AMZN Missed Bad, But Overall EPS Strong

Earnings continue to be the market driver as a strong group of reports overcame very disappointing Q3 GDP numbers. As a result, markets gapped higher at the open and then had some follow-through the first hour of the day. This died into a sideways grind in all 3 major indices and then a late-day rally took all 3 out near the highs of the day. The DIA printed a beautiful Bullish Harami that bounced up off the 8ema, but all 3 of the major indices had strong, white bullish candles. The SPY and QQQ both closed at new all-time high closes. On the day, SPY gain 0.98%, DIA gained 0.65%, and QQQ gained 1.09%. The VXX fell 3% to 21.27 and T2122 spiked to the top of the mid-range at 73.68. 10-year bond yields rose to 1.575% and Oil (WTI) rebounded hard after being down 1.5% in the premarket to close up 0.62% at $83.17/barrel.

During the day, FB announced the name it has chosen for the name change that they announced during their Q3 earnings report Monday. The name will be “Meta” and the company will begin trading under the ticker MVRS on December 1. The name change is similar to Google, who became Alphabet years ago. The move reflects a FB shift in emphasis away from social media and toward what it believes is the next major trend, “virtual reality.” This is the reason the name was announced at a VR event.

After hours, AMZN posted terrible numbers, missing badly on both earnings and also coming in $1 billion light on revenue. The company also lowered guidance for Q4. The other big dog name reporting after the close was AAPL, which beat on earnings but missed on revenue. Elsewhere, TEAM, GILD, DXCM, RSG, AJG, WDC, and DVA all beat on both lines. SBUX and FTV missed on revenue, but beat on earnings. SGEN missed on earnings, but beat on revenue. SYK followed AMZN’s lead and missed on both lines.

This morning Treasury Sec. Yellen is touting the Democratic $1.75 trillion spending agreement as being “anti-inflationary.” However, moments after the agreement had been “reached,” House Progressive Democrats said they would not vote for it unless other bills are voted upon at the same time. Elsewhere, the final earnings of the week continue to roll in. CHTR, AON, CL, CERN, CBOE, NWL, XOM, PSX, and CHD all beat on both lines. It is worth noting that both XOM and PSX absolutely crushed earnings estimates. So far today, only LYB (missing on earnings, but beating on revenue) and WY and LHX (both beating on earnings, but missing on revenue) have any red on the report cards art all.

Overnight, Asian markets mixed, but leaned to the red side. Shenzhen (+1.45%), Indonesia (+1.03%), and Shanghai (+0.82%) led the gainers. Meanwhile, Australia (-1.44%), South Korea (-1.29%), and India (-1.05%) paced the losses. In Europe, stocks are almost exclusively down at mid-day. Only a slightly green Belgium and Norway are preventing a red sweep. The FTSE (-0.18%), DAX (-0.79%), and DAD (-0.35%) are typical of the continent in early afternoon trading. As of 7:30 am, US Futures are pointing to a red open, led by Tech. The DIA is implying a -0.10% open, the SPY implies a -0.48% open, and the QQQ is implying a -0.87% open after AMZN missed badly and AAPL missed on revenue. 10-year bond yields are up in early trading and Oil is off slightly.

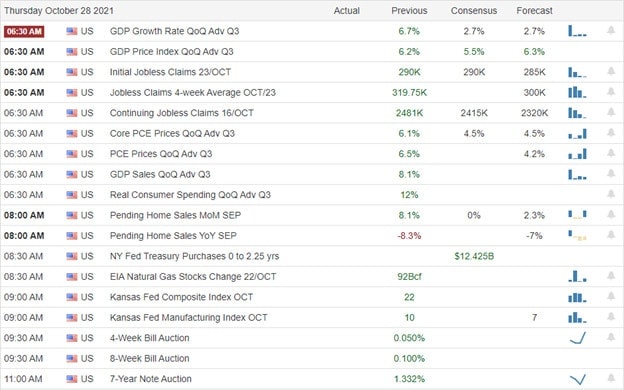

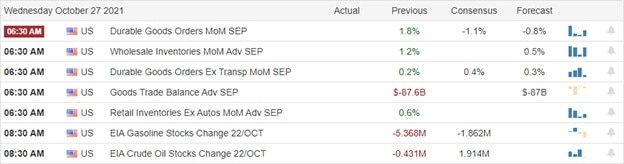

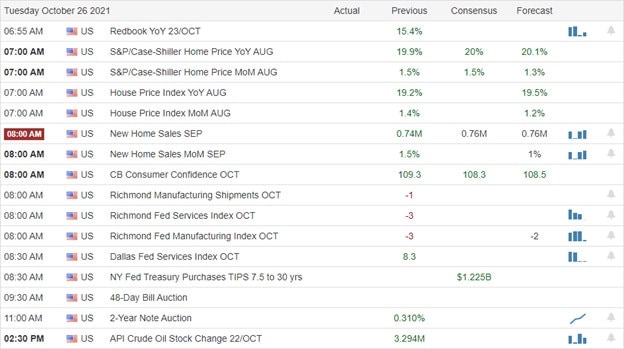

The major economic news scheduled for release on Friday is limited to Sept. PCE Price Index, Sept. Personal Spending, and Q3 Employment Cost Index (all at 8:30 am), Chicago PMI (9:45 am), and Michigan Consumer Sentiment (10 am). Major earnings reports scheduled for the day include ABBV, AON, BAH, CRI, CERN, CHTR, CVX, CHD, CL, XOM, FTS, FMCC, HUN, IMO, LHX, LAZ, LYB, NWL, PSX, PNM, POR, RCL, SJR, GWW, and WY before the open. There are no reports scheduled for after the close.

The bad AMZN miss (and AAPL miss on revenue) is going to color the action in the tech sector this morning. However, overall, the vast majority of earnings have been coming in strong and most of the major earnings reports are behind us after this morning. So, be prepared for some rotation as fear may drive traders away from FANGMAN names and toward later-cycle plays. Stay nimble and remember that it’s Friday…payday…and time to prepare your portfolio for the weekend (and end of the month).

The trend remains bullish in all 3 major indices, with the two broader indices sitting at all-time highs and the Dow just inches away. Keep in mind that long-term trading success has never come from betting on a reversal. So, remember, the trend is our friend. So, focus on your trade rules and on managing the things you can control. And that should include consistently taking profits when you have them and moving your stops. Watch your current positions before looking to add new trades. Trade carefully and think twice about holding through earnings.

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas for Friday. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service