Hope of a Deal

Last nights CNBC headline that reads, “US and China are reportedly drawing closer to a final agreement” lifted markets around the world with the hope a deal is forthcoming. Although the article goes on to say both countries still have to agree on a number of important issues the bulls grabbed a hold of that headline and ran. As a result, the US Futures point to a gap up open that indicate the SPY and the QQQ will open above key resistance levels assuming the bullish sentiment holds throughout the morning.

Once again assuming the bulls have the energy to hold this new price level of support it opens the door for the market to test all-time market highs in the near future. Of course we still have to be watchful of a pop and drop pattern if buyers fail to support the morning gap so be careful not to chase. Remember we have the big employment number coming Friday morning and it’s not unusual for the market to become light and choppy as we wait.

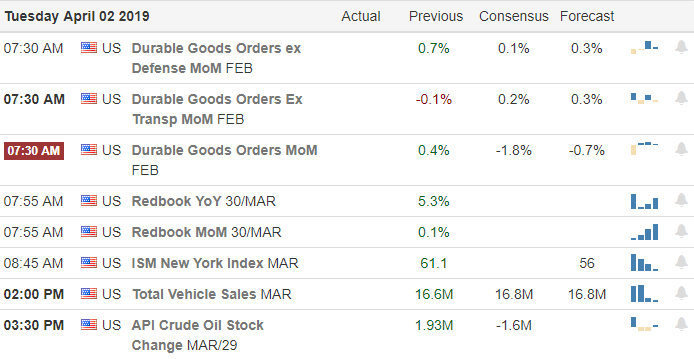

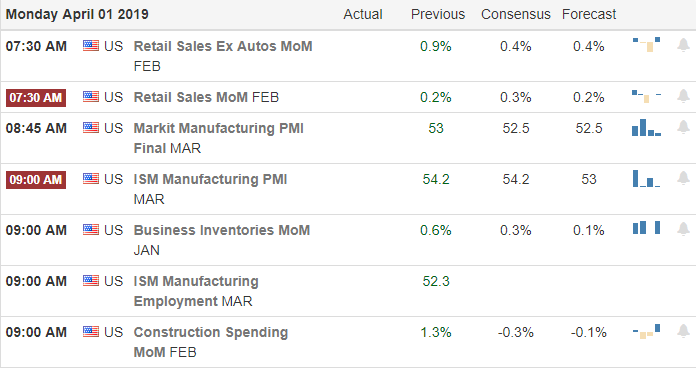

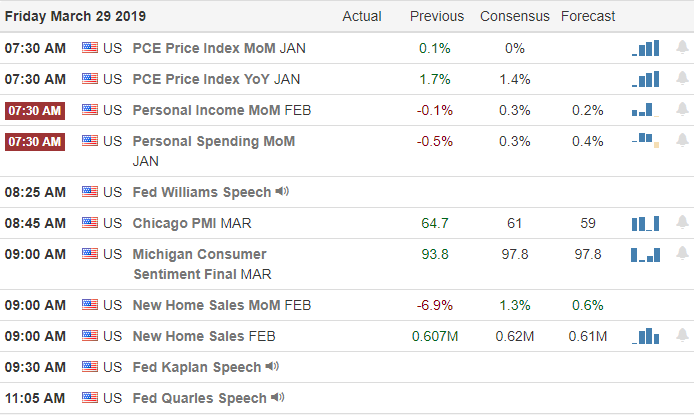

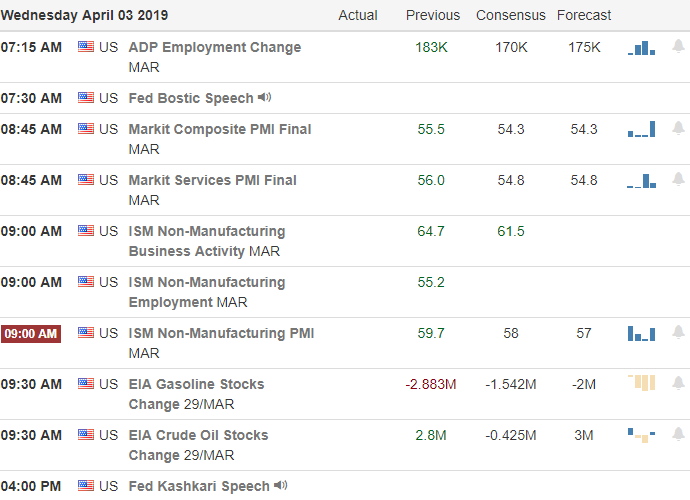

On the Calendar

We have fewer than 30 companies reporting earing today as the first quarter reports continue. Among the most notable are CALM, DGLY & KODK.

Action Plan

Shortly after the Asian markets open CNBC reported that the US and China are drawing closer to a final trade agreement. Then went on to say, “Both countries have yet to agree on a number of important issues.” None the less the Asian markets responded bullishly to the headline closing higher across the board. Currently European markets are mixed but mostly higher with the FTSE just slightly in the red.

Consequently the US futures are bullish across the board with the Dow indicating a gap up of 100 points or more as I write this report. At the close yesterday the indexes all faced a challenging price resistance level but as of right now both the SPY and QQQ indicate they will gap through resistance at the open. That certainly opens the door for a possible new record market highs in the near future assuming the bulls can hold above resistance. Of course we must still watch for the possibility of a pop and drop pattern developing if buyers fail to support the morning gap this morning. Remember we have the big Employment Situation number coming Friday morning and it’s not uncommon for the price action to become light and choppy as we wait.

Trade Wisely,

Doug