As always with a gap open we want to avoid the urge to chase. Wait and watch the price action after Clues of a slowing economy that continue to pop up in the economic data have slowly begun a toll on this tremendous bull run. Slowing retail and housing were swept aside due to hopes of a forthcoming US/China trade deal. The appears to be growing weary of the wait and yesterdays disappointing trade numbers added additional pressure.

Thus far the selling has been very controlled and after such a steep rally should not have been a surprise. Futures this morning are currently trying to rally off the overnight low but are suggesting a modest gap down at the open. Although we may see in increase in price volatility as fear grows I would be careful not to chase the gap waiting to see if sellers support the move.

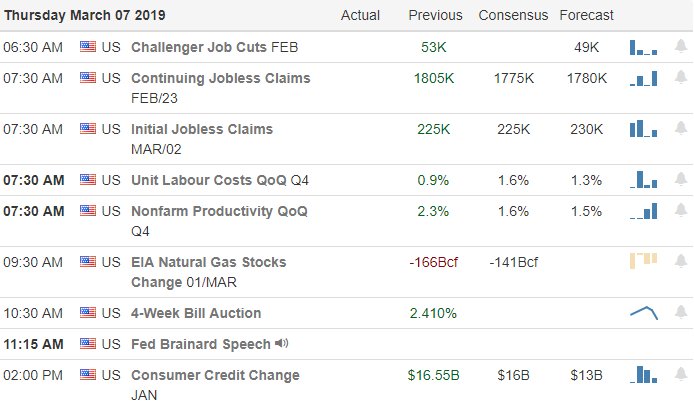

On the Calendar

We have 185 companies fessing up to quarterly results today. Among the notable earnings are: COST, BKS, AOBC, BURL, CRCM, CHUY, LOCO, GNC, HRB, HOV, KR, PLUG & UMH.

Action Plan

Disappointing economic growth numbers in Europe, US trade deficits, North Korea appearing to restart their nuclear program while the world continues to wait for a US/China trade deal have the futures looking gloomy this morning. The bulls have worked pretty hard to hold price action supports are beginning to falter as hungry bears continue the gap to see if sellers support the move lower with additional selling.

T2122 this morning is likely to reach the bullish reversal zone at the open. That doesn’t mean we should get an immediate bounce it only suggests the odds of a relief rally are growing as long as there is not a piling on of more bad news. So far this has been a very controlled pullback but this mornings gap down has the potential to increase price volatility.

Trade wisely,

Doug

Comments are closed.