1-13-19 Sunday Session

The Week Ahead

Yesterday I mentioned that the market needs a rest, but he tenacious bulls had other plans yesterday printing the 5th straight day up since September. The Dow has now recovered 2254 points in 11 days, and yet nothing has changed with the political uncertainty. There has been progress in the trade negotiations but still, no agreement and the government shut down at 21 days is now tied for the longest in history with no apparent resolution in sight.

Please understand I’m not suggesting bearishness I’m only pointing out the curious nature of the market and how important it is to follow the price action and trade the chart without trying to predict. I still believe the market needs a little rest or pullback, but big opportunity may be just around the corner. As we head into an uncertain weekend, I suggest being careful chasing this rally which appears stretched in the short-term. However, I would be preparing a watchlist of candidates that could soon setup great swing and positon trades.

On the Earnings Calendar, we have a light day with only eight companies reporting with INFY the most notable reporting before the bell.

The Bulls proved to very tenacious yesterday defending price levels every time there was even a hint of profit-taking. One would think that kind of pressure would continue through the end of the week, but interestingly enough the futures appear to be lackluster this morning. As I write this, the US Futures are suggesting a flat open as we enter the 21st day of the government shutdown. That ties for the longest shutdown in history, but as we head into the weekend, there seems to be no resolution in sight.

Trade negotiations this week proved to be productive, but there are not stories coming out that there is a lot of work to be done before finalizing an agreement. Now the question is will bulls remain strong as we head into the weekend amid all the uncertainty? T2122 continues to signal caution and suggesting a short-term overbought condition but as you know price action is currently not confirming that conclusion. We will have to tread carefully this morning to see if the bulls have the energy to push higher or if the profit-takers take control ahead of the weekend. I would suggest being very careful about over-committing to long positions this late in the rally.

Trade Wisely,

Doug

Follow-through below yesterdays low could lead price back to test the $254.55 / $252.85 area. The past four days the buyers have been able to string together four new highs and four new lows, however, the $258.00 area is proving to be more of a task then the buyers anticipated with the narrowing of the range. Follow-through below yesterdays low could lead price back to test the $254.55 / $252.85 area. The $258.00 resistance line is what we have talked about the last few days is also where the 60-min. 200-SMA has camped out.

The LTA – Live Trading Alert Program is software that runs independently of any charting programs, an in real time finds chart setups. Hi, this is Rick Saddler founder of Hit and Run Candlesticks, as you know I have been using a live scan most of my trading career. It wasn’t until after I started to use the scanner that I became successful. Some people even say I am one of the best directional swing traders they have ever seen, that just not true; it’s because of the Live Scanner and what it does for me. It would be very hard for me to give up the scanner and believe every trader that wants to succeed needs to consider this tool.

You can get then scanner for a 30-day trial, but please keep it for at least 6-months to give it and you a chance. Below are a few scans it currently can run and we can customize scans for you! 30-Day Trial

Bull Trend

Bull 3×8 Cross

Bull Consolidation

Bull PBO Pull Back

Bull Candlestick Signals

Bull (RBB) Set-up

Bull Doji Confirmation

Bullish Moving Average Bounce

Bullish Continuation Patterns

Bear Trend

Bear 3×8 Cross

Bear Consolidation

Bear PUO Pull Back

Bear Candlesticks signals

Bear (RBB) Set-up

Bear Doji Confirmation

Bear Moving Average Bounce

Bearish Continuation Pattern

LTA – Live Trading Alerts Scanner 30-Day Trial Comes with Live Coaching

VIX–X Chart – The VIX

HRC Watch list additions – It’s Friday, no trade ideas today

Past performance does not guarantee future.

2 Hours Private coaching – Read More

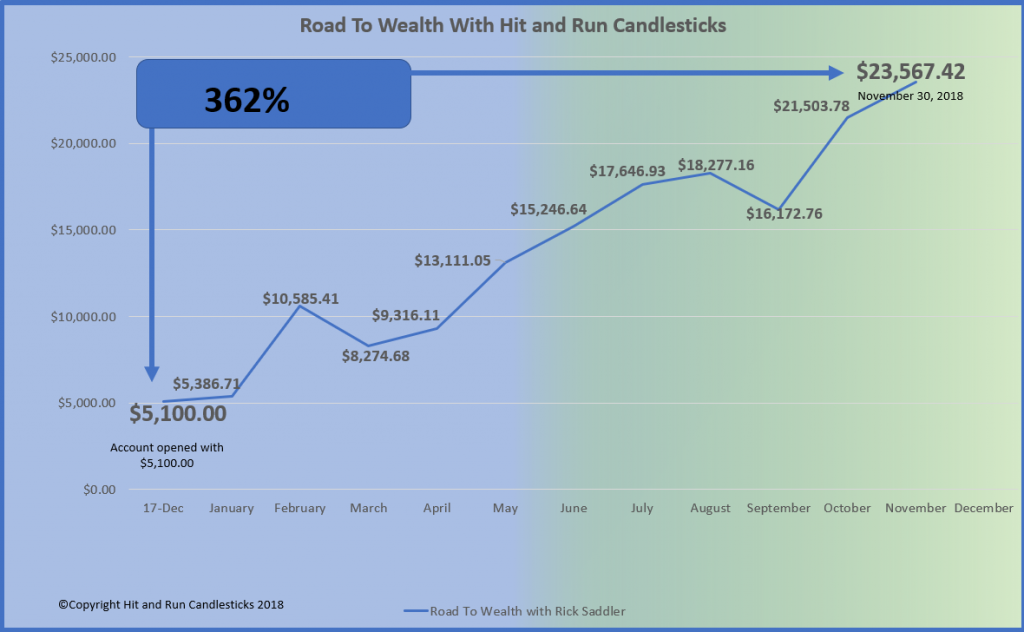

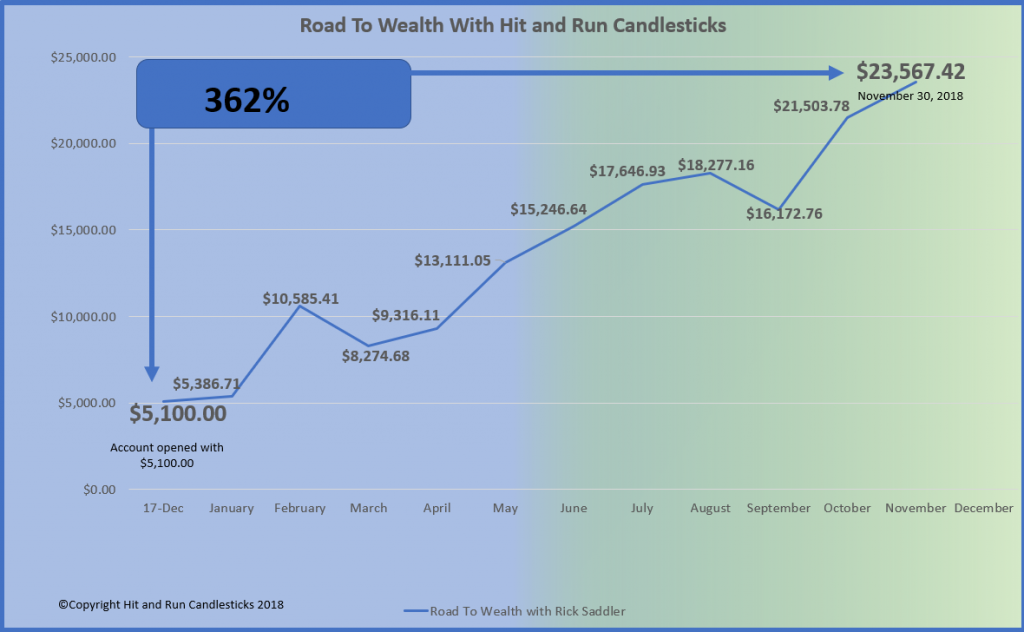

Hit and Run Candlesticks – Join Rick Daily in trading room #1 membership required. Join in, ask questions and learn how Rick picks his trades and trades them. 2018 account + 307% starting with only $5,100. Become a member of Hit and Run Candlesticks and let’s bring on 2019

Read More

Right Way Options Room Update – The RWO trading room is now open all day to share ideas and watchlist suggestions. Watch and learn from Doug as he prepares and explains his trades. Learn More about Right Way Options – Read More

2 Hours Private coaching – Read More

Top Gun Day Trading Room is for the active day/scalp trader looking to profit daily with no overnight risk. Daily trade alerts and trading education. Read More

2 Hours Private coaching – Read More

Road To Wealth Coaching Looking for extended coaching? Serious out trading? Work with Rick Saddler on a daily basis. Read More

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing/ Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by it and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service

Climbing more than 2200 points in just 10-days, the US futures this morning are suggesting a little rest might be in order. As we enter the 20th day of the government shutdown and as of now no indication of when an agreement with China might occur there is still significant uncertainty for the market to ponder.

With the VIX closing below a 20 handle perhaps we could see a simple consolidation rather than the punishing selloff we have experienced lately. With hundreds of charts indicating possible bottoming patterns, a little rest or pullback could set up some great entries for swing and position traders. Remember that the market is likely to remain very sensitive to political news and still subject to quick price action and reversals so remain flexible and focused on price action. Great opportunity for swing traders and good stock pickers may be just around the corner so dust off that wishlist and be prepared.

On the Earnings Calendar, we have 17 companies reporting earnings today with none that are notable unless you happen to own one of them. Remember earnings season is coming, it would be a good time to get into the habit of checking reporting dates.

With a failed meeting between the President and Democratic congressional leaders our government shut down now enters day 20. The news on US / China trade remains positive, but there has been no indication as to when a decision might be forthcoming. After notching a 4th bullish day, the futures are suggesting the market needs a little rest this morning. As I write this the Dow indicating a gap down just short of 100 points but I do expect that improve during the pre-market pump.

Climbing more than 2200 Dow points in just ten days a little rest is definitely warranted, but that does not necessarily mean we are due a significant selloff. The best scenario would be a consolidation as we wait for some resolution of all this government uncertainty. Let’s keep a close eye on price support levels in the indexes. The good news is with so many charts showing signs of bottoming a pullback, or some consolidation could be just what the doctor ordered to set up trade entries. Polish up your watchlist because major opportunity may be just around the corner.

Trade Wisely,

Doug

After three days of negotiations, the US team is packing up and heading home, and the market has high hopes that a deal is forthcoming. Asian markets rallied strongly when the negotiation extended into the unscheduled 3rd day closing up sharply. European markets are currently bullish across the board as well. As a result, US Futures are suggesting a gap up open extending hopes for a fourth day up, largely ignoring the border wall wrangling and government shutdown entering the 19th day.

The current rally appears a bit stretched in the short-term and bearish hanging man patterns were left behind near resistance levels is a concern so be careful not to chase. A little profit taking is not out of the question, but this bull rally could easily extend if a US/China trade deal happens. Don’t fight the bull but don’t over commit long and watch price action for possible reversals. I guess the moral of the story is to be prepared and remain flexalbe.

On the Earnings Calendar, we have 22 companies reporting earnings. Most notable are LEN and STZ before the bell and BBBY after the closing bell today.

Hopes are high that the US / China negotiations have borne fruit after extending for an unscheduled 3rd day. As the negotiations team packs up to head home, everyone is wondering if there is a deal or if more decessions are necessary. As of now, it would seem the markets are unconcerned about the government entering its 19th day and oval office speech that elevated tension between the warring parties.

Yesterdays gap, pullback and then afternoon rally left behind possible hanging man candle pattern near resistance levels in the indexes. However, on the trade deal hopes futures are currently suggesting a gap up open of more than 50 points. While a hanging man pattern at resistance is a reason for concern, if the bulls can follow through for the 4th day up the pattern loses strength. We will have to see how the day turns out, but it would be wise to pay close attention to the price action after the open and not to over-commit long until the bulls prove they can stretch this rally further.

Trade Wisely,

Doug

Follow-through below yesterdays low could lead price back to test the $254.55 / $252.85 area. The past four days the buyers have been able to string together four new highs and four new lows, however, the $258.00 area is proving to be more of a task then the buyers anticipated with the narrowing of the range. Follow-through below yesterdays low could lead price back to test the $254.55 / $252.85 area. The $258.00 resistance line is what we have talked about the last few days is also where the 60-min. 200-SMA has camped out.

VIX–X Chart – The VIX chart tested our $ 19.70 line with an Inverted Hammer with nine new lows out of ten candles. An oversold bounce seems to be logical within the next day or two. Side note: The T2122 4wk New High/Low Ratio chart is pegged in the overbought area.

HRC Watch list additions – CGC, KL, ROKU, TNDM, FB, PHYS, GE. We cover the details of these trade ideas and others in the trading room throughout the day. We hope you join us to learn the trade details and how we plan to trade our trades.

Past performance does not guarantee future.

Hit and Run Candlesticks – Join Rick Daily in trading room #1 membership required. Join in, ask questions and learn how Rick picks his trades and trades them. 2018 account + 307% starting with only $5,100. Become a member of Hit and Run Candlesticks and let’s bring on 2019

Read More

2 Hours Private coaching – Read More

Right Way Options Room Update – The RWO trading room is now open all day to share ideas and watchlist suggestions. Watch and learn from Doug as he prepares and explains his trades. Learn More about Right Way Options – Read More

2 Hours Private coaching – Read More

Top Gun Day Trading Room is for the active day/scalp trader looking to profit daily with no overnight risk. Daily trade alerts and trading education. Read More

2 Hours Private coaching – Read More

Road To Wealth Coaching Looking for extended coaching? Serious out trading? Work with Rick Saddler on a daily basis. Read More

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing/ Trading involves significant financial risk and is not suitable for everyone. No communication from us should be considered as financial or trading advice. All information provided by it and Run Candlesticks Inc, its affiliates or representatives is intended for educational purposes only. You are advised to test any new approach before implementing it. Past performance does not guarantee future results. Terms of Service