All eyes on the FOMC.

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.

On the Calendar

To kick off this FOMC week we begin with a Fed Speaker at 9:00 AM from the Atlanta Federal Reserve Bank. After that, all we have is three bond events to wrap of the day.

On the Earnings Calendar, we have quieted down as well with just 55 companies reporting results today. However, just because earnings season is winding down, it doesn’t relieve from the responsibility of checking earnings dates against current holdings and stocks we are planning to purchase.

Action Plan

Friday turned out to be a choppy day of price action. The Dow tried a couple of times to get over the big round number at 25,000 but ultimately failed to hold above it by the close of the day. The QQQ and the SPY seemed content to chop in a small range but while the IWM bounced slightly to close the day positive. Sadly, the SPY closed below the 50-day average raising concerns that the Bears could gain the upper hand.

As I write the morning note, the Dow Futures are decidedly bearish and currently pointing to a 130-point gap down at the open. If the selling pressure persists, we could easily start breakings some key support levels which would encourage even more bears to plie on raising the fears about the overall market. If there ever was a time that we need the Bull to step up it’s now. Keep in mind that the FOMC begins its 2-day interest rate policy meeting on Tuesday with their decision released Wednesday afternoon. The market continues to be hypersensitive about rates, and with a new Fed Chairman at the helm, tensions are high. I’m expecting some wider ranging chop that could contain some fast price action as we wait for their decision.

Trade Wisely,

Doug

Boring, choppy price action.

Choppy price action days like we saw yesterday can be frustrating and downright boring at times as we watch price grind up and down. Inexperienced traders just wanting some action often let choppy, boring markets affect their decision making. When I was a new trader just like most new traders, I just wanted to trade. Consequently, I made a lot of very bad decisions trying to force trades just because I was bored. Long story short if the choppy price action persisted very long I would have a huge string of losing trades. Individually the trades were not big losers but added up the damage to my account was substantial. If boredom is affecting your decision making, take a break. It’s amazing how a short break from your screens can help a trader maintain focus and promote good decision making.

Choppy price action days like we saw yesterday can be frustrating and downright boring at times as we watch price grind up and down. Inexperienced traders just wanting some action often let choppy, boring markets affect their decision making. When I was a new trader just like most new traders, I just wanted to trade. Consequently, I made a lot of very bad decisions trying to force trades just because I was bored. Long story short if the choppy price action persisted very long I would have a huge string of losing trades. Individually the trades were not big losers but added up the damage to my account was substantial. If boredom is affecting your decision making, take a break. It’s amazing how a short break from your screens can help a trader maintain focus and promote good decision making.

On the Calendar

No rest this Friday on the Economic Calendar with four important reports. Kicking off at 8:30 AM Eastern with the Housing Starts report which is calling for a decline from the 1.326 million annualized in January to 1.285 for February. Permits according to consensus will decline in February to 1.322 million vs. 1.377 million annualized. At 9:15 is Industrial Production forecasters expect a 0.4% increase overall with the manufacturing growth increasing 0.4% as well. The Consumer Sentiment report at 10:00 AM is expected to decline slightly to 98.8 vs. the 99.7 February reading. Also at 10:00 AM is the JOLTS report is expecting job openings to decline slightly to 5.800 million vs. 5.811 in December. AT 1:00 PM is the Old Rig count but it very unlikely it will move the market.

On the Earnings Calendar, we have 67 companies expected to report results.

Action Plan

At the open yesterday, futures pointed to a possible bounce, but the bulls lacked the energy to hold onto early gains as trade war fears continue to swirl. The good news is the DIA held onto supports by the close while the other indexes all help up pretty well. There is, however, the reason to keep a close eye on the DIA and the SPY because it wouldn’t take much to tip the scales to favor the bears. So come on bulls sharpen those horns and push.

As I write this, futures markets are flat to every so slightly bullish but remember we have some big reports the market will have to digest before the open. Also, keep in mind as we head into the weekend that the FOMC meets next week on interest rate policy so don’t be surprised to see some directionless chop in the day ahead. Have a great weekend.

Trade Wisely,

Doug

Trade War Fears

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

Fears of a US / China trade war took a major toll on the Dow yesterday as Boeing began to heavily sell-off. Although the weight of Dow pulled down on the other indexes, the QQQ, SPY, and IWM help up pretty well overall. Now the question is will there be follow-through selling or will the Bulls dig in and fight. Fear is a powerful emotion that is often irrational and pure speculation. Thus, price moves tend to be extreme as fear and quickly lead to full-on panic.

However, yesterday’s selling seemed measured and controlled with 3 of the four indexes holding onto a fragile but current up-trend. Keep in mind that big moves inspired by fear can also quickly reverse if that fear suddenly passes. Have a plan, stay focused on price and be prepared for anything but don’t let fear control your trading.

On the Calendar

Thursday is a big day on the Economic Calendar with several potential market-moving reports with four of them dropping at 8:30 AM. The weekly Jobless Claims is expected to come in at 229,000, continuing to show strong labor demand. A robust consensus of 23.0 with rising backlogs and the risk of hitting capacity constraints, from the Philly Fed Business Survey. The Empire Ste Mfg. Survey should come in cooler at 15.0 according to consensus. Then the Import/Export Prices are seen rising a moderate 0.3% on imports as well as 0.3% increases in export prices. At 10:00 AM we hear from the Housing Market Index which forecasters see steady strength with an unchanged reading or 72. To finish off the major reports today, we have the Treasury International Capital at 4:00 PM.

Today marks our last really big earnings day this season with nearly 190 companies expected to report. While there are earnings spread out for the remainder of the month, they should be overall less impactful as the number of reports diminishes.

Action Plan

Things were looking pretty good yesterday until fear of a trade war with China sent a share of BA sharply lower. After losing the 25,000 level, the Dow experienced some pretty heavy selling testing the lower boundary of the price wedge pattern. Although the SPY, QQQ, and IWM experienced some selling pressure, they all managed to close within their current uptrend and stayed above their respective 50-day averages.

I said yesterday that my gut tells me that the market wants to go higher. Yesterday’s price action while bearish didn’t dissuade that feeling. With 3 out of 4 indexes holding onto an uptrend, the technicals slightly favor the bulls as long as support levels hold. However, it wouldn’t take much more selling pressure to shift the battle to the bears so stay focused on price action. The current pullback has the potential to set-up some great entries if the bulls can tow the line. Mark up your watchlist and be prepared.

Trade Wisely,

Doug

Who invited the Bears?

Okay, we had a nice little bull party going on; who invited the bears? It seems everywhere you look we see Bearish Engulfing candles and nasty failure patterns in the charts. Is it really that bad? First, let’s remember that Bearish Engulfing candles must follow-through in the next period to confirm. Without that confirmation, it’s nothing more than a day of profit-taking. Secondly, let’s step back from the hard right edge and notice that only the DIA has failed to break out into an uptrend. I pointed out yesterday that the index has moved up so many days in a row that rest or pullback was possible.

Okay, we had a nice little bull party going on; who invited the bears? It seems everywhere you look we see Bearish Engulfing candles and nasty failure patterns in the charts. Is it really that bad? First, let’s remember that Bearish Engulfing candles must follow-through in the next period to confirm. Without that confirmation, it’s nothing more than a day of profit-taking. Secondly, let’s step back from the hard right edge and notice that only the DIA has failed to break out into an uptrend. I pointed out yesterday that the index has moved up so many days in a row that rest or pullback was possible.

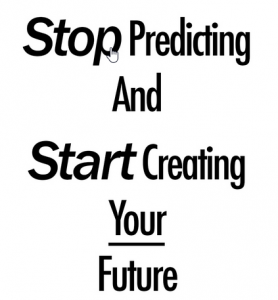

Please understand I’m not saying that to try and pat myself on the back for a correct call. What I’m trying to demonstrate is that if you remove emotion and study the price action, the answers are usually there. No prediction just simple observation. So, who invited the bears? The king of all indicators, Price Action.

On the Calendar

There are some big reports on the hump day Economic Calendar. At 8:30 AM we have two potential market-moving reports with PPI and Retail Sales. Consensus suggests the headline will come in up 0.2%. Remove food and energy, and it is expected to rise 0.2% while trade services move up 0.3%. According to forecasters, Retail Sales should snap back after declining in January with a 0.4% February expected increase. Remove autos and gasoline, and they see a 0.4% increase. Business Inventories at 10:00 AM should see a sizable build of 0.5% in January giving a boost the inventory component of GDP. Last but not least is the Petroleum Status Report which is on forecast but obviously critical the prices of oils stocks.

On the Earnings Calendar, I see 122 companies stepping up to report quarterly results. Stay on your toes as this earnings season finally begins to lighten up after this week.

Action Plan

The bears stepped in yesterday producing a slew of reversal patterns on all four major indexes on Tuesday. At the close Bearish Engulfing candles were left behind on the QQQ, IWM, SPY. The DIA was also under pressure one again failing at the 50-day average but managed to hold just above the physiological 25,000 level on the Dow index. It was pretty grim as I looked through my watchlists last night seeing lots of potential topping patterns and blue ice failure patterns all over the place.

One would naturally expect the bears to follow through today with another push lower today, but the premarket futures are indicating a willingness of the bull to fight back. As I write this, the Dow Futures are pointing to a gap up of about 80 points at the open. However, with all the early earnings news and important economic reports coming before the open anything is still possible. Everywhere I look in the charts I see clues of bearishness, but for some reason, my gut is telling me the market wants to go up. That’s not a prediction; it’s merely a feeling that of course will have to be confirmed by price action. Price is king and always will be.

Trade Wisely,

Doug

Price is King

After two months of messy price action, the storm clouds are giving way to blue skies, but it may take a little longer for smooth sailing to return. The DIA continues to lag significantly behind the other indexes as it continues to struggle with its 50-day average as resistance. The QQQ is leading the way, and the SPY and IWM are not far behind dragging the DIA along like a boat anchor. Clearly, the other indexes can continue to move higher without the DIA, but the work will be harder until it can carry its weight rather than being dragged. Overall the bulls are in control, and many stocks have resumed their trends but don’t be surprised if the daily index price action starts to grind or even slips into consolidation. There can be great trading in this environment, but we may have to exercise some patience and plan a little extra holding time for options trades.

After two months of messy price action, the storm clouds are giving way to blue skies, but it may take a little longer for smooth sailing to return. The DIA continues to lag significantly behind the other indexes as it continues to struggle with its 50-day average as resistance. The QQQ is leading the way, and the SPY and IWM are not far behind dragging the DIA along like a boat anchor. Clearly, the other indexes can continue to move higher without the DIA, but the work will be harder until it can carry its weight rather than being dragged. Overall the bulls are in control, and many stocks have resumed their trends but don’t be surprised if the daily index price action starts to grind or even slips into consolidation. There can be great trading in this environment, but we may have to exercise some patience and plan a little extra holding time for options trades.

On the Calendar

Only one big report today’s Economic Calendar but the Consumer Price Index is one that can move the market. The report comes out at 8:30 AM Eastern and will be watched closely for pricing pressures which, of course, would signal inflation. Consensus for the headline CPI is for a monthly gain of 0.2% and a yearly rate of 2.2% up just one-tenth. Remove food and energy, and consensus expects a slight rise to 1.9% A couple of smaller reports from Small Business Optimism, Redbook, and a couple of bond events round out the day.

On the Earnings Calendar just short of 110 companies are expected to report earnings today.

Action Plan

An interesting mix of price action in the indexes yesterday as the QQQ sailed to new records while the DIA sold off below the 50-day average once again. The SPY saw only modest profit taking while the IWM squeezed out its 7th day up in the current rally. All in all a good showing by the bulls considering the size of last Friday’s rally. The VIX managed a small rally but by the close remained under resistance and the 50-day average as market fears seem to be calming down.

As I write this Dow Futures are pointing to about a 70 point gap up which would recover about half of yesterdays losses, but a lot could still change, and earnings as economic news come out. The T2122 4 week new high / low ratio is suggesting the current rally is getting a bit long in the tooth, and a pullback or consolidation may be just around the corner. There are a lot of very nice looking charts but be careful on to chase. Remember we want to buy stocks at or near price support. The bulls are in control so any consolidation or pullback that holds support could set up great trade entries.

Trade Wisely,

Doug

Predicting

This weekend I received an email suggesting that I’m completely wrong and that all trading and all traders are predicting. I wholeheartedly disagree. Gamblers are predictors that continually lose money because they focus on the big win rather than the business of trading. To be successful as a trader over the long haul, you have to think like the CEO of a business. A CEO makes business decisions only after careful risk analysis and planning that puts the odds of winning in their favor. In other words, a good trader thinks like the House working every day to maintain a statistical advantage where the potential rewards are always greater than the risk. Be the House! Make business decisions and leave the predicting to the amateurs.

This weekend I received an email suggesting that I’m completely wrong and that all trading and all traders are predicting. I wholeheartedly disagree. Gamblers are predictors that continually lose money because they focus on the big win rather than the business of trading. To be successful as a trader over the long haul, you have to think like the CEO of a business. A CEO makes business decisions only after careful risk analysis and planning that puts the odds of winning in their favor. In other words, a good trader thinks like the House working every day to maintain a statistical advantage where the potential rewards are always greater than the risk. Be the House! Make business decisions and leave the predicting to the amateurs.

On the Calendar

W have a busy week on the Economic Calendar, but we kick it off with a light Monday. We have five bond events throughout the day follow only by the Treasury Budget at 2:00 PM. The consensus is calling for a monthly deficit of $216.0 billion because of tax reform.

On the Earnings Calendar, this should be the last big week of the quarter with more than 500 companies reports. Today we will hear from about 120. Remember checking earnings reports against current holdings each day as part of your daily preparation is an important habit to develop.

Action Plan

Friday was a rip-roaring day as the bulls gathered in a show of force and firmly re-establishing their control of the market. The QQQ set a new record high to begin the day and just kept right on pushing higher through the close. The SPY not only drove through the downtrend line but also managed to close above the February resistance. The IWM tested the resistance of record highs, and even the DIA which has been lagging behind found the energy to break through its 50-day average.

As I write this, the Dow Futures are pointing to a 100 point gap up to punctuate Friday’s bull run. Even though the bulls appear are large and in the pre-market be careful not to get caught up in the exuberance by chasing. To marks, the 7th day of a straight up QQQ’s rally and with today’s gap up the Dow will have improved by nearly 900 points in 4 days! A little rest or even some profit-taking is not out the question. In-fact a consolidation or slight pullback to test supports would be a very normal and healthy price action. Your watchlist of trending stocks should now contain a target rich environment for quality setups assuming the bull maintain control.

Trade Wisely,

Doug

Employment Situation

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.

The 800-pound gorilla in the room today is the Employment Situation report and what it may or may not reveal about inflation. Consensus suggests the unemployment rate will drift lower to just 4% and could point to wage pressures. The SPY by the close of the market yesterday defeated the 50-day average but only by half a point. The Dow continues to lag behind struggling with the 25,000 level and still 390 points below its 50-day average.

Price action the last couple days has been encouraging with the bulls defending against pullbacks. If the Employment Situation report shows inflation is in check, the bulls appear to have the upper hand. Expect fast price action after the open and keep in mind whipsaw are possible due to the overall market volatility.

On the Calendar

We have the biggest report of the week on the Economic Calendar before the market open. The Employment Situation comes out at 8:30 AM may provide clues that will influence the FOMC coming decision on interest rates. According to consensus, February non-farm payrolls are expected slightly higher at 205,00 vs. the 200,000 reading in January. The unemployment rate is expected to tick down to 4.0%, but hourly earnings, rising only by a modest 2% in the month with year-on-year holding at 2.9%. We have one Fed Speaker today that is speaking three times 8:40 AM, 10:45 AM and finally 12:45 AM. There are two other non-market moving reports such as Wholesale Trade at 10:00 AM and the Oil Rig Count at 1:00 PM.

On the Earnings Calendar, we have just 73 companies reporting results today.

Action Plan

Once again it was encouraging to see the bulls hang in there yesterday and not give in to all the hype over trade wars. In fact, if you judge by the market reaction, the President’s plan thus far was a non-event. This morning it’s all about the Employment Situation report. Unfortunately, all we can do as retail swing traders is to deal with the gap up or gap down that it’s capable of producing at the open. As I write this, futures markets are essentially flat as the market waits.

A report that does not display inflationary pressures could move the market higher which the price action seems to favor at the moment. Of course, if inflation is seen raising its ugly head enough to cause an FOMC reaction the market tone could quickly shift bearish. Only time will tell, and all we can do is patiently wait for the open. I wish you all a great day and a fantastic weekend.

Trade Wisely,

Doug

Battle for Control

Yesterday’s defense of support was indeed a very welcome sight. Price action would suggest that the bulls may be gaining the upper hand, but this battle for control will still require a significant effort. Although the QQQ and IWM are above the 50-day average, the SPY and the DIA are still below giving a reason for caution. As this battle for control plays out, keep in mind that the VIX is still indicating significant volatility. It would also be wise to remember that the Employment Situation number Friday morning has the potential to move the market substantially. The market seems to be very sensitive to any hint of inflationary pressures. Friday’s report could provide and important clues to the next FOMC action.

Yesterday’s defense of support was indeed a very welcome sight. Price action would suggest that the bulls may be gaining the upper hand, but this battle for control will still require a significant effort. Although the QQQ and IWM are above the 50-day average, the SPY and the DIA are still below giving a reason for caution. As this battle for control plays out, keep in mind that the VIX is still indicating significant volatility. It would also be wise to remember that the Employment Situation number Friday morning has the potential to move the market substantially. The market seems to be very sensitive to any hint of inflationary pressures. Friday’s report could provide and important clues to the next FOMC action.

On the Calendar

There is a full Economic Calendar today, but there is only one report that’s likely to move the market. At 8:30 AM the Jobless Claims number came in at a 49-year low last week should rise slightly to 220,000 according to consensus. We will also hear from the Challenger report, Consumer Comfort, Services Survey, Nat. Gas Report, Fed Balance Sheet and Money Supply and several bond events throughout the day.

Today is the biggest day of the week on the Earnings Calendar with 236 companies expected to report. Make sure to check reporting dates on the companies you hold and those you’re considering to purchase.

Action Plan

After gapping sharply lower, Wednesday proved to be a roller coaster ride as the bulls and bears fought for control. By the end of the day, the bulls had the upper hand with the SPY once again testing the 50-day average from below. The QQQ held firmly as the market leader, and in a surprising show of strength the small caps confidently broke resistance levels as well as defeating the downtrend. The Dow is the market laggard still more than 400 points below its 50-day average and 200 below the big round number of 25,000.

Futures this morning are currently suggesting a flat to slightly bullish open with the VIX hovering around a 17 handle. With bulls showing a strong willingness to defend price supports I’m cautiously optimistic that they are gaining the upper hand. However, with the DIA and SPY still below the 50-day and important clues on inflation coming in Friday morning Employment Situation report, anything is possible. Stay focused on price and remain flexible. Don’t buy anything that you are not willing to hold through some volatile swings. Smaller than normal position sizes can be a good way to plan for the additional volatility.

Trade Wisely,

Doug

Hypersensitive

I must admit after the close yesterday I was encouraged that daily range of price action seemed to be calming slightly. I was also happy to see the bulls ability to defend the big Tuesday gains as the SPY tested the 50-day average from below. Sadly after the close, news of the Cohn resignation, reignited the volatility of this hypersensitive market. Currently, the futures are pointing to a substantial gap down at the open. If selling persists after the open, we could see another failure of the 50-day average and another lower high. We should prepare for very fast price action at the open and the possibility that last Friday’s low might see a retest. Buckle up it could be a bumpy ride today.

I must admit after the close yesterday I was encouraged that daily range of price action seemed to be calming slightly. I was also happy to see the bulls ability to defend the big Tuesday gains as the SPY tested the 50-day average from below. Sadly after the close, news of the Cohn resignation, reignited the volatility of this hypersensitive market. Currently, the futures are pointing to a substantial gap down at the open. If selling persists after the open, we could see another failure of the 50-day average and another lower high. We should prepare for very fast price action at the open and the possibility that last Friday’s low might see a retest. Buckle up it could be a bumpy ride today.

On the Calendar

A big day on the Economic Calendar begins at 8:15 AM with the ADP Employment Report which is expected to show 195,00 gain in private payrolls. At 8:30 AM the International Trade deficit is expected to widen to 55.1 in January vs. February’s 53.1 reading. Also at 8:30 is the Productivity and Costs report which according to consensus rose at an annualized 3.2% rate. 10:30 AM brings the EIA Petroleum Status Report which is not forecast forward but has recently supported oil prices showing supply declines. The Beige Book which is used by the FOMC when making a rate decision is out at 2:00 PM today. If it shows, inflationary pressures are rising the interest rate hypersensitive market could react. Also on the Calendar this morning are three Fed Speakers on the speaking tour ahead of the FOMC meeting later this month.

On the Earnings Calendar, there are just over 150 companies expected to report results today. By in large earnings continue to come in mostly positive with earnings growth projected this year.

Action Plan

The price action yesterday was very 2-sided, but at the close, I was happy to see the range of the day finally staring calm down a little. Unfortunately, after the close, a sucker punch came flying in as the Wall Street-friendly Cohn resigned. Futures moved sharply lower on the news and this morning as I write this a gap down of about 300 Dow points look likely. So much for calming down! Technically speaking this new could not have come at a worse time with the major indexes testing the 50-day moving average. The big question to be answered now is; will last Friday’s low hold as support? Let’s hope cooler heads prevail.

Expect very volatile price action this morning as the market works through the emotion of the morning gap down. Intraday whip-saws are likely, and price action could be very fast. Anything is possible so remain flexible and avoid making decisions based on your particular bias. Focus on price and the clues it will provide.

Trade Wisely,

Doug

Symmetrical triangle

Yesterday follow-through bullishness was a welcome sight, but at the same time, it raised additional caution flags as we approach the 50-day average resistance on the SPY and the IWM. The DIA still has to rally significantly just to reach its 50-day with the QQQ’s remain the dominant market leader. Looking at the index charts, we now see the possibility of a tricky symmetrical triangle pattern. The Symmetrical triangle pattern gives us about 50/50 odds of it breaking higher or breaking down. The large range between the high and low makes the current pattern particularly challenging.

Yesterday follow-through bullishness was a welcome sight, but at the same time, it raised additional caution flags as we approach the 50-day average resistance on the SPY and the IWM. The DIA still has to rally significantly just to reach its 50-day with the QQQ’s remain the dominant market leader. Looking at the index charts, we now see the possibility of a tricky symmetrical triangle pattern. The Symmetrical triangle pattern gives us about 50/50 odds of it breaking higher or breaking down. The large range between the high and low makes the current pattern particularly challenging.

If you recall it was just one week ago when the Dow rallied 400 points in a single day. The next day it gave it all back, and that was when the index had managed to break above the 50-day. Now the dilemma we face is that the big rally yesterday only brought is back to test the underside 50-day average. Fortune may favor the bold if your right on direction but the bold could also lose a fortune if they happen to be wrong. Volatility remains high so plan your risk accordingly.

On the Calendar

Today’s Economic Calendar begins and ends with Fed Speakers today on the lead of the FOMC announcement on March 21st. Dudley speaks at 7:30 AM, Brainard at 7:00 PM and Kaplin at 8:30 PM. The Redbook number is out at 8:55 AM as well as a couple of bond events which are very unlikely to move the market. However, the Factory Orders report at 10:00 AM can move the market and according to consensus will see a decline 1.2% in January.

On the Earnings Calendar today we have 142 companies reporting results. Stay vigilant as the first quarter earnings season drags on and on.

Action Plan

A very encouraging day yesterday as indexes followed through on from Friday’s bullishness. The higher low has now developed a potential wedge pattern or what many call a symmetrical triangle. The SPY and IWM are not testing their respective 50-day averages but still have the resistance levels above as well as the downtrend yet to conquer. Believe it or not, the Dow needs to rally 400 points more just to test its 50-day averages as resistance, so there is still a lot of work that needs to be done by the bulls. As of now, the Dow will have to prove it can get back over the big round number 25,000 which it could do battle with today.

A wedge pattern (symmetrical triangle) can be a tricky pattern to negotiate especially if that pattern has the huge range between the highs and lows we currently have on the DIA, SPY, and IWM. The current rally has produced a lot of good-looking charts. Keep in mind if the indexes fail to break-through the 50-day resistance the swing lower to test support again could be very punishing on any new entries. Plan your risk carefully.

Trade Wisely,

Doug

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.

With very little on the Economic Calendar and earnings season finally starting to wind down all eyes will be focused on the FOMC. In fact, all the attention over the next 3-days will likely focus on just one man. Jerome Powell, our new Fed Chairman. The market has obviously expressed considerable anxiety about the prospect of additional interest rate increases. The big unknown is will the new chairman’s feathers be dovish or hawkish? The market hates uncertainty and consequently may react emotionally both before and just after the FOMC policy statement. We could expect some additional wild price action during his first Press Conference as well. Remember the market and stay irrational much longer than you and I can remain liquid. Anything is possible so remain flexible and plan carefully for what could turn out to be very bumpy ride.