With the DIA and SPY cling to bullish trends, worrisome cracks have developed in the index charts. I use charts because I believe they me clues. However, to read those clues, we have to see the charts for what they are, not for what we want them to be. The QQQ and IWM are in failure patterns below their 50-day averages, and both the DIA and SPY show possible lower highs that are in striking distance of new lower lows. For years and market, sell-off offered an opportunity to buy the dip, and perhaps this one is no different, but I think it time to consider the possibility the market top is near.

Asian markets traded mostly lower overnight, with Australia falling a full 2%. European markets trade decidedly bearish this morning, and the U.S. futures, despite solid earnings results, point to bearish open as we wait for the FOMC minutes.

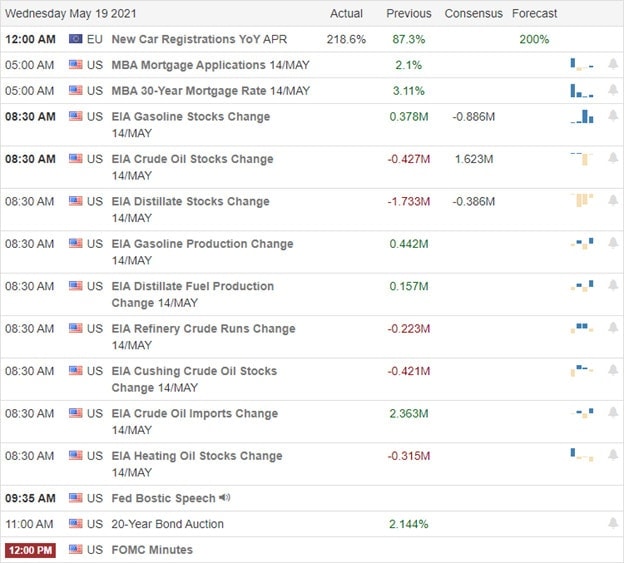

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have 31 companies fessing up to quarterly results. Notable reports include CSCO, ADI, JD, LB, LOW, SCVL, TGT, & TJX.

News & Technicals’

Though we saw solid earnings results yesterday, the market yawned and spent the day chopping in a very tight range intraday consolidation. This morning we have already heard from TGT and LOW with massive beats on expectations, but the bears seem to be making another attempt at control this morning. According to reports, about $270 billion has disappeared from the crypto markets, and bitcoin continues to slide south after the Musk tweet. One has to wonder at the validity of a currency that collapses after a company chooses not to use it to sell cars. Ahead of the FOMC minutes, the 10-year treasuries lifted to 1.66% this morning, and the 30-year rose to 2.385% as inflation worries persist. President Biden extended the grace period for Chinese companies to comply with new restrictions to June 11th versus the prior date of May 27th.

Some worrisome cracks are starting to show in the primary index charts. Both the QQQ and IWM show possible failures at their 50-day moving averages. The VIX, as of yesterday, is trying to hold a higher low, and the Absolute Breadth Indicator has trended lower since March of last year. Despite consistent reassurance from the Fed that the current inflation is transitory, worries persist that the market is overheating and may soon force the hand of the FOMC. Though the DIA and SPY continue to cling to bullish trends, price patterns in the charts are raising some concern. The DIA now shows a lower high and is within striking distance of last week’s low. The SPY is in a similar pattern and has a stronger overhead resistance than that of the DIA. Futures trade decided bearish this morning ahead of the Petroleum numbers, a 20-year bond auction, and the release of FOMC minutes. Caution flags are waving, so plan accordingly.

Trade Wisely,

Doug

Comments are closed.