More Chop, No Direction

✅ SMS text alerts and reminders?👈

✅ At hit and Run Candlesticks, we focus on Stocks / Simple Directional Options

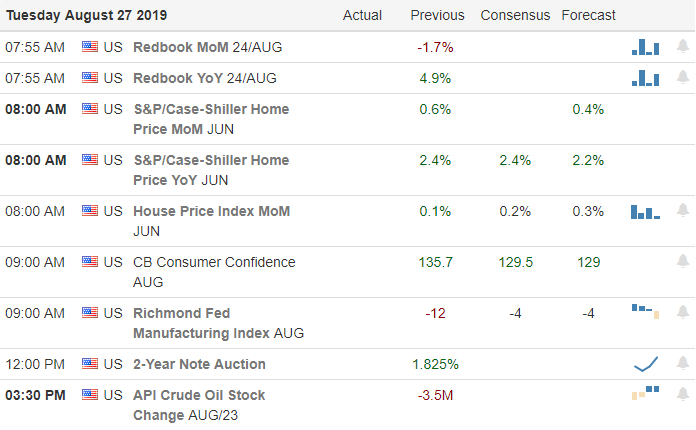

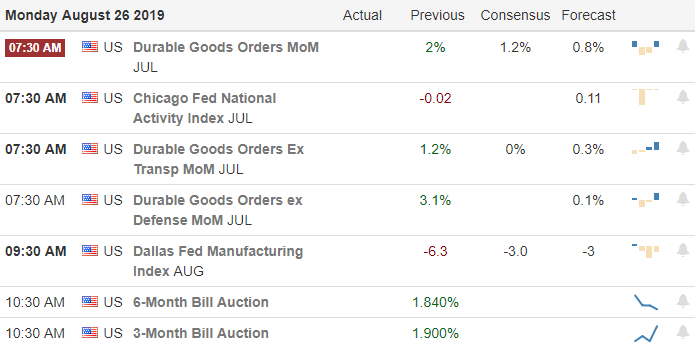

The market (SPY), More chop and no direction, Friday the buyers had a chance to break out and stay out of the sideways channel they have been playing in, but instead, they started the day with a bullish bang and ended with a fizzle. Here is Tuesday morning after a 3-day weekend and the futures are pointing to a weak open possible below the 34-EMA. The question for the day is where we will close for the day? A close above $ 292.15 we would consider cautiously bullish and below $290.60 bearish

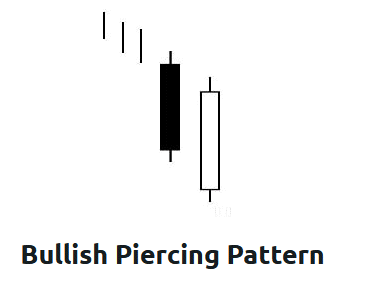

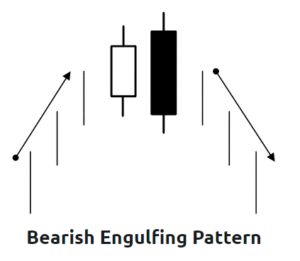

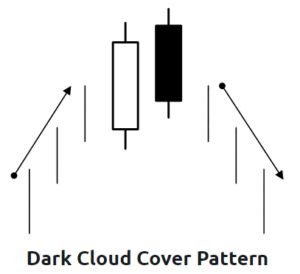

Bearish Dark Cloud Cover Pattern: Do you have an umbrella handy? When dark clouds are on the horizon, you know that a downpour could soon be on the way.

Similarly, when you spot the Dark Cloud Cover pattern on a Japanese candlestick chart, you need to anticipate the arrival of a bearish reversal. This candlestick pattern is somewhat easy to spot because its formation clearly reflects its name: at the end of an uptrend (i.e., a sunny day), a black candle appears (a “dark cloud”), heralding a reversal. Let’s learn a little more about this ominous signal… .Read More Dark Cloud Cover Pattern.

The I path Series S&P 500 VXX Short Term Futures ETN. A close today above the 34-EMA keeps the VXX in a bullish chart pattern, a close above $28.85 would spark fear.

😊 Have a great trading day – Rick

Trade-Ideas

✅ September 3, 2019, No Trade Ideas Today. Trade smart and wait for the QEP→ (QEP) Quality Entry Patterns). These Trade ideas are not recomendations.

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service