Oil Absolutely Hammered Again

Friday was a volatile day for markets when hope for a treatment drug faded slightly as it became clear only partial preliminary data from an uncontrolled test had been reported. A 2.5% gap-up sold off and then markets wavered most of the day until the bulls rallied hard the last hour. The large-caps closed near their highs, but for a change, the Nasdaq lagged. At day end the SPY was up 2.7%, the DIA up 3.01%, and the QQQ up 0.96%. Accordingly, the VXX fell to 39.05 while the 10-year bond yield rose to 0.642%. Oil got crushed again as WTI fell almost 9% to $18.12/barrel.

On the virus headline front, the world now has 2,421,018 confirmed cases and 165,939 deaths. At the same time, in the US we now have 764,265 confirmed cases and 40,683 deaths. On the bright side, New York said it was “past the high point.” The same seems to be true in New Jersey and Connecticut. However, such statements assume the spread does not resume or at least that any future waves will turn out to be less severe than the first.

The pressure to “reopen American” continued to increase, mostly along political lines, over the weekend. Some opening did take place as Florida opened its beaches and parks. Texas said it will follow suit on Monday and that its retail-to-go businesses can reopen Friday. It’s notable that New York, New Jersey and Connecticut (the virus epicenter in the US) all opened their marinas for boating as well. So, at least recreational areas are starting to open.

On the small business bailout front (bill 3.5), both Sec. of Treasury Mnuchin and House Speaker Pelosi told reporters they were very close to a deal Sunday afternoon. Details are not clear, but it seems to be looking in the $400-$500 billion additional spending range. This would add another $300 billion to the small business bailout fund, provide $50 billion in disaster loans. Both sides hope for approval from both houses by mid-week. This comes as JPM announced that it already has $26 billion in small business relief applications that still need funding.

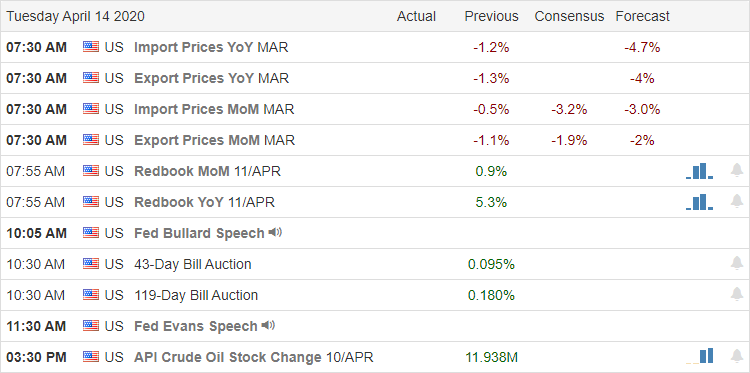

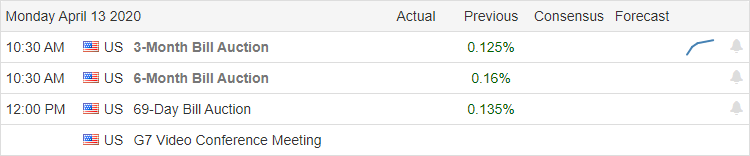

Overnight, Asian markets were mixed but mostly red on a Chinese Prime Loan rate cut of 20 basis points to 3.85% for a one-year loan. Oil has continued to be pounded all through the overnight session and at 7:30 am sits at $13.03/barrel (up off a low of $12.43, but even so the lowest price in 2-plus decades for WTI). In Europe, markets are in the red, but generally down less than a percent at this point in their day. As of 7:30 am, US futures are pointing toward a 1%-2% gap lower.

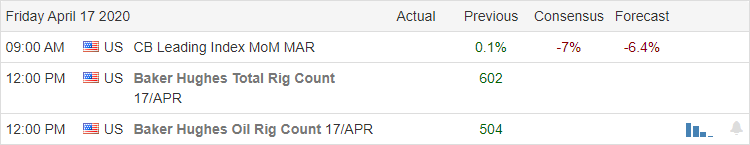

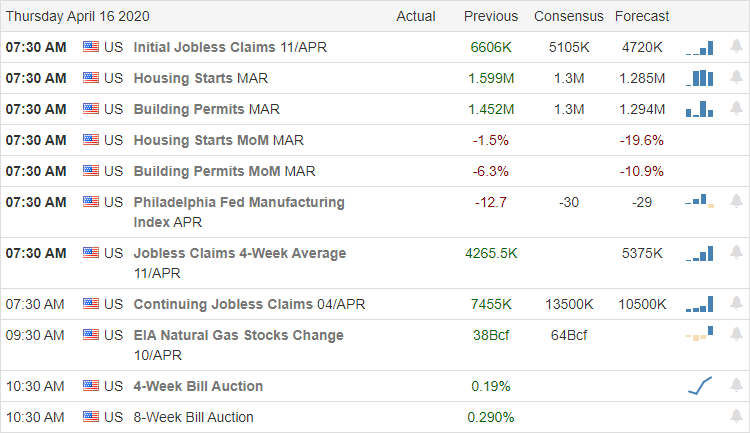

There is no major economic news for Monday. However, on the earnings front, HAL, MTB, and TFC report before the open. CDNS, EFX, IBM, and ZION report after the close.

The uptrend remains strong, but gaps and volatility also are still the norm. Optimism seems to be the rule lately, ignoring any bad economic news or earnings. However, we are in earnings season and we know there will continue to be a stream of both bad economic news and good virus-hope news. More immediately, the massive sell-off in Oil surely signals huge fear over economic demand. So, traders need to continue to be very attentive, and either be very fast (day trade) or very slow (long-term holds). Be very cautious about any swing trades you take in a news-driven market.

Ed

No Swing Trade Ideas for your consideration and watchlist for Monday. Trade smart, take profits along the way and trade your plan. Also, don’t forget to check for upcoming earnings. Finally, remember that the stocks/etfs we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service