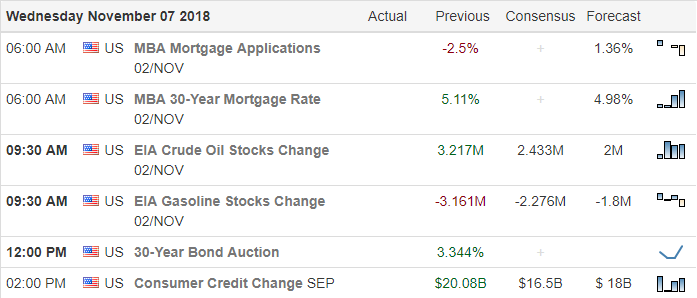

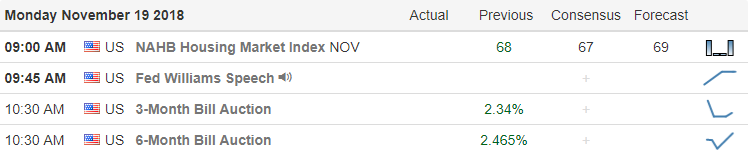

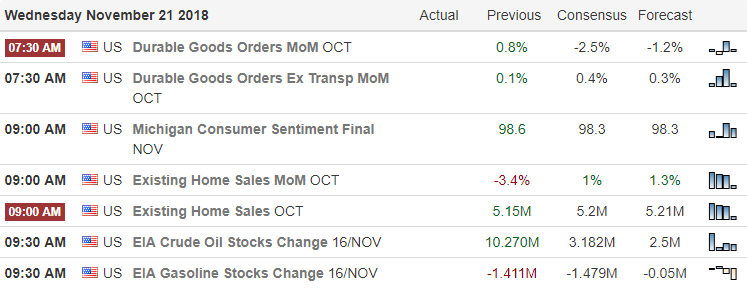

On the Calendar

On the Earnings Calendar, we have less than 40 companies reporting earnings as we head into the holiday. Notable reports today are ADSK, BILI, BJ, BZUN, CPRT, DE, FL, GPS, KEYS, SE.

Action Plan

After yesterdays nasty gap down and selloff, the indices are once again in negative territory for the year. Now the question is will the October lows hold as the price support for the DIA, SPY, and IWM? The QQQ’s yesterday broke support creating yet another layer of resistance as the tech sector continues to slide lower. This morning futures are suggesting a bounce this morning, and I’m already seeing traders trying to predict that this is the bottom.

After sliding 1000 points in just two days, it might be wise to consider that this mornings rally is merely a short-term oversold rally! Sure you could gamble and win but its still a straight up gamble nothing more! We have a very busy economic calendar this morning and some important earnings reports, but after the morning rush volume is likely to drop quickly as traders head out for their holiday plans. I want to wish every one of you a very Happy Thanksgiving!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/QlWMHLIWkiY”]Morning Market Prep Video[/button_2]

QQQ

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Asian markets follow the US lower overnight, and European markets are lower across the board this morning. As a result, US Futures indicate a substantial gap down with the QQQ set to test Octobers low at the open. As the holiday approaches volumes are very likely to decline after Wednesday’s open so plan your risk carefully and remember cash is a position!

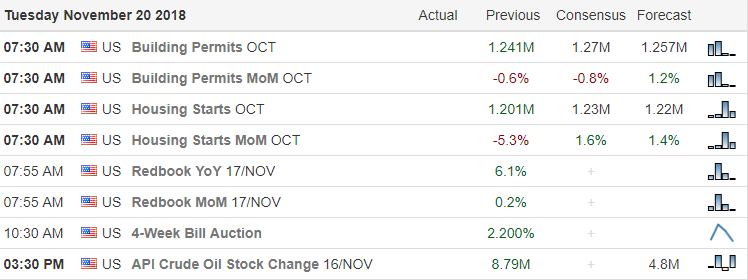

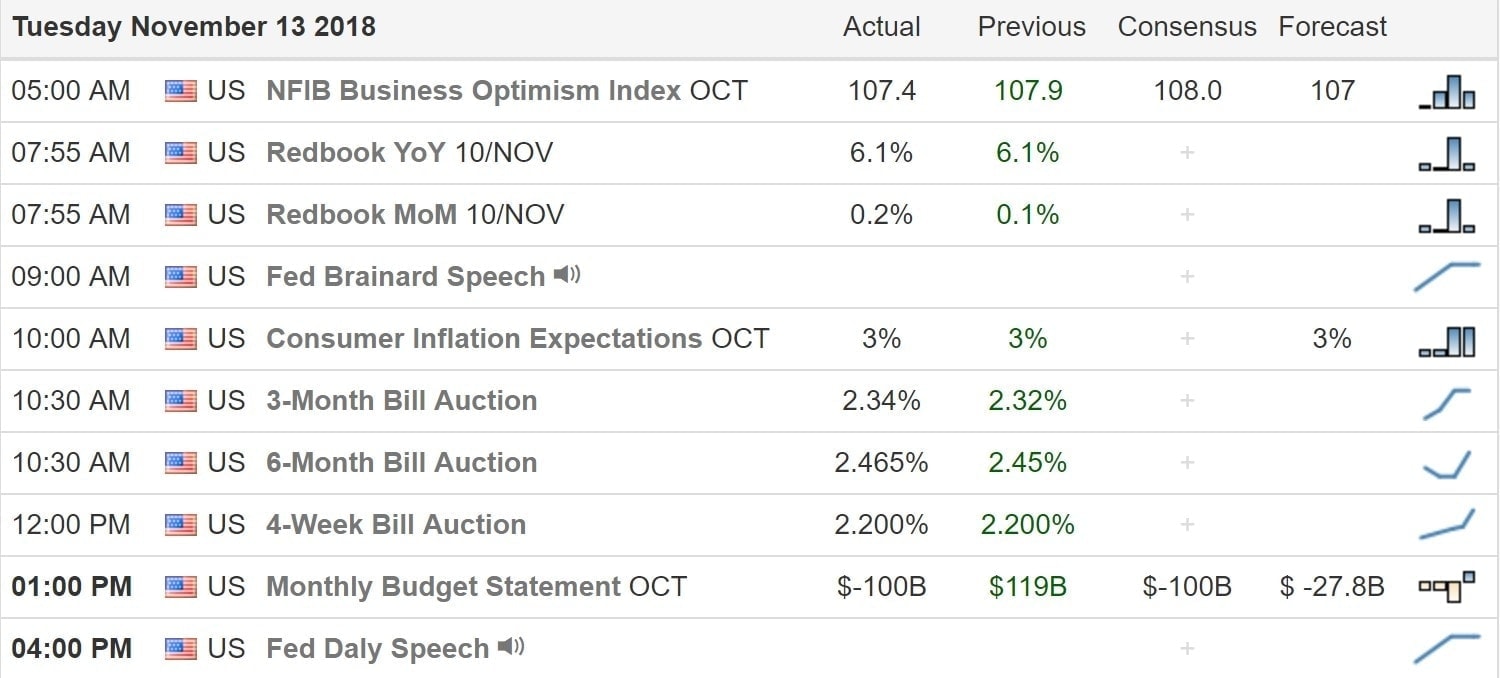

On the Calendar

On the Earnings Calendar, we nearly 60 companies reporting earnings today. Notables include A, ADI, BBY, BECN, CPB, HRL, INTU, JEC, KSS, LB, LOW, MDT, NUAN, PSTG, ROST, SFL, TGT, TJX, URBN.

Action Plan

My concern about the QQQ chart became a reality yesterday with new that AAPL has slashed production of its new iPhone’s and more concerns about FB leadership surfaced. The NASDAQ broke support sliding 3.25% dragging the rest of the market lower as it declined. Now a test of the October low and possibly lower seems inevitable for the QQQ. Currently, the US Futures indicate sharp declines at the open as the technical damage in the charts continues to grow.

Historically the influence of Santa should begin, but those eight little reindeer have to battle a tremendous headwind this year. Asian markets were sharply lower overnight, and currently European are down across the board. As bearish as all that sounds be careful not to chase short positions near support with a gap down open. Wait to make sure there are follow-through sellers supporting the gap. At this time the VIX is indicating fear, but if the market breaks to new lows, we will have to watch for signs of panic selling. Keep in mind volume will likely decrease substantially on Wednesday so plan your risk carefully as we head into the holiday.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/LESUEzKiE0I”]Morning Market Prep Video[/button_2]

Choppy Holiday Price Action

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

You may have to very flexible and nimble willing to taking profits and cutting losers quickly. After the morning rush on Wednesday expect volume to drop like a rock unless driven by a surprise new event. Expect choppy price action on the half day of Black Friday trading and the Cyber Monday holiday sales events. If you’re heading out early for your holiday plans, I want to wish you safe travel and a very Happy Thanksgiving!

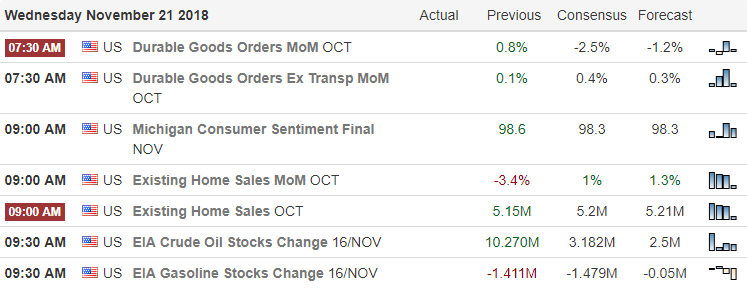

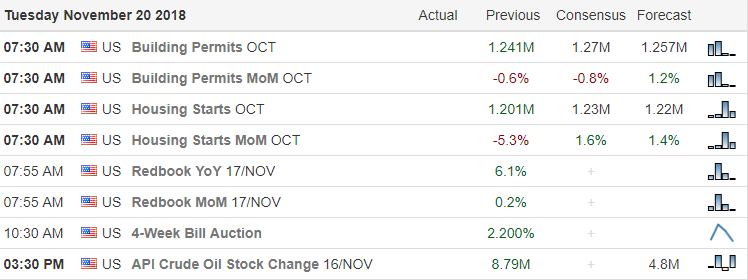

On the Calendar

There are 66 companies reporting earnings today. Notables today are AABA and JD which both report before the bell this morning.

Action Plan

Major holidays weeks typically see a significant decline in volume adding an additional challenge to our trading. We may find plenty of good long and short entry signals, but they may lack the energy to follow-through and profit. Thursday the market is closed, and Friday it’s only open half a day. In the past, both Black Friday and Cyber Monday are also light volume days with everyone focuses on the holiday shopping deals and travel.

Futures are suggesting a slightly bearish open with the Dow currently indicated to gap down about 75 points. Asian and European markets were bullish overnight. Because of the risks of holding over a holiday weekend, if I do trade, I will plan to take profits quickly and cut losers without mercy. I intend to be light in my portfolio on swing trades by Wednesday and will most likely stay that way until next week. If the holiday sales events go well then perhaps Santa can begin working his magic by next week. If sales disappoint, then watch the emergence of the Grinch.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/FvpgiSvf5gk”]Morning Market Prep Video[/button_2]

Nice bounce, but?

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

With volatility so high anything is possible. If the market provides us with a quick profit, we should consider taking some or all of it off the table during turbulent market conditions. It may not be what you were planning for hoping for but it far better to take small gains consistently than letting those gains diminish or disappear overnight. As we head into the weekend, consider your risk carefully and remember that Thanksgiving is just around the corner which means volume will likely decline sharply heading into the holiday.

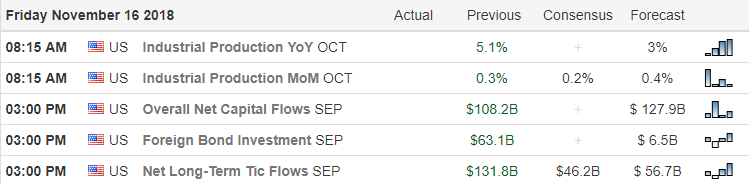

On the Calendar

On the Earnings Calendar, there are only 16 companies reporting as the 4th quarter season winds down.

Action Plan

After the nice bounce yesterday, I’m guessing that everyone was hoping for a follow-through push higher this morning. I know that’s what I wanted to see! However, what we want has nothing to do with what the market gives us. The unfortunate truth is that currently, the Dow Futures look to take back some of the reality with a gap down of more than 100 points. Disappointing yes, but not all that surprising given the recent market volatility.

As we head into the weekend, consider your risk carefully with high market volatility in mind. If you have current profits, it may be wise to take some if not all the gains and tuck that safely away in your account over the weekend. As 4th quarter earnings wind down, expect the market to become even more sensitive to any reports China trade and the likelihood of an agreement. Also, as Thanksgiving approaches, keep mind that volume can quickly dry up as traders take time off for the holiday, adding to the already challenging price action. Have a great weekend everyone!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/D1NmsubofDc”]Morning Market Prep Video[/button_2]

Is the Sky Falling?

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

In fact, the vast majority of market bottoms are formed this way. They take time, and they are always volatile and trying to fight it is a good way to go broke. As always it will be the institutions with their trillions of dollars that will decide when it’s over not the retail traders! If your being chopped to pieces in this volatility, stop trading. Study price, watch and wait for your edge to return. Better days are coming and when it does there well great stock at discounted prices.

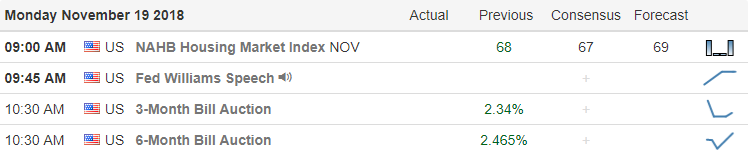

On the Calendar

On the Earnings Calendar, we have nearly 250 companies reporting results today. The bad news is this could add to market volatility with the good news is we are beginning to wind down earnings this quarter.

Action Plan

Some pretty wild price action yesterday with Dow swing more than 325 points from high to low in a very volatile session. The possible silver lining I mentioned yesterday didn’t show itself but looking at the major index charts is still possible as long as prices hold above October’s low. Having said that Bears are still in control and we must remember that anything is possible. Sadly IWM has now officially printed the so-called death cross with the 50-day crossing below the 200-day average.

Currently, futures have recovered from overnight lows and currently suggesting a flat to every so slightly bullish open. When the market downturn began in early October, I said the technical damage could take weeks if not months to repair. I have also mentioned several times that the V-bottom that had been forming after a 2000 point rally in the Dow was very rare an that has also proved to be true. That was not a prediction; it was merely a study of typical price action after a selloff. If I can do it, believe me, anyone can read price action as long as you set aside bias and remain disciplined.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/oBoKPXSObeY”]Morning Market Prep Video[/button_2]

Possible Silver Lining

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

After more than a 2000 point nine-day rally in the Dow, a pullback should not have been a big surprise. I warned about the possibility in yesterday’s morning video. It was not a prediction but rather just a simple observation of price action, support an resistance that anyone can do if you set aside personal bias. Clearly, volatility remains high, and with futures pointing sharply higher this morning it would be wise to keep that in mind. Don’t rush blindly with a fear of missing out, wait for your edge and trade with a well thought out plan.

On the Calendar

On the Earnings Calendar, we have just over 200 companies reporting to keep us on our toes and volatility high.

Action Plan

I don’t need to tell you that yesterday was a brutal day of selling. The rising dollar, rising interest rates, and declining oil prices seemed to take the blame for the bearishness according to the news. Blah, blah blah. How about the fact that the Dow had gained over 2000 points in just nine days of trading! Anyone that’s been paying attention had to know a pullback was possible. In fact, I would go so far to say that yesterday’s selling was a good thing as long as key support hold.

Let’s remember our overall economy is strong. The GDP is showing 3% growth, and employment continues at historic levels, so it’s not all gloom and doom. The fact remains that the current market is very volatile and that should not be a surprise given the technical damage in the charts. As always the best we can do as retail traders is to stay focused on price action and ready to react without bias no matter the direction.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/LLDVexwqQ3k”]Morning Market Prep Video[/button_2]

Las Vegas Money Show

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush.

Friday’s 200-point Dow sell-off was a reminder that only is volatility still with us but that there is still a lot of technical damage in the chart still in need of repair. Although we have a lot of earnings reports today with this being a banking and governmental holiday, they may find it difficult to find the volume necessary to move. Of course, anything is possible so say focused on price action and disciplined to your rules of engagement.

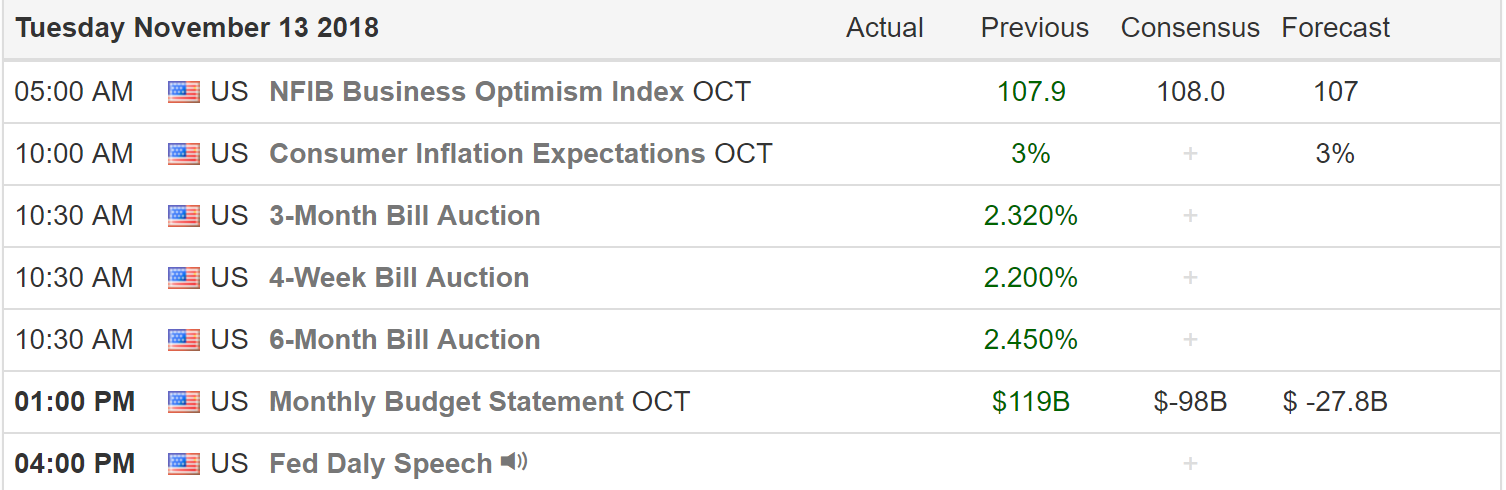

On the Calendar

Due to the observance of Veterans day bonds and currency trading markets are closed today. The stock market will be open but with most banks and big instructions closed trading could be limited. There is a Fed Speaker at 2:30 PM Eastern today but nothing on the calendar that would be expected to move the market.

On the Earnings Calendar

There are just over 150 companies reporting earnings today so make sure you continue to check earnings dates against current holdings.

Action Plan

We may find today a challenging day to trade with bond markets and currency markets closed. With banks and most of the large trading intuitions closed or lightly staffed we could see choppy price action after the morning rush. As I write this, the US Futures are pointing to flat to a mixed open. Don’t be surprised if the volume drops off quickly making it difficult for anything to follow-through.

The one thing that could give the market a little boost it’s the more than 150 companies reporting earnings today. However, I would be careful of a possible pop and drop and keep in mind all the indexes remain under significant resistance levels. Having said that we also need to keep an eye out for the beginning of a Santa Claus rally. Historically mid to late November tends to be the time Santa begins to affect so stay focused. Remember current volatility will likely continue to make swing trading challenging for many traders. However, if you stay disciplined to your rules, wait for price action and chart patterns to develop there will be an opportunity for profits.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/V2yPnkzv09E”]Morning Market Prep Video[/button_2]

Market Bias

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

We all have, and that’s just one clue that bias is keeping you from success. Fighting the market is an exercise in futility! The truth is the market could care less what you think you know about technical analysis, candle patterns or indicators. Set your bias aside and take the time to study the price action of the chart. The clues are always there if your bias is not in the way clouding your view of the price action.

On the Calendar

With the majority of earnings reports completed for this quarter, the number of reports will begin to drop significantly. Today there are 119 companies reporting.

Action Plan

Selling in Asian markets overnight has translated into European market also lower across the board this morning. As a result, US Futures which held up quite well most of the night began to react very negatively early in the morning. As I write this, the Dow is indicated to gap sharply lower in response. However, a pullback after such a steep rally is not a surprise, and I expect many traders are already short in anticipation.

At the close yesterday, the VIX was beginning to respond to price support. The gap down this morning could once again bring some fear into play so plan for volatility to remain elevated. With the FOMC indicating another rate hike next month and the ongoing uncertainty of China trade negotiations, a substantial market pullback is possible. Unfortunately, due to the huge rally, finding support could mean a nasty swing lower. Let’s hope all the market needs is a restful consolidation! Stay focused on price action and as we head into the weekend, plan your risk carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/xrKBgO6ko9I”]Morning Market Prep Video[/button_2]

Earnings and FOMC

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Although I expect volatility to remain high, we could see the price action become rather light and choppy after the morning rush as we wait for the FOMC decision at 2:00 PM Eastern. Consider the fact that the Dow has gained 2000 points in a straight-up move as you plan your risk heading into the weekend. The odds are that at some point the market will want to test support levels which are now significantly lower.

On the Calendar

On the earnings calendar, we have nearly 500 companies reporting today. The number of earnings drop off tomorrow, and there is significantly fewer next week.

Action Plan

With nearly 500 earnings reports and FOMC decision on interest rates today what could possibly go wrong? LOL Currently the US Futures are pointing to a modest gap down this morning considering the huge post-election rally. After recovering more than 2000 Dow points from the low in just eight days, it should not be a surprise if we see some profit-taking and a little market rest in the very near future. Of course, if a deal can be struck with China anytime soon, that would be a game changer.

Expect considerable volatility today as we wait for the FOMC decision and the market reacts to last really big day of earnings this quarter. I for one took advantage of the big rally taking profits to the bank. This morning I’m very light in my account and to be honest I’m currently feeling pretty comfortable with that decision. The possibility of a pullback or at a minimum is very high, but with the energy and momentum, we saw yesterday If could easily be next week before we see much selling activity. The spin out of Washington could become very intense over the next few days so plan your rick into the weekend carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/5Uz0oGsfdd8″]Morning Market Prep Video[/button_2]

Election Results

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Expect very fast price action as the market turns its attention to the more than 1000 companies yet to report earnings results this week. Also, keep in mind that the FOMC begins its 2-day meeting today to adding some market stress as we wait for their decision on Thursday afternoon. A big gap like this can generate a lot of emotion and a fear of missing out. As a result, we need to stay focused on price action and disciplined to your rules to win the day.

On the Calendar

On the Earnings Calendar, we have more than 400 companies reporting earnings today. Expect considerable volatility as a result.

Action Plan

Finally, the mid-term elections are behind and although there were some major changes the US Futures indicate that the market is happy with the results. As of this moment, the Dow is pointing to a gap up of more than 150 points, but let’s remember that the more than 400 companies reporting earnings today could easily change that significantly before the open.

With the election out of the way, the market will once again focus on earnings results, trade negotiations and of course the FOMC which begins its 2-day meeting today. The morning gap will propel the DIA high enough to test its 50-day average as resistance. The SPY looks to recover it’s 200-day average this morning with the QQQ looking to open very close to its 200-day while the IWM lags significantly behind them all. As happy as the market appears this morning, please keep in mind that this recovery still has a tremendous amount of work to repair the technical damage in the charts. Expect very fast price action today and the potential of a pop and drop if profit takers capitalize on the big morning gap.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/hU91f88XKtk”]Morning Market Prep Video[/button_2]

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

I don’t know about you, but I certainly wanted to see a little bullish follow-through after yesterdays nice bounce. Unfortunately, the current futures market is proving once again that what I want has nothing to do with what the market does! Sadly a lesson that took me a long time to learn.

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush. Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.