Debt Ceiling

Modestly better than expected earnings results and a 2-year debt ceiling agreement between the Whitehouse and Congress have the US indicating a bullish open ahead of a big day of reports. After a mostly choppy price action day, the bull finally overwhelmed the bears as they defended trends and key supports. Of course with nearly 140 companies on deck to report and the Existing Home Sales number a 10:00 AM Eastern a lot could change by the open but so far it would appear the bulls have the upper hand.

Asian markets responded bullishly overnight on the better than expected earnings results closing in the green across the board. European markets are also bullish this morning as they welcome a new Prime Minister ( Boris Johnson ) and a government reorganization that may or may not lead to Brexit deal. As a result, all four major indexes indicate a bullish open. Expect price action volatility to expand as the number of earnings reports ramp-up this week.

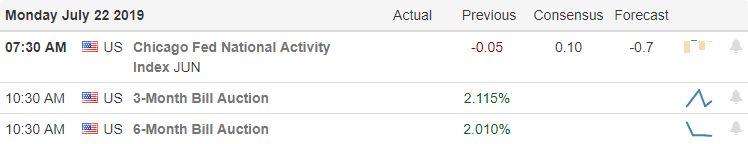

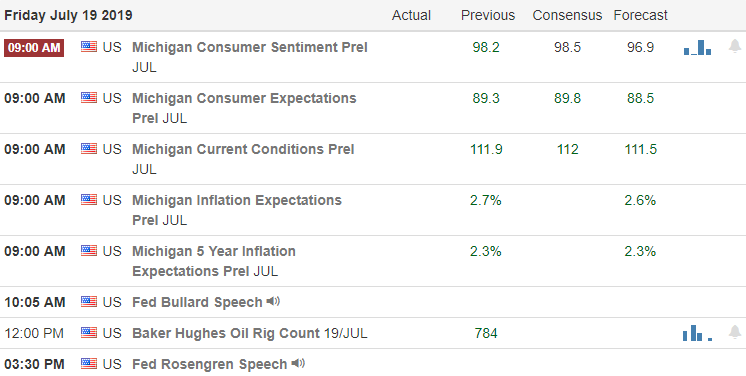

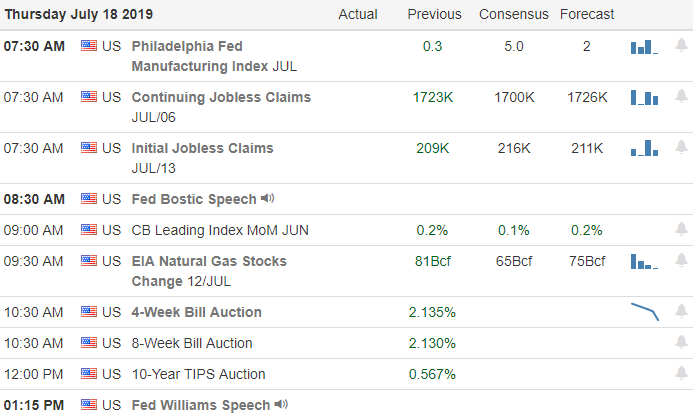

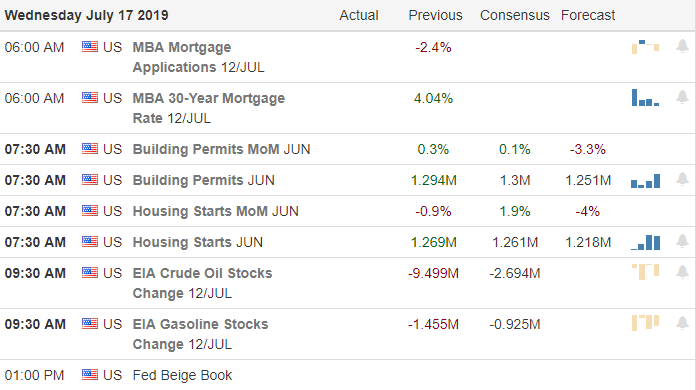

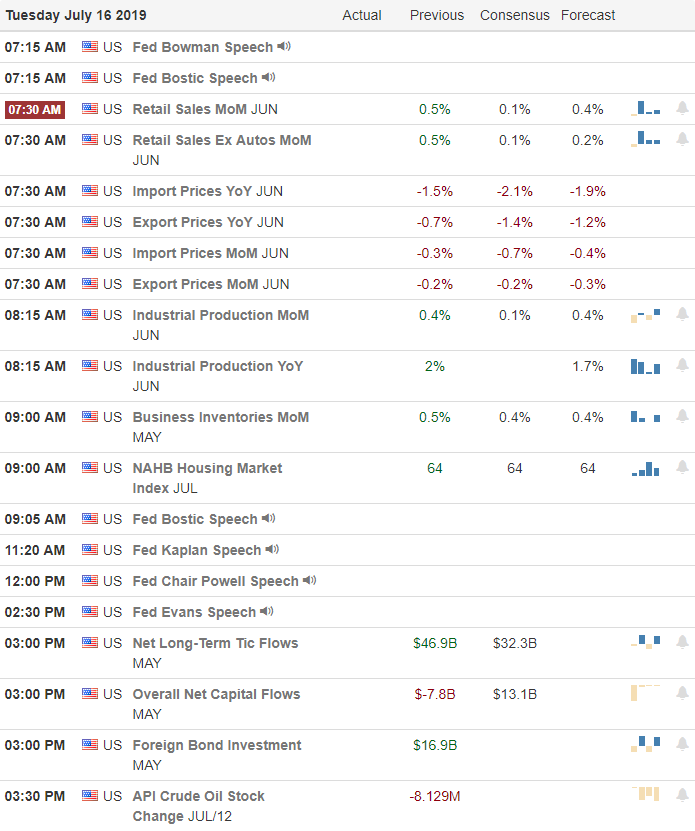

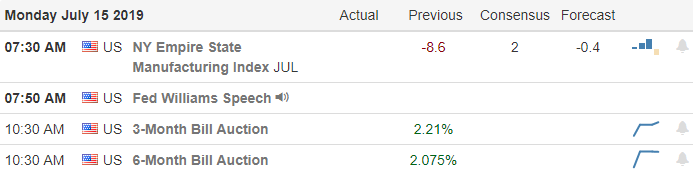

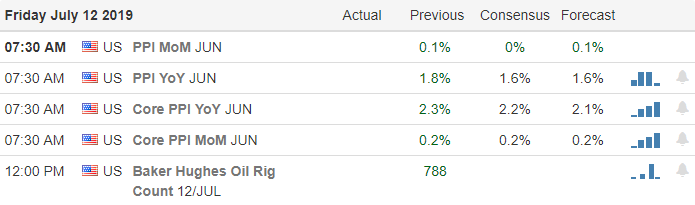

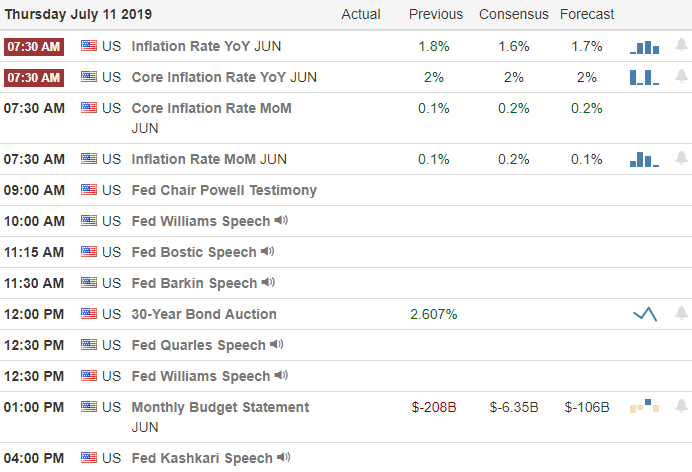

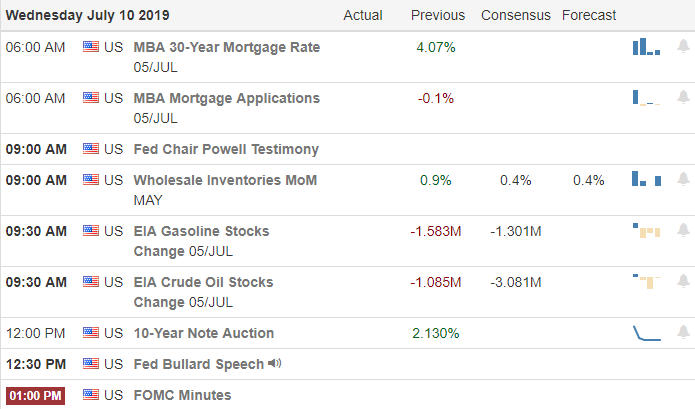

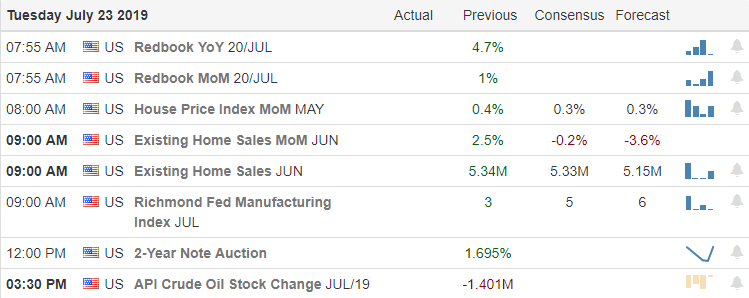

On the Calendar

On the Tuesday Earnings Calendar, we have about 140 companies fessing up to quarterly results. Notable reports include AN, AVY, BIIB, CNI, CNC, CMG, CB, KO, DFS, FITB, FE, HAS, IRBT, JBLU, KEY, KMB, LMT, PNR, PHM, DGX, SHW, SNAP, SWK, TXN, TRV, UBS, UTX & V.

Action Plan

After a mostly choppy price action day, the bulls finally got it together and appeared to gain the upper hand by the close. The QQQ demonstrated the tenacity of the bulls recovering and defending a key support and ultimately maintaining the bullish trend in the DIA, SPY as well. Earnings after the bell appeared to come in slightly better than expected and the announcement of a Whitehouse and Congressional 2-year debt ceiling deal also lifted spirits.

Consequently, US Futures are pointing to a higher open this morning ahead of nearly 140 earnings reports that obviously could improve or dampen the actual open depending on the reaction of the results. At 10:00 AM Eastern we will get the latest reading on Existing Home Sales which can move the market and the only such report on the economic calendar with the power to do so today. I’m expecting volatility to expand the rest of the week as the number of earnings reports expands. Challenging price is likely with the possibility of substantial morning opening gaps that could include overnight reversals.

Trade Wisely,

Doug