Gloom and Doom

It’s pretty difficult when looking at index charts to see anything other than gloom and doom. There is technical damage everywhere you look, and a general feeling of dread has gripped the market. The financial news headlines have become predominantly negative with more and more talking heads predicting more gloom and doom to come. Having traded for more than 28 years, I can tell this is the normal process of correction.

It’s pretty difficult when looking at index charts to see anything other than gloom and doom. There is technical damage everywhere you look, and a general feeling of dread has gripped the market. The financial news headlines have become predominantly negative with more and more talking heads predicting more gloom and doom to come. Having traded for more than 28 years, I can tell this is the normal process of correction.

If you remember when the selloff began I suggested this would take weeks if not months to resolve. That was not a prediction of the future just the experience of an old trader that has seen this many time before. The market will eventually heal and better days will return. Remember its always darkest before the dawn, and we will likely see more days of gloom and doom ahead but when it’s over a target rich environment will emerge as great stocks will be at discount prices. Believe that.

On the Calendar

Motor Vehicle Sales tops the Economic Calendar which comes out very early in the pre-market and is the only report likely to move the market today. Forecasters expect Motor Vehicle Sales to remain soft with total unit sales slipping to 17.0 million annualized rate vs. the February 17.1 reading. Domestic sales expected to slip from 13.2 million in February to a 12.9 million rate today. The Redbook is out at 8:55 AM, a Fed Speaker at 9:30 AM and a bill auction at 11:30 AM wrap up the calendar for today.

We also have a light day on the Earnings Calendar with only 18 companies expected to report results.

Action Plan

Yesterday was an ugly day in for the market with three of the four major indexes dipping deep enough to test their 200-day moving averages. Only the QQQ managed to hold just above its 200-average which was just over one point away from the low of the day. The SPY really took it on the chin closing below the 200-average, despite the late rally bouncing the indexes off the lowest prints of the day. Even the popular FANG stocks had not escaped technical damage with AMZN now down more than 15% from its high print less than one month ago.

Currently, futures are pointing to a gap up open of more than 75 points, but I would be very careful trying to anticipate a bounce with the QQQ’s so close to a 200-average test. If you take a look at the weekly index charts, we are very close to testing the weekly 50-averages which could easily see a test in the coming days. Remember its always the darkest before the dawn. The selling will eventually stop, and great stocks will be on sale at discount prices. However, repairing so much technical damage could take some time, and we could see some very choppy price action ahead as the markets try and build a level of support.

Trade Wisely,

Doug

Do you believe in magic?

I’m going to kick off this quarter with a little rant. Over the long weekend, my email and social media feed’s filled with all kinds of offers selling the dream of simple market riches. They all allude to some newly discovered indicator or pattern that can suddenly transform any trader into the super wealthy almost overnight. That is total BS! There is no magic or double top secret newly discovered formula you can buy that will make you rich. Sorry to burst your bubble but it’s the truth.

I’m going to kick off this quarter with a little rant. Over the long weekend, my email and social media feed’s filled with all kinds of offers selling the dream of simple market riches. They all allude to some newly discovered indicator or pattern that can suddenly transform any trader into the super wealthy almost overnight. That is total BS! There is no magic or double top secret newly discovered formula you can buy that will make you rich. Sorry to burst your bubble but it’s the truth.

There is only one way to success in any business. It’s called hard work. It’s the original and the only magic formula to success. Start with some education, develop a trading plan (business plan) pull up your big-boy britches and get to work. Trading success is a marathon, not a sprint. There are obstacles to overcome and a lot of frustrating times on the path to success. However, if you stay dedicated, disciplined, focused, willing to pay your dues and put in the overtime, then success can be yours. Choose to believe in all that other mumbo-jumbo and plan to provide liquidity to those that do it the old-fashioned way. Hard work!

On the Calendar

The Economic Calendar on the first trading day of Q2 the Economic Calendar hits the ground running with three important reports. At 9:45 AM Eastern we get the PMI Mfg. Index which consensus expects to come in steady and strong with a 55.7 reading. The ISM Mfg. Index at 10:00 AM expects a slight decline to 60.0 vs. the 60.8 February print that hit a very strong 14-year high. Also at 10:00 AM is Construction Spending which consensus suggests will bounce 0.5% higher in February vs. the flat reading in January. There are 7-bond events on the calendar as well as a Fed Speaker at 6 PM to round out the day.

On the Earnings Calendar, there are 132 stragglers expected to report Q4 2017 earnings today.

Action Plan

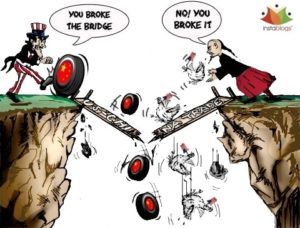

On Friday the Bulls managed a nice bounce of more than 250 Dow points. The bullish sentiment spread across the all 4 of the major indexes but they all remain in down-trending patterns and below significant levels of price resistance. Historically stocks do much better in April, but we seem to be getting off to a rocky start for the Q2 with the Dow Futures currently suggesting a gap down open of more than 75 points. China announced the new tariffs on more than 120 products yesterday as our two governments square off for a Trade War and keeping the markets on edge.

After a 3-day weekend, it’s normal to see some light and choppy trading as traders extend their vacations one more day but that may not be the case today with so much nervous energy. With earnings and economic reports continuing to demonstrate strength, our current uncertainty is by-in-large politically generated. Political volatility is very challenging to trade because complete market reversals can occur as often and as quickly as the political spin shifts.

Trade Wisely,

Doug

Three-Day Weekend

With the wild 2018 Q1 coming to an end today it seems very appropriate it culminates with a three-day weekend. Tensions have been very high, and nervous traders could use some time to decompress and prepare for Q2. Typically, volumes drop ahead of a long weekend and price action becomes quite choppy. However, with frayed nerves and emotions, high anything is possible. Keep a close eye on the price action watching for clues of additional selling as traders may choose to go into the long weekend with their cash safely tucked away in the account. On the other hand, the bulls could attempt a little relief rally in a reaction to the 200-day average on the SPY and DIA. Long story short prepare for anything ahead of this three-day weekend.

With the wild 2018 Q1 coming to an end today it seems very appropriate it culminates with a three-day weekend. Tensions have been very high, and nervous traders could use some time to decompress and prepare for Q2. Typically, volumes drop ahead of a long weekend and price action becomes quite choppy. However, with frayed nerves and emotions, high anything is possible. Keep a close eye on the price action watching for clues of additional selling as traders may choose to go into the long weekend with their cash safely tucked away in the account. On the other hand, the bulls could attempt a little relief rally in a reaction to the 200-day average on the SPY and DIA. Long story short prepare for anything ahead of this three-day weekend.

On the Calendar

On this last trading day of Q1, the Economic Calendar has several potential market-moving reports. At 8:30 am the Jobless Claims consensus is looking for a slight decline of 1000 to a 228k print vs. 229K last reading. Also at 8:30 AM, forecasters expect the Personal Income and Outlays report to show a 0.4% increase in personal income. Consumer spending is also expected to rise 0.2% with the closely watched core PCE price index coming in at 0.2% in February and a 1.5% annualized reading. Consumer Sentiment is at 10:00 AM and expected to remain strong with a 102.0 forecast reading. There are several other non-market moving reports throughout the day, a Fed Speaker at 1:00 PM, and a couple of bond-related events to close out the quarter.

The Earnings Calander shows 89 companies stepping up to report today. Make sure you have a plan if you’re holding or considering an entry on stocks that are reporting.

Action Plan

Yesterday indexes experienced some 2-sided choppy price action as the bulls and bears battle around the SPY and DIA 200-day average. The Dow traded in a chop range of more than 350 points making it a very challenging and frustrating environment for most traders. Currently, the Dow Futures are pointing to gap up open that but still within yesterday’s choppy range. With a 3-day weekend ahead don’t be surprised to volumes drop quickly after the morning rush.

Have an awesome extended weekend everyone. Happy Easter!

Trade Wisely,

Doug

Extreme Volatility

Resistance proved to be too strong yesterday with the bears laying in wait to ambush the morning rally. Current price action is displaying such extreme volatility even the most adept and experienced day traders find it challenging. Trying to navigate such volatile price action as a swing trader would only be suitable for those with a very high tolerance for risk.

Resistance proved to be too strong yesterday with the bears laying in wait to ambush the morning rally. Current price action is displaying such extreme volatility even the most adept and experienced day traders find it challenging. Trying to navigate such volatile price action as a swing trader would only be suitable for those with a very high tolerance for risk.

I have been warning that swing traders have little to no edge when a market becomes so violently emotional. If your continues to be chopped up, stop trading until the market calms down and your edge returns. Standing aside during times like this does not make you less of a trader. In fact, I would argue it makes you the smart CEO of your trading business that recognizes when the risk is just too high. Remember cash is a position that can serve you well in times as volatile as these.

On the Calendar

There are a total of five reports that come out at 8:30 AM Eastern on this last hump day in March. Two of the five, GDP and International Trade in Goods could easily move the market while with corporate Profits, Retail Inventories and Wholesale Inventories unlikely to do so. The GDP number according to consensus is expected to rise slightly to 2.7% annualized vs. the last reading at 2.5%. Consumer spending should hold steady at a 3.8% rate with the GDP index unchanged at 2.3%.

Consensus suggests the deficit in International Trade will narrow slightly to 74.0 billion vs. December reading of 75.3. At 10:30 the Pending Home Sales Index is expected to bounce back 3% after posting a sharp 4.7% decline in February’s report. The EIA Petroleum Status report produced a surprise decline in supplies on the last reading helping to boost oil prices. It’s 10:30 AM reading today is not forecast forward but does have the potential of moving the market on its release. We have a Fed Speaker at 11:30 AM, two note auctions and then Farm Prices report at 3:00 PM to close this busy day.

The Earnings Calendar shows 83 companies are expected to report results today as if there is not already enough to keep us on our toes today.

Action Plan

Yesterday I suggested it would be wise not to chase the morning gap and to be careful buying as the market pushed up toward resistance levels. After a nice morning rally which looked steady and consistent, the market ran headlong into a bear ambush. At the close, all four of the major indexes closed with bearish candle patterns as high volatility continues to plague the market.

With the Dow, less than 500 points away from its 200-day average it seems the odds would favor the bears testing this important level. Please exercise caution if you do plan to trade and remember swing traders have very little edge when such volatility exists.

Trade Wisely,

Doug

Short Squeeze Rally

An impressive short squeeze rally was triggered yesterday as panic over a potential trade suddenly seemed not so likely. To protect themselves from additional losses traders that were holding short positions were forced to cover accelerating the rally and squeezing even more out as the day progressed. A whipsaw of this magnitude clearly demonstrates just how quickly very emotional markets can shift direction. With the Dow rallying 669 points and this morning futures pointing to a more than a 100 point gap up guard yourself from getting caught up in this quickly shifting drama.

An impressive short squeeze rally was triggered yesterday as panic over a potential trade suddenly seemed not so likely. To protect themselves from additional losses traders that were holding short positions were forced to cover accelerating the rally and squeezing even more out as the day progressed. A whipsaw of this magnitude clearly demonstrates just how quickly very emotional markets can shift direction. With the Dow rallying 669 points and this morning futures pointing to a more than a 100 point gap up guard yourself from getting caught up in this quickly shifting drama.

The fear of missing out (FOMO) is a powerful emotion that often efficiently robs traders of their hard-earned capital so quickly it will leave your head spinning. Focus on the price action of the and remember to hold onto your edge realizing that in just one day markets are now very close to overhead resistance in a bearish overall pattern. Keep in mind huge intraday point swings are possible so if you trade make sure you have handle the risk.

On the Calendar

The Tuesday Economic Calendar kicks off at 8:55 AM with the Redbook report which is unlikely to move the markets. At 9:00 AM the Case-Shiller is calling for continued strength in home prices with an adjusted monthly consensus of 0.7% gain and a year-on-year rate seen at 6.2%. Consumer Confidence is out at 10:00 AM and consensus remains very strong expecting a 131.0 reading in March vs. February’s 130.8 print. Also at 10:00 AM are two non-market moving reports the Richmond Fed Mfg. Index and the State Street Investor Confidence Index. Other than that we have a Fed Speaker at 11: 00 AM as well as three bond auctions.

On the Earnings Calendar, I show 69 companies that are expected to report today.

Action Plan

With trade war fears suddenly diminishing yesterday’s market experienced a strong short squeeze forcing many traders to cover short positions to stop growing losses as the market rallied. This morning Dow Futures are pointing to more than a 100 point gap up at the open as the bulls try to follow through with some buying pressure. As good as it was to see such a nice relief bounce lets keep in mind that the indexes have significant overhead resistance and technical damage that it has yet to recover. At the close yesterday, the Dow is more than 950 points below its 50-day average with the SP-500 over 80 points below. Long story short, there is a lot of work to do even though both the Dow and SP-500 are displaying a possible double bottom pattern.

Be careful chasing morning gaps after such a big one-day-rally keeping in mind that short-term profit taking could occur at any time. The VIX remains above its 50-day average so continue to expect large intraday price swings, head fakes, and nasty whipsaw price action where the swing trader edge is small, and the potential for risk is high.

Trade Wisely,

Doug

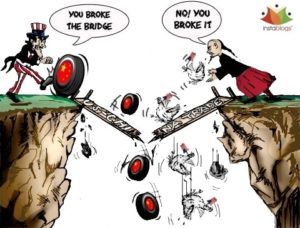

Volatility

Politically induced market volatility can be remarkably violent because of all the emotion whipped up in the press. It reminds of the Chicken Little nursery rhyme where one minute the press seems to infer the sky is falling and the next minute reporting well, maybe not! Such seems the case this morning as the trade war spin seems to have reversed over the weekend and cooler heads will likely prevail. Who would have guessed? LOL.

Politically induced market volatility can be remarkably violent because of all the emotion whipped up in the press. It reminds of the Chicken Little nursery rhyme where one minute the press seems to infer the sky is falling and the next minute reporting well, maybe not! Such seems the case this morning as the trade war spin seems to have reversed over the weekend and cooler heads will likely prevail. Who would have guessed? LOL.

Sadly it’s the poor retail swing traders that get damaged the most in these violent swings of market emotion. As I have said several times over the last three months, retail swing traders have little to no edge in such a violently emotional market. Trading accounts get chopped to pieces, and the traders have their confidence crushed in the turbulence. Always remember that cash is a position and that you don’t have to trade every day to be successful. Be patient your edge will return in due time.

On the Calendar

We begin this week on the Economic Calendar with only non-market-moving reports today. The Chicago Fed Activity Index is at 8:30 AM Eastern with the Dallas Fed Mfg. Survey at 10:30 AM. We have two Fed Speakers at 12:30 PM and 4:30 PM as well as four bound related events to complete the calendar day.

The Earnings Calendar shows 73 companies report results today. It’s hard to believe, but Friday marks the end of 2018’s first quarter. That means second quarter Earnings season is only about three weeks away.

Action Plan

Last week was a rough week for the market as trade war fears brought the bears out in droves. The DIA and SPY closed at its lowest at its lowest level of the year so far this year. The SPY closed Friday just below the 200-day average with the DIA missing that mark by only 1.5 points. The QQQ’s fell more than 2.5% while the IWM dropped just over 2% on the day.

It would seem this morning that the tough talk with China was a move designed to bring them to the table to cut a fair trade deal. Over the weekend pressure was added to China as a former Obama official said that President Trump’s concerns were valid. China has already made moves to relieve some of the trade deficit imbalances, and both sides have expressed a willingness to negotiate over the weekend. As a result, Dow Futures are currently pointing to a 275 to 300 point gap up this morning. That kind of huge gap will put some serious pressure on short traders that held over the weekend forcing them to cover. That means the conditions for a short squeeze exist this morning. Volatility is very high so expect very fast price action with intraday reversals that could easily swing the Dow more than 100 points in just a few minutes. It may be wild, but at least we will get some sweet relief from last weeks heavy selling.

Trade Wisely,

Doug

Trade war gloom.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

On the Calendar

We wrap up this week’s Economic Calendar with two important reports. At 8:30 AM Eastern is the Durable Goods report which according to forecasters will bounce back 1.7% in February. Capital goods should rise about 0.7% and remove ex-transportation is expected to show a solid gain of 0.6%. New Home Sales numbers at 10:00 AM is expected to come in with a strong 620,000 annualized vs. January’s reading of 593,000. We have Fed Speakers at 10:30 AM and 11:30 followed by the Oil Rig count at 1:00 PM to finish off the calendar week.

On the Earnings Calendar, there are only 24 companies expected to report, and I don’t see any that would be particularly market moving.

Action Plan

The bears hit the ground running yesterday with about a 200 point gap down at the open as a head start. After fall 500 points there was a brief rally, but tough tariff talk brought the bears back in force closing the day down 724 point in the Dow. With yesterdays selloff all four of the major averages are now below their 50-day moving averages. Future markets this morning are only adding to the pain currently pointing to 100 point gap down, but that is an improvement from the overnight lows if you’re looking for a little silver lining. The SPY only has about 57 points to reach the 200-day average while the Dow would need to drop another 600. I know no one wants to see that happen but it sure looks like that’s a good possibility.

If your short, congratulations, its time to watch for clues of a relief rally to take some profits. Those standing aside stay focused on price action, manage your watchlists and prepare. The selling will eventually end there will be nice discounts prices on good stocks when it does.

Trade Wisely,

Doug

Stop Digging

I have the privilege of working with a lot of traders from all over the world. A common theme I’ve heard over the last couple months is that many are seeing their accounts chopped to pieces. I hear things like; Everything that was working last year is now delivering a lot of losses. What they have failed to recognize is that the market has changed and they have not adapted to the change. There is an old saying, “if you find yourself in a hole, Stop Digging.” The market has changed and has become very challenging even for very experienced traders.

I have the privilege of working with a lot of traders from all over the world. A common theme I’ve heard over the last couple months is that many are seeing their accounts chopped to pieces. I hear things like; Everything that was working last year is now delivering a lot of losses. What they have failed to recognize is that the market has changed and they have not adapted to the change. There is an old saying, “if you find yourself in a hole, Stop Digging.” The market has changed and has become very challenging even for very experienced traders.

If you find that the market is handing you one loss after another, then it’s time to stop digging and reevaluate. If you have no “edge,” then your likely only providing liquidity to those that have adapted. Stop, reevaluate, wait for your edge to return or adapt your trading to the current market conditions. The only alternative is to watch your capital disappear along with your dreams of financial independence.

On the Calendar

The Thursday Economic Calendar is a full-one, but there are only two potential market-moving reports today. First is the 8:30 AM Jobless Claims that consensus expects to decline 1000 to 225,000 as labor demand continues to be steady and strong. Secondly, we have the PMI Composite at 9:45 AM which consensus suggests will remain strong at 55.2 with PM Manufacturing at 55.7 and PMI services at 55.7. Reports today that are not expected to move the market, FHFA Housing Price Index, Consumer Comfort index, Leading Indicators, Natural Gas report, Kansas City Manufacturing Index, Fed Balance Sheet, Money Supply, and 8-bond related events.

The Earnings Calendar shows 84 companies are expected to report earnings today.

Action Plan

When I ran out early yesterday for an eye doctor appointment, the price action was still whippy but leaning slightly toward some hopeful bullishness. Sadly the bulls were unable to hold on to that bullish sentiment with only the IWM managing to close the day positive. It would seem jitters over additional tariffs, and the potential of a trade war with China is to blame. Yesterday I mentioned that the indexes were sitting at the edge of a very big cliff and it wouldn’t take much to push them over the edge. With the Dow futures pointing to more than a 150 point gap lower this morning, it would appear tariff fears could give us that push.

Remember big morning gaps can often create whipsaws and very fast price action. Be careful not to chase the gap. The next visible price support lower on the Dow is still several hundred points away. If the bulls don’t fight back hard, we could experience another significant selloff today. Protect your capital.

Trade Wisely,

Doug

What if?

Waiting is never fun. It allows the mind to wander through all the “What If” scenarios and invites speculation of the unknown. The financial media will do it’s it part to whip up the emotion with dramatic headline graphics and bumper music that would make Hollywood jealous. What does all that drama and speculation accomplish? Nothing but make us emotional.

Waiting is never fun. It allows the mind to wander through all the “What If” scenarios and invites speculation of the unknown. The financial media will do it’s it part to whip up the emotion with dramatic headline graphics and bumper music that would make Hollywood jealous. What does all that drama and speculation accomplish? Nothing but make us emotional.

The “what if” game is endless and unproductive. We still have to wait for the FOMC decision, and no one knows what that will be until its released. Will they add additional interest rate increases to the forecast? We will find out at 2:00 PM Eastern and no amount of talking head conversations will change that.

What we can do as retail traders is prepare. If you’re very nervous about the announcement, then perhaps your over-trading and need to make some adjustments to your risk. If you’re new to trading or lack sufficient experience for such events perhaps standing aside is your the best course of action. Work to make good business decisions without bias or prediction and be prepared to react without emotion.

On the Calendar

A big day on the Economic Calendar on this hump day. We get started with important reports at 10:00 AM Eastern when Existing Home Sales which consensus expects a slight increase to 5.420 million annualized rate. At 10:30 AM the Petroleum Status Report which as recently shown a decline in supplies helping to bolster oil stocks ever so slightly. After that it’s all about the FOMC Announcement at 2:00 PM along with the FOMC Forecasts. Then at 2:30 PM the newly seated Chairman Powell will have the entire world focused on every word he utters during the Press Conference.

On the Earnings Calendar, there are 56 companies expected to fess up on their quarterly results.

Action Plan

Today the entire financial world will be focused on the FOMC and what our new Fed Chairman will have to say at the press conference. Based on his introduction speech where Chairman Powell seemed to lean hawkish has the market speculating more interest rate increases in the FOMC forecast. Interest-sensitive securities have experienced some selling this week in anticipation of this report. It’s understandable that the market is pensive as we wait for their decision but all the speculation is, and drama is a waste of time. As retail traders, all we can do is wait for the decision and react once the decision is known.

I’m expecting choppy price action ahead of the 2:00 PM announcement. However, after the release of the statement and forecast, we can expect very wild price action as the market reacts. Today is likely too much more volatile than we have recently experienced. Currently, the futures are pointing to a mixed open. The spooky thing is that the DIA and the SPY are sitting right on the edge of a very steep cliff. Any miss step or poorly chosen word could easily push them over the edge. Let’s hope that’s not the case and instead that Chairman Powell offers a steady hand that prevents a fall.

Trade Wisely,

Doug

Fear

The data breach in FB coupled with the unknown of the coming FOMC decision gave the bears just what they needed to strike fear into the hearts of traders and investors. Fear is only of those powerful emotions that can quickly create a lot of technical damage and make our jobs as trades that much more difficult. When we allow fear to creep into our trading, it diminishes our ability to make good trading decisions. Remember trading is a business, and just like any other business emotional decision making has no place in business. Emotional trading is like cancer relentlessly eating away your capital. The good news is this cancer is curable with a simple trading plan with a set of rules designed to protect you from YOU! If you don’t have a plan, stop trading until you do or continue to watch your capital disappear. You are the CEO of your business and solely responsible for your results. The choice is yours.

The data breach in FB coupled with the unknown of the coming FOMC decision gave the bears just what they needed to strike fear into the hearts of traders and investors. Fear is only of those powerful emotions that can quickly create a lot of technical damage and make our jobs as trades that much more difficult. When we allow fear to creep into our trading, it diminishes our ability to make good trading decisions. Remember trading is a business, and just like any other business emotional decision making has no place in business. Emotional trading is like cancer relentlessly eating away your capital. The good news is this cancer is curable with a simple trading plan with a set of rules designed to protect you from YOU! If you don’t have a plan, stop trading until you do or continue to watch your capital disappear. You are the CEO of your business and solely responsible for your results. The choice is yours.

On the Calendar

The very light Tuesday Economic Calendar biggest highlight is the beginning of the 2-day FOMC meeting. Other than that we have the Redbook at 8:55 AM and a bond auction at 11:30. None of which would be expected to move the market.

The Earnings Calendar shows 52 companies are expected to report today. FDX is the most noteworthy report of the day that releases results after the bell.

Action Plan

Yesterday saw some ugly price action as traders and investors choose to dump positions. Some point to the selling on FB as the catalyst for the bearish day, but I think jitters ahead of the FOMC interest rate policy announcement is more likely to blame. Whatever the cause, yesterday delivered serious technical damage to the SPY and DIA charts and spiking the VIX over 20% as fear seemed to overwhelm the market. The QQQ managed to hold onto its 50-day average but sadly broke some important price supports as well as the current uptrend. Small caps seemed to fair the best not only bouncing strongly off the IWM 50-day average but also recovering important price support by the close of the day.

As I write this, Futures markets a mixed with a slight bearish bias. With no major earnings or economic reports this morning the market will have little more than its nervous emotions to chew on today. If the Bears step in with some, follow-through selling fear could quickly turn into panic. On the other hand, if the Bulls step up to defend critical price supports, then we have a chance of repairing some of the technical damage created by yesterday’s selling. With the FOMC announcement on Wednesday afternoon, choppy price action is likely. Couple that with rising volatility and we have the potential of wide range chop with fast whipsaw price action. Plan carefully and protect your capital.

Trade Wisely,

Doug

It’s pretty difficult when looking at index charts to see anything other than gloom and doom. There is technical damage everywhere you look, and a general feeling of dread has gripped the market. The financial news headlines have become predominantly negative with more and more talking heads predicting more gloom and doom to come. Having traded for more than 28 years, I can tell this is the normal process of correction.

It’s pretty difficult when looking at index charts to see anything other than gloom and doom. There is technical damage everywhere you look, and a general feeling of dread has gripped the market. The financial news headlines have become predominantly negative with more and more talking heads predicting more gloom and doom to come. Having traded for more than 28 years, I can tell this is the normal process of correction.