Understanding Volatility

Understanding volatility is very important to the options trader. In this calls we discuss how volatility effects options prices and the way to use that knowledge to your advantage.

Understanding volatility is very important to the options trader. In this calls we discuss how volatility effects options prices and the way to use that knowledge to your advantage.

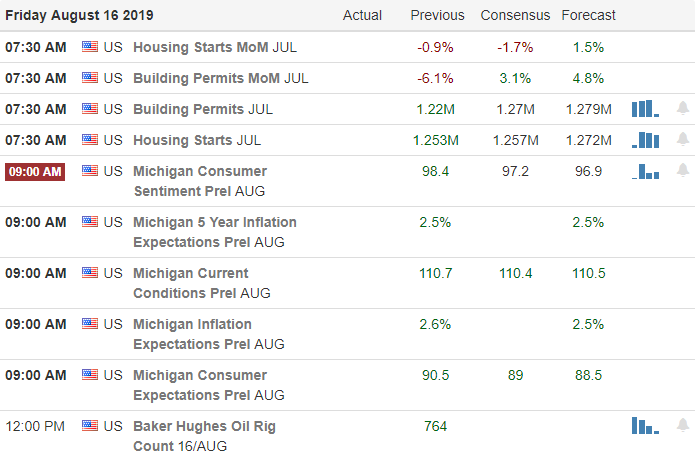

Lots of questions with very few answers created a very frustrating day of price action on Thursday. As bond yields finally began to moderate late afternoon, the market picked a direction and provided a least a modest relief rally into the close. A good round of earnings reports after the bell and a bit of bond market stabilization during the night lifted spirits around the world. The big question for traders this morning, can we trust this mornings bullishness amidst all the volatility enough to add risk heading into the weekend still full of uncertainty?

Overnight Asian market closed modestly bullish across the board as bond yield slightly improved. European markets are moving higher this morning after a technical issue delayed the open in the UK. US Futures are solidly bullish this morning with the Dow pointing to a gap up of more than 200 points. Be careful not to chase the open in-case this wildly volatile decides to pop and drop. Also, consider carefully the amount of risk your willing to carry into the weekend.

We get a little break on the Friday Earnings Calendar with just 68 companies reporting earnings today with DE as the most notable.

Will, there be real progress on trade negotiations or not? Will the FOMC reduce the rates or not? Will, the Bond Rates, invert and remain inverted or not? Will China send troops into Hong Kong to put down the protests or not? Will the global economic slow down effect the US economy or not? That uncertainty created another very volatile session on Thursday, and until we get some clarity is likely to continue to create very difficult price action for traders to navigate.

Yesterday T2122 signaled an oversold condition, but with so much uncertainty the market struggled until late afternoon when it finally managed to put together a little relief rally. A round of good earnings reports after the bell also lifted spirits, and treasury yields somewhat stabilizing during the night has futures pointing to a significant gap up this Friday morning. The question is, can we trust it, or could it produce a pop and drop pattern or even worse another lower high within the downtrend? Secondly, how much risk will traders be willing to hold into an uncertain weekend? Nonetheless, any relief rally is a welcome sight after a week of heavy selling.

Trade Wisely,

Doug

FOCUS: Stocks/Options Friday 8/16/2019; tar light, star bright, first star I see tonight . . . . Unfortunately, this hopeful nursery rhyme doesn’t apply in the world of swing trading, where an Evening Star candlestick pattern indicates that nasty things are on the horizon. When traders spot this pattern, which is a top reversal signal, they know that lower stock prices may soon be on the way. However, the Evening Star candlestick pattern is a tricky pattern to identify, so investors must proceed with caution when they think they’ve sighted it. Scroll down to learn a little more about this hard-to-spot signal. To read more click here

WOW you wake up on a Friday morning, and the DJ-30 is up 250 points, let’s party! Yesterday the SPY closed with a Doji, double bottom and on the Dotted Deuce, remember sustained follow-through is vital for a bullish move to be meaningful. A decisive close over yesterdays Doji ($285.65) could set the stage for a possible Morning Star type reversal. Over ($288.20) could be a set up to challenge the 50-SMA. A positive move today could also be a pure relief rally setting up another big short. Watch for clues and lack of follow-through; we sure will be.

The VIX-X CBOE Market Volatility Index needs to be below ($21.25) for the SPY or market to rally. Yesterday’s long wick Shooting Star type candle might get us to ($20.00). Overall the VIX charts are bullish, maintain a cautious stance on the market.

The VIX-X CBOE Market Volatility Index seems to be a bit nuts, up-down. Follow-through above $22.40 the VIX-X will want to challenge $23.65, below $21.25 a test of $20.00 is likely

😊 Have a great trading day – Rick

✅ Untill this market settles down we will only post trade ideas from the trading room. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). . Chart discussion 9:10 AM Eastern.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it. 🎯 Dick Carp: the scanner paid for the year with HES-thank you 🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed. 🎯 Bob S: LTA is incredible…. I use it … would not trade without it 🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold. 🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Early this morning China announced its tariff retaliation plan quickly reversing futures markets that had initially indicated a bullishness throughout most of the night. August is typically a difficult month with last-minute vacations and the beginning of a new school year but this year has been particularly challenging with all the political and economic uncertainty. Sadly, I think the intense price action volatility is likely to continue into the near future.

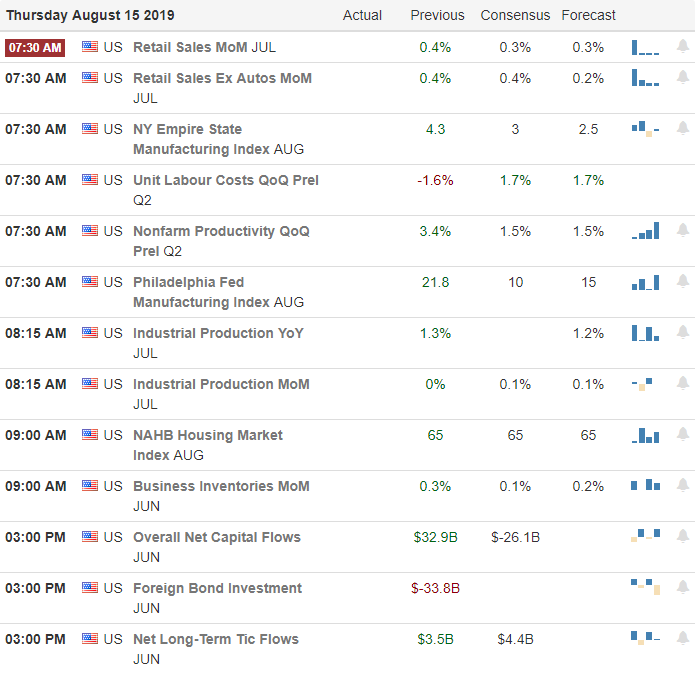

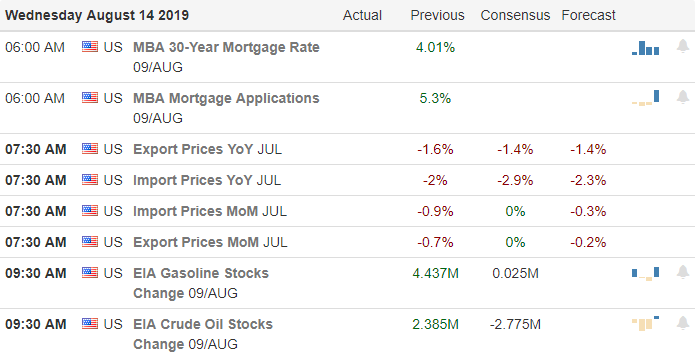

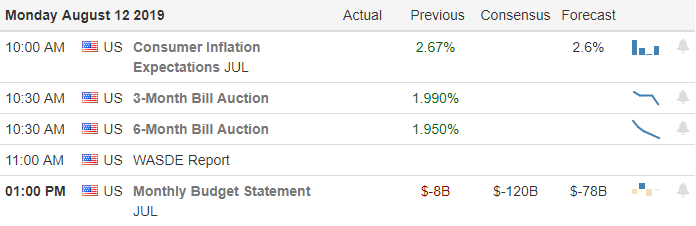

Overnight Asian markets closed mixed but mostly higher even as China once again lowers their economic growth expectations. However, European markets are decidedly bearish this morning in reaction to the trade war retaliation from China. US Futures have fluctuated wildly this morning ahead of several big earnings reports and huge day of market-moving economic reports. Expect wild price gyrations today as the market digest all the data.

We have a major decline in the number of earnings on the calendar today with just 45 companies reporting. However, we have several market-moving notable reports which include, WMT, BABA, AMAT, CSIQ, DDS, JCP, NIO, NVDA, and TPR.

I think it’s fair to say that the Trader’s Almanac was certainly right this year about August offering up challenges. Crossing over the midpoint of August I wish I could say that the volatility is nearing an end but with all the trade uncertainty and global market indicators continuing to flash warning signs of recession I suspect that is not the case. US Futures most of the night were pointing to a significant rebound from yesterday selloff, but China put the kibosh on bullishness announcing its tariff retaliation plans early this morning. Off in the distance, you can likely see the tweet-storm clouds building.

Today we have a huge day of economic reports for the market to digest as well as several big earnings reports likely to fuel the fire of volatility. With futures now indicating another nasty gap down at the open we should expect the 200-day moving average to begin pulling very hard on the SPY. Expect bond yield inversion fear-mongering to continue today as markets react to China’s tariff retaliation today. The silver lining in all of this is that great stocks are now at sale prices and when the selling finally ebbs there will be some fantastic bargains to be had. Until then, protect your capital, wait for your edge to return and hold fast to your trading rules that protect you from emotional decision making.

Trade Wisely,

Doug

FOCUS: Stocks/Options Wednesday 8/15/2019; Walmart may help the market today; Walmart reported earnings that topped expectations and raised its outlook for the full year, building on the momentum in its core U.S. business and investments into grocery. Its shares jumped more than 5% in premarket trading on the news. Walmart is gapping out of a bullish “W” pattern; we will now wait for a swing trade entry over the next few days with an easy direction option trade, Stay tuned and stay connected with us. Check out the Text alert link below.

Yesterday the SPY fell another 2.96% landing on our Dotted Deuce moving average; we still think there is a good chance the 200-SMA will see a test sooner or later, meaning we may see a relief rally of some sort. The first big hurdle I see on the SPY for the Bulls is about the $288.70 area; if the bulls can post a close over the $288.70 line, then they could face the possible challenge the 50-SMA. Anything below $286.50 keeps the 200-SMA on the list.

The VIX-X CBOE Market Volatility Index seems to be a bit nuts, up-down. Follow-through above $22.40 the VIX-X will want to challenge $23.65, below $21.25 a test of $20.00 is likely

😊 Have a great trading day – Rick

❓ Did you receive the 13 short trade ideas I sent out last night via SMS text alert? If not and you have a smartphone use the link 👇 below to register.

✅ Untill this market settles down we will only post trade ideas from the trading room. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). . Chart discussion 9:10 AM Eastern.

🎯Dick Carp: the scanner paid for the year with HES-thank you

🎯Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯Bob S: LTA is incredible…. I use it … would not trade without it

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

✨✨✨ NOTE: If you are having trouble logging in to the trading room and using the Chrome browser, login to your members page on the Hit and Run Candlesticks website for instructions to resolve the issue. ✨✨✨

Punishing price volatility continues today nearly reversing yesterday’s sudden and massive rally. The decision to delay the tariff increase until December 15th suddenly reversed trapping short traders in one of the fastest moving short squeeze rallies I have seen in my trading career. Unfortunately, that didn’t resolve the bond rate inversion that occurred that is once again punishing those that picked up long positions yesterday.

Asian markets rallied slightly on the tariff increase delay, but massive protests in Hong Kong dampened the response. Economic data out of Germany raising concerns of a European recession have their markets seeing red across the board this morning. Still facing significant technical damage and a bond yield inversion signaling a possible recession in the US, futures are pointing to a sharp overnight reversal with Dow pointing to a gap down of nearly 250 points. Buckle up as another volatile market day begins.

The Wednesday Earnings Calendar is the last big day of earnings reports this season with more than 250 companies reporting. Notable reports include A, GOOS, CGC, CSCO, IHRT, LK, M, NTAP & VIPS.

After the Whitehouse decided to wait until December 15th the market moved up like a rocket has been strapped to its back. Unfortunately, the trade war is not the only thing the market has on its mind right now, and the rally stopped about as quickly as it began after running into price resistance around the 50-moving average. This morning the market must come to grips with the 2 and 10-year bond rate inversion which occurred as we slept. Rate inversion is not a perfect indicator of recession but has accurately signaled it correctly the vast majority of the time.

Consequently, it looks as if the punishing price volatility will continue this morning with US Futures pointing to a substantial gap down at the open. Not helping the matter is that European markets have also swooned after a German GDP shrank by 1% fanning the flames of global slow down and recession. Technically, the indexes continue to have a lot of technical damage to repair despite yesterday’s rally and the punishing overnight reversals have made it nearly impossible to trade except for the very experienced day-traders.

Trade Wisely,

Doug

FOCUS: Stocks/Options Tuesday 8/14/2019; Trump postponed a few products in the recent round of trade products to help under the Christmas tree, so the question; is this a band-aid of a fix to the market condition? I think is it merely a band-aid. The trade issues and a host of problems are causing stress to the SPY and the US market in general.

Yesterday the SPY closed at $293.75 after touching our resistance line at $293.75. Also long as the price is below the 34-EMA and 50-SMA and Above the 200-SMA I will remain slightly bearish and very casualty bullish with very tight stops. I have adjusted the SPY danger line to $288.00. A close below $288.00 sets up $283.95 which is about 6% off the SPY highs. $293.75 remains the line for the bulls to beat, anything under $293.75 is nothing but trouble.

The VIX-X CBOE Market Volatility Index posted a nasty bearish engulf but will all candlesticks signals confirmation is required. It does not look like there will be follow-through today unless the bull’s step in and take charge. Above $27.55.00 on the VXX chart could put us back into the VXX trade.

❓ Did you receive the 13 short trade ideas I sent out last night via SMS text alert? If not and you have a smartphone use the link 👇 below to register.

😊 Have a great trading day – Rick

✅ For your consideration: Due to tecnical resans will will not havetrade ideas in our blog post, however we will in the pre-market gettogether. Remember to trade your own trade. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). . Chart discussion 9:10 AM Eastern.

🎯Dick Carp: the scanner paid for the year with HES-thank you

🎯Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯Bob S: LTA is incredible…. I use it … would not trade without it

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

✨✨✨ NOTE: If you are having trouble logging in to the trading room and using the Chrome browser, login to your members page on the Hit and Run Candlesticks website for instructions to resolve the issue. ✨✨✨

Yesterday’s slow but steady selloff added to the technical damage of the index charts drawing the first lower high since mid-May. That officially creates at least a short-term downtrend as traders look for safety amidst, fluctuating currencies and bond yields inching toward the dreaded inversion that often signals a coming recession.

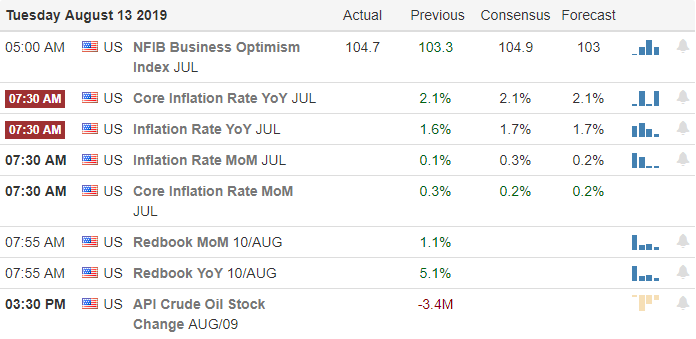

Overnight Asian markets closed lower across the board as protesters fight for greater democracy in Hong Kong, and China threatens military action. Across the pond, European markets are also modestly bearish this morning in reaction to all the political turmoil. US Futures currently indicate a flat to slightly bearish open as traders nervously watch bond rates ahead of the CPI report at 8:30 AM Eastern. With yesterday’s price action, we can’t rule out the possibility of a test of last weeks lows. However, with market emotions so high anything is possible, so it would be wise to remain focused and flexible.

On the Tuesday Earnings Calendar, we have nearly 175 companies reporting results today. Among the notable reports, AAP, EAT, ELAN, JD, TLRY, and YY.

Markets sold off slowly but steadily yesterday as traders closely watched bond rates that continued to inch closer to the dreaded inversion that often signals a coming recession. More importantly, the selloff created technical damage leaving behind a lower high on the daily chart, which indicates the establishment of a downtrend. Trade war uncertainty, bond rates, fluctuating currencies, and the massive protests in Hong Kong; it’s no wonder that traders are looking to protect their capital.

According to reports after the bell yesterday, there was a problem that affected the markets during the last 50 minutes of trading where real-time prices were not displayed. How that may or may not change the look of charts at the open today will be interesting. Currently, futures are once again getting the morning pump and rallying off overnight lows ahead of earnings reports and the 8:30 AM Eastern CPI report. At this point, we should not rule out the possibility of a retest of last weeks lows, but with market emotions so high anything is possible so stay focused on price action and remain disciplined to your rules.

Trade Wisely,

Doug

FOCUS: Stocks/Options Tuesday 8/13/2019; The recent volatility is likely to continue unless the China trade war can be solved. A few other problems are Iranian aggression, North Koreas missile firing and slowing global growth.

(SPY) Yesterday we closed below our $288.90 line shown to Hit and Run Candlesticks members. With a close below $288.90, I now see a path to $285.10 in the coming days with the possibility of a one or two-day relief rally which would set up a short trade. The loss of $285.10 would set a test up for the August lows ultimately price searching out $279.00 which is the 200-SMA on the daily chart

On the bright side, there is always the unlikely possibility of a bull run, under $273.75 the bulls are underwater with rocks in their pockets. At this time, over $293.75 would put the price back in the bands and bullish pattern position.

The VIX-X CBOE Market Volatility Index popped from Fridays Doji up over 17% closing near resistance. Over $21.85 should challenge the recent highs and below $17.85 would suggest the fear is backing off and the market bulls will try to rally.

❓ Did you receive the 13 short trade ideas I sent out last night via SMS text alert? If not and you have a smartphone use the link 👇 below to register.

😊 Have a great trading day – Rick

✅ For your consideration: Here are a few charts I thought should go on the watch-List, remember to trade your trade. Trade smart and wait for the QEP → (QEP) Quality Entry Patterns). FB, CERN, AWI, GPN, TSS, SMAR. Chart discussion 9:10 AM Eastern.

🎯Dick Carp: the scanner paid for the year with HES-thank you

🎯Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Growing trade tensions and expanding Hong Kong protests and China once again lowering the Yuan overnight has the market under some bearish pressure this morning. Not helping that sentiment is the fact that Golden Sachs lowered economic growth estimates rising fears of a recession. If the indexes fail, creating a price action lower high, the technical damage of the charts could become severe and officially mark the beginning of a market downtrend. The bulls must defend Friday’s low or expect the bears to be emboldened pushing the indexes lower once again.

Overnight Asian markets closed mixed but mostly modestly higher as trade war tensions dampen activity. European markets currently see modest declines across the board ahead of the US Market open. As of now, US Futures suggest a gap down open between 150 and 200 Dow points. Fear could quickly turn to panic selling if Friday’s lows fail as support. We should continue to expect high price volatility, intra-day new driven reversals, and big overnight gaps making the markets very difficult to navigate for swing and position traders.

On the Monday earnings calendar, we have just short of 130 companies expected to report earnings today. Notable reports today include GOLD, SYY, and TME.

Massive protests in Hong Kong continue to grow spilled into the airport, forcing the cancelation of all flights during the night. The violence is also growing between police and residents asking for greater democracy and a release from Chinese influence. So as trade tensions between China and the US grow leader XI Jinping is facing his greatest challenge to his power since coming into office. Also during the night China once again lowered the midpoint of the Yuan slightly setting the currently below Friday’s session lows.

Over the weekend Goldman Sachs cuts their economic growth forecasts citing the lingering trade war and rising fears of a recession. After a nice afternoon comeback on Friday that saw indexes recovering the moring session selloff, US Futures are under bearish pressure this morning. A lower high failure near the 50-day moving average is likely to embolden the bears and creates severe technical damage to the index charts. If the bulls are unable to defend Friday’s price low, panic could trigger a wave strong selling pushing the indexes past last weeks lows where the SPY and QQQ could test their 200-day averages. Let’s hope the bulls find enough inspiration in earnings reports to fight hard!

Trade Wisely,

Doug