China surprised the market at 5:30 AM this morning saying they are willing to negotiate to resolve the trade war sharply reversing the US Futures from overnight lows. Traders holding long positions will feel the sweet relief of a big gap up open. However, traders caught short will suffer and may experience the pain of a short squeeze. Though this is a very positive development, make sure to maintain perspective and not get caught up in the hype. Saying they are willing to negotiate is a long way from signing a binding deal, and there are likely going to be a lot of drama along the way.

Asian markets closed mostly lower overnight as Treasury yields continued to deteriorate. European markets reversed early losses after the China news and are currently green across the board the morning. US Futures leaped dramatically on the prospect of a China re-engaging in trade talks with the Dow Futures now pointing to a gap up open of more 250 points. Price volatility will likely be wild this morning, so stay disciplined to your trading plan and rules to avoid emotional decisions influenced by the drama this news has created.

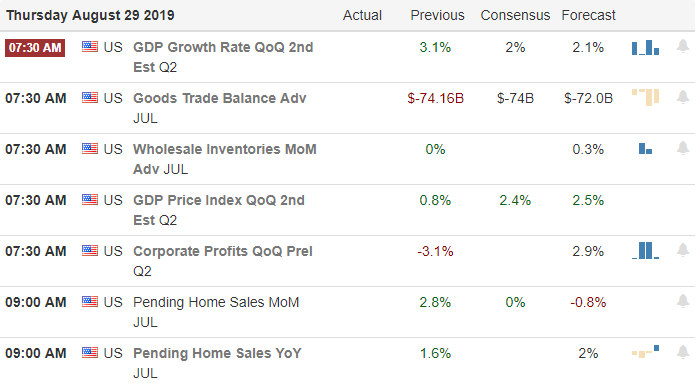

On the Calendar

Sixty-three companies are fessing up to their quarterly earnings results this Thursday. Notable reports include DG, ULTA, ANF, ABOC, BBY, BURL, COO, DELL, DLTR, HAIN, TD, and WDAY.

Action Plan

Futures that had been bearish most of the night quickly rallied about 5:30 AM this morning when China says it willing to resolve the trade war and return to the negotiations table. Although agreeing to talk is a long way from agreeing to a binding deal to level the playing field for trade between the two countries, its certainly a positive step forward. Unfortunately, China has also decided to sent troops into Hong Kong. Lets’ hope this conciliatory action is not merely a distraction as they use force to put down the long-running protests.

Market bulls will, of course, be very happy this morning but bears caught short are likely to feel the pain of a short squeeze this morning. I would be careful not to get caught up in the hype, keeping in mind bond yields, Brexit and that an actual signed deal is still likely months away. Also for the market to digest is the big morning on both the economic and earnings calendars. Price volatility could be wild this morning, so plan your approach to the market carefully.

Trade Wisely,

Doug

Comments are closed.