After a concerning morning selloff during the morning session, the bulls stepped up right on queue defending current up-trends and holding key support levels with a nice afternoon rally. After the bell, yesterday MSFT’s strong earnings report also seems to have at least temporarily lifted some trade war fueled tech earning concerns.

FOMC members Willimas & Clarida spurred speculation of a more aggressive interest rate cut after their comments late Thursday. As a result, Asian markets closed decidedly bullish seeing green across the board. However, European markets are mixed but mostly slightly lower this morning after the Fed clarifies and tones down the rate cut rhetoric. Consequently, US Futures point to modestly bullish open as earnings reports roll in and ahead of the Consumer Sentiment at 10:00 AM Eastern. With tensions once again on the rise after the US downing of an Iranian drone carefully consider the risk you carry into the weekend.

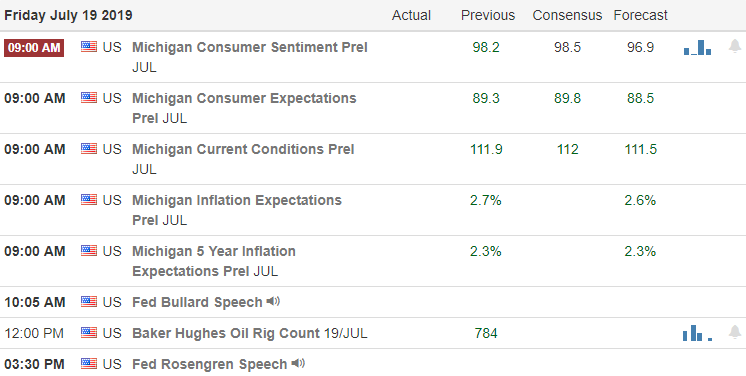

On the Calendar

On Friday’s Earnings Calendar we have a slightly lighter day with 39 companies reporting. Notable reports today include BLK, CLF, KSU, MAN, NVR, SLB, STT, and SYF.

Action Plan

Yesterday’s strong earnings report from MSFT may go a long way to soothing traders concerns of a trade war influenced tech slow down at least for today. Next week we jump headlong into earnings with more than 800 companies expected to report with big tech being a major focus. There is renewed hope of a bigger rate cut this morning after a late afternoon speech’s by FOMC members Williams & Clarida spurred speculation of a more aggressive Fed. If that is the case, with such strong current economic indicators, it will leave very little firepower for the Fed if an economic crisis really does arrive.

Technically speaking the afternoon rally yesterday seemed to come at just the right time holding current trends and key support levels in the indexes. Toss in a good MSFT report, and a warm and fuzzy feeling of possible rate cuts the US Futures are suggesting a modest rally at the open, and I would not be surprised if overnight futures highs get tested sometime during today’s session. We have Consumer Sentiment at 10:00 AM Eastern that is expected to remain strong and more Fed speak to round out this week’s economic calendar.

Trade Wisely,

Doug

Comments are closed.