Futures perked up overnight, trying to shake off inflation jitters, but those pesky bonds are moving slightly higher this morning, mixing in some uncertainty. As solid earnings results from HD and WMT try to inspire the premarket bulls, we still have new permits, and housing starts to digest before the open. Though the DIA and SPY continue to cling to a bullish trend, the QQQ and IWM remain challenged by the overhead resistance of their 50-day averages. Keep in mind intraday whipsaw and pop and drop patterns are still possible as we attempt to challenge price resistance levels. Stay focused.

Overnight Asian markets enjoyed a bounce back with the NIKKEI, leading the up closing up more than 2%. European markets have also turned positive this morning. However, the concern is growing about a quickly spreading virus variant in the U.K. Fueled on the blowout earnings results, U.S. futures point to a bullish open ahead of new construction housing data. Remember, choppy price action is still possible ahead of the Wednesday release of the FOMC minutes. Be careful not to chase the open.

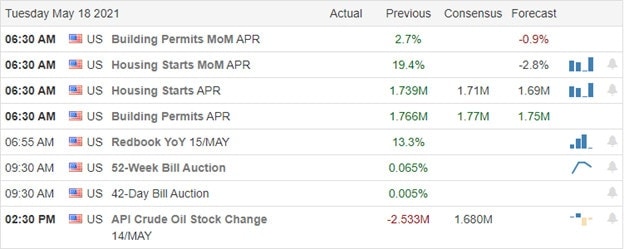

Economic Calendar

Earnings Calendar

On the earnings calendar, we have a focus on big retail, with more than 40 companies reporting. Notable reports include HD, WMT, BIDU, DQ, IQ, M, NTES, SE, TTWO, TTM, & TCOM.

News and Technicals’

After a day of choppy rest with modest losses, the futures perked up overnight as they try to shake off last week’s inflation jitters. Home Depot reported blowout results early this morning as sales lept higher by 32.7%. The new virus variant that emerged in India could become the dominant strain in the U.K. in a matter of according to health officials. The U.K. is detecting a rapid spread of the new variant. Though futures try to push higher this morning, the same is true of the 10-Year Treasuries as they top 1.65%, with the 30-year rising to 2.368%. In a call with Netanyahu, Biden said the U.S. supports a ceasefire; however, the conflict between Israel and Hamas continues to escalate. More than 300 rockets have bombarded Israeli cities.

On the technical front, not much changed yesterday, with the SPY and IWM remaining under their 50-day averages. The DIA and SPY ended the day with only modest losses holding on to key supports though still challenged by overhead resistance. Earnings from HD and WMT are trying to inspire the bulls as we wait on the latest reading of building permits and housing starts. It will be interesting to see if the sharply rising materials costs have dampened new construction activity. As the futures rise, keep in mind that bonds are also moving higher this morning. Be careful not to chase and watch for the possible pop and drop near price resistance levels. Keep in mind that the T2122 indicator is nearing an overbought condition already, and the VIX yesterday held at a higher low. We should also not rule out the possibility of another day of chop as we wait on the FOMC minutes released Wednesday afternoon.

Trade Wisely,

Doug

Comments are closed.