QQQ

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Yesterday as I evaluated the index charts I mentioned my biggest concern was the vulnerability of the QQQ chart and its ability to drag the market lower. Unfortunately, with the WSJ reporting fresh concerns about FB leadership and AAPL cutting production of its new iPhone’s, the QQQ’s broke support as the tech index tumbled 3.25%.

Asian markets follow the US lower overnight, and European markets are lower across the board this morning. As a result, US Futures indicate a substantial gap down with the QQQ set to test Octobers low at the open. As the holiday approaches volumes are very likely to decline after Wednesday’s open so plan your risk carefully and remember cash is a position!

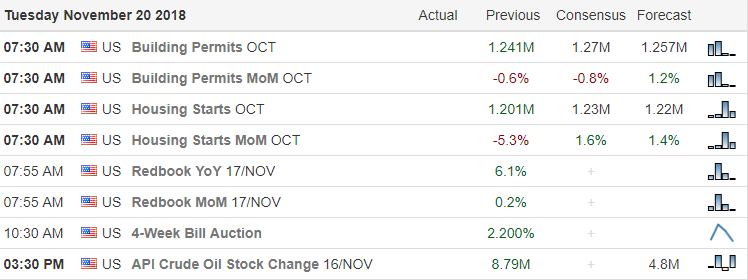

On the Calendar

On the Earnings Calendar, we nearly 60 companies reporting earnings today. Notables include A, ADI, BBY, BECN, CPB, HRL, INTU, JEC, KSS, LB, LOW, MDT, NUAN, PSTG, ROST, SFL, TGT, TJX, URBN.

Action Plan

My concern about the QQQ chart became a reality yesterday with new that AAPL has slashed production of its new iPhone’s and more concerns about FB leadership surfaced. The NASDAQ broke support sliding 3.25% dragging the rest of the market lower as it declined. Now a test of the October low and possibly lower seems inevitable for the QQQ. Currently, the US Futures indicate sharp declines at the open as the technical damage in the charts continues to grow.

Historically the influence of Santa should begin, but those eight little reindeer have to battle a tremendous headwind this year. Asian markets were sharply lower overnight, and currently European are down across the board. As bearish as all that sounds be careful not to chase short positions near support with a gap down open. Wait to make sure there are follow-through sellers supporting the gap. At this time the VIX is indicating fear, but if the market breaks to new lows, we will have to watch for signs of panic selling. Keep in mind volume will likely decrease substantially on Wednesday so plan your risk carefully as we head into the holiday.

Trade Wisely,

Doug

Comments are closed.