Market Waiting on Data or Fed Direction

Markets opened flat and then the large-caps sold off all morning, before trading sideways in a tight range most of the afternoon. However, a rally the last hour of the day took stocks out very near their highs. On the other hand, the QQQ sold off early, but started a rally about 10am that lasted the rest of the day. This gave us a strong white candle and new all-time high close in the QQQ and the SPY. Both the DIA and SPY printed Hammer-type candles. On the day, SPY gained 0.23%, QQQ gained 0.96%, and DIA lost 0.24%. The VXX gained a percent to 312.12 and T2122 fell back to the mid-range at 55.86. 10-year bond yields rose t o 1.496% and Oil (WTI) gained slightly to $71.03/barrel.

During the afternoon Monday, CEO Jamie Dimon said JPM has been “effectively stockpiling cash” rather than buying bonds or other assets. He warned that the Covid-era trading boom is coming to an end, expecting less in trading revenue this Q2 as compared to a year ago. He also said JPM disagrees with the Fed and feels “there is a very good chance inflation will be more than transitory.” As a result, Dimon says the bank has been hoarding cash and he expects the net interest income for the year to be down from $55 billion to $52.5 billion.

CNBC is reporting a consensus view on the Fed’s words and actions on Wednesday. It is widely expected they will take no policy actions. However, it is likely the FOMC will release wording that signals it is thinking about changing its policy on bond-buying. The dots (interest rate forecasts) are also likely to point toward a first interest rate hike in 2023. All this would be consistent with what the Fed has said in the past. In other words, no rocking the boat, but an announcement that the dock is just over the horizon.

Related to the virus, new US infections continue to fall. The totals rose to 34,335,239 confirmed cases and deaths are now at 615,232. These numbers are now under-reported again as some states (mostly Southern) have decided to stop reporting data on a daily basis. Nonetheless, on the data we do have, the number of new cases is falling again and are back down to an average of 13,189 new cases per day (the lowest number since March 2020). Deaths are also falling, just more slowly, but are now down to 348 per day (again, the lowest number since March 2020). Related to the virus, new US infections continue to fall. The totals rose to 34,335,239 confirmed cases and deaths are now at 615,232. These numbers are now under-reported again as some states (mostly Southern) have decided to stop reporting data on a daily basis. Nonetheless, on the data we do have, the number of new cases is falling again and are back down to an average of 13,189 new cases per day (the lowest number since March 2020). Deaths are also falling, just more slowly, but are now down to 348 per day (again, the lowest number since March 2020).

Globally, the numbers rose to 177,086,088 confirmed cases and the confirmed deaths are now at 3,829,038 deaths. The trends are better again as we have seen a slowing in the rate of increase now that India has passed its peaked. The world’s average new cases are falling quickly now, but remain at 375,190 new cases per day. Mortality, which lags, is also falling, but remains at 8,899 new deaths per day.

Overnight, Asian markets were mixed again. New Zealand (+1.07%), Japan (+0.96%), Taiwan (+0.92%) and Australia (+0.92%) paced gainers. Meanwhile, Shanghai (-0.92%), Shenzhen (-0.86%), and Hong Kong (-0.71%) led the losses. In Europe markets are also mixed, but lean green so far today. The DAX (+0.55%), and CAC (+0.45%), and FTSE (+0.31%) lead the continent, with Norway (-1.01%) a notable exception. As of 7:30 am, US Futures are pointing to a flat open. The DIA is implying an unchanged open, the SPY implying a +0.10% open, and the QQQ implying a +0.14% open. It seems markets are waiting on this morning’s data or perhaps even on more insight from the Fed.

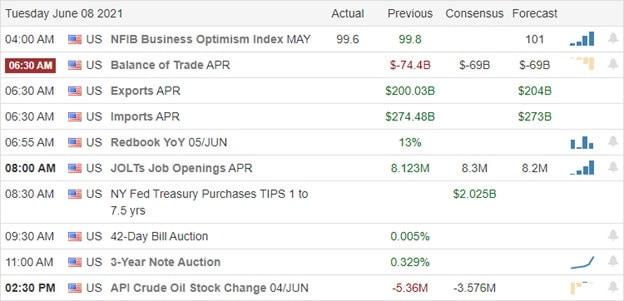

The major economic news scheduled for Tuesday includes May PPI, May Retail Sales, and NY Empire State Mfg. Index (all at 8:30 am), May Industrial Production (9:15 am), Apr Business Inventories and Apr Retail Sales (both at 10 am). The only major earnings reports on the day are after the close when HRB, LZB, and ORCL report.

Premarket seems to suggest that traders are waiting on more data. The inflation, sales, and manufacturing information may give us just such a push one way or the other. Just keep in mind that we sit at all-time highs, the QQQ is a little extended from its T-line, and the DIA can’t get going (is diverging from the other major indices). In short, this means markets are undecided, rotating, or at least maybe more volatile.

As always, follow the trend and respect support and resistance levels. However, don’t just assume those levels will hold. All trends reverse at some point and every S/R level is breached eventually. Keep moving your stops, locking in profits, and maintaining discipline. Follow those trading rules and stick to the trade plan. Remember that consistency is the key to long-term trading success.

Ed

Swing Trade Ideas for your consideration and watchlist: LLNW, LAZR, BLNK, AMAT, MP, QCOM, TDOC, SAND. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service