The hits keep on coming! There is a point in nearly every market selloff when it seems bad news continues to pile on with one hit after another. This morning we wake up to a worsening yield curve as the 30-year bonds hit new record lows. The Sterling rapidly falls as the Prim Minister confirms he is moving to suspend parliament, raising the risk of a no-deal Brexit. As if to add insult to injury, China has yet to confirm they will re-engage in trade negotiations as the president alluded to Monday morning. Yesterday’s pop and drop that left behind bearish engulfing patterns on the index charts sure didn’t help the technical’s or inspire much confidence.

Overnight Asian markets closed flat but mostly lower in reacting to the declining 30-year bond yields. European markets mostly lower this morning as Brexit fears rise and the Sterling falls. US Futures that had held bullish gains through the night now point to a flat slightly bearish open ahead of earnings reports. Caution continues to be warranted as you plan your day ahead.

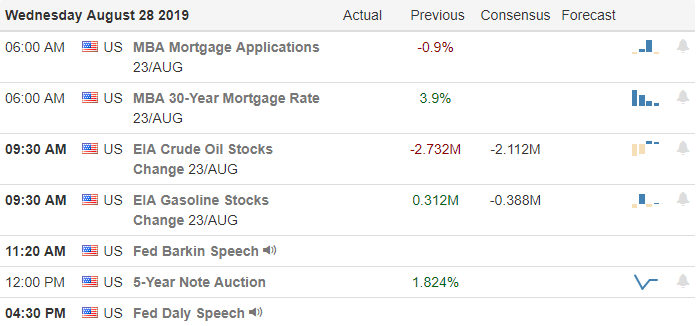

On the Calendar

Wednesday’s Earnings Calendar has just over 70 companies reporting quarterly results. Notable earnings include BOX, COTY, DAKT, EXPR, FIVE, GES, HRB, MOV, PVH, TIF, VRNT, and WSM.

Action Plan

My goodness, there is a lot going on this morning affecting the market. The 30-year bond is hitting new record lows as the yield curve inverts even further. Most negatively are those on a fixed income, which may force many into higher risk dividend investments to make ends meet. The British Prime Minister Boris Johnson move to suspend parliament, causing the Sterling to fall and raising the risk of a no-deal Brexit. US Futures quickly pared overnight gains after Johnson confirmed the rumor in a speech today.

Yesterday’s pop and drop price action added some technical damage, leaving behind bearish engulfing candle patterns as another day passes with China not confirming a resumption of trade negotiations. I think the market must come to grips with the very likely increase from 25 to 30 percent tariffs. With little on the economic calendar today, there will little to distract the market from the yield inversion and trade war uncertainty. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.