Bulls Looking to Gap Higher on Fed Rethink

Wednesday saw a mixed start to the day for markets. SPY opened 0.14% lower, DIA opened 0.07% higher, and QQQ gapped down 0.39%. From that point, all three major index ETFs chopped sideways until early afternoon. Oddly, instead of waiting on the Fed decisions and statement, all three started to rally at 1:30 p.m. However, the rally really picked up steam with a strong spike higher between 2:30 p.m. and 3 p.m. This was followed by 30 minutes of a sideways grind in all three. At that point, the Bears woke up and markets sold off sharply the rest of the day. This action gave us Inverted Hammer candles in all three major index ETFs. DIA gave us a white version while SPY and QQQ printed black versions. This means that all three also retested and failed their T-line (8ema) during the session. This all happened on about average volume. We saw average volume in the QQQ and SPY along with heavier-than-average volume in the DIA.

On the day, the 10 sectors were evenly split with Utilities (+1.18%) far out front leading the five gainers while Energy (-1.36%) was way out front leading the five red ones. At the same time, SPY lost 0.29%, DIA gained 0.20%, and QQQ lost 0.72%. VXX gained 0.59% to close at 13.69 and T2122 climbed out of the oversold territory to close in the lower-end of the mid-range at 28.51. 10-year bond yields fell to 4.639% and Oil (WTI) plummeted 3.31% to close at $79.20 per barrel. So, on Wednesday, saw a typical “wait and see” in the morning. However, oddly, markets seemed to think they knew how the wind would be blowing about a half hour ahead of the Fed announcements. Then we saw a spike, followed by rest and then a sharp selloff. In short, traders seem relieved the Fed left rates where they were and loved the fact Chairman Powell essentially took more rate hikes off the table. However, they also then realized there won’t be a rate cut anytime soon and that scared them back into a bearish move.

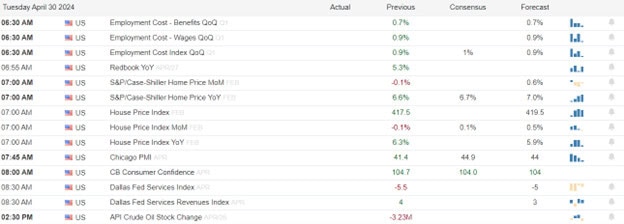

The major economic news scheduled for Wednesday included the ADP Nonfarm Employment Change, which came in stronger than expected at 192k (compared to a forecast of 179k but down from the March reading of 208k). Later, April S&P Global Mfg. PMI was just a tick stronger than predicted at 50.0 (versus a 49.9 forecast but down from March’s 51.9). After that, March Construction Spending was well down from what was anticipated at -0.2% (compared to a +0.3% forecast but slightly better than February’s -0.3% value). Meanwhile, April ISM Mfg. Employment came in a bit stronger than expected at 48.6 (versus a 48.2 forecast and the March 47.4 reading). At the same time, April ISM Mfg. PMI was lower than predicted at 49.2 (compared to a 50.0 forecast and a March 50.3 value). However, the April ISM Mfg. Price Index was well above expectations at 60.9 (versus a 55.5 forecast and a 55.8 March reading). On the jobs front, March JOLTs Job Openings were down at 8.488 million (compared to the 8.680 million forecast and significantly down from the February 8.813 million). Later, EIA Weekly Crude Oil Inventories showed a large, unexpected inventory build of 7.265 million barrels (versus a predicted drawdown of 2.300 million barrels and the prior week’s 6.368-million-barrel drawdown).

However, the big news of the day was the Fed. The FOMC held rates flat, but the statement added a note that there has been a lack of progress on inflation toward its 2% goal since its last meeting. Beyond that, the statement added a flat declaration that, beginning in June, the FOMC will slow the pace of its balance sheet reductions (in terms of bonds) from an average of $60 billion to $25 billion per month. However, it will also maintain the $35 billion per month pace of reductions for non-Treasury balance sheet items (mortgage-backed securities and agency debt). In terms of Powell’s press conference, the Chair poo-pooed the idea of stagflation, saying “I don’t see the ‘stag’ or the ‘-flation’,” … “(So,) I don’t really understand where that’s coming from.” When asked about the possibility of a rate hike, Powell said “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.” When pushed further on what it would take to cause a rate hike, the Fed Chair replied “I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.” The rest of the press conference really boiled down to Powell saying the Fed has not gained any additional confidence that inflation is on path to 2% (which the Fed has said is the required trigger for a rate cut). Powell said, “It is likely that gaining such greater confidence will take longer than previously expected. We are prepared to maintain the current target federal funds rate for as long as appropriate.”

In stock news, on Wednesday, TELL sent Houston-based workers home as it is in talked to sell its shale gas business in order to raise funds for its “Driftwood LNG Export” plant. At the same time, research firm S3 Partners released a report saying that the so-called Magnificent 7 (GOOGL, MSFT, AAPL, NVDA, AMZN, META, and TSLA) now account for $1.08 trillion in short interest. This means they represent 12% of the US market’s total shorts. Later, Bloomberg reported that KR is in talks with DIS about adding DIS+ streaming as a benefit of the grocery chain’s membership program for the remainder of 2024 at no cost. At the same time, SPR announced it had a plan that gives it “a high degree of confidence” it can meet BA’s quality and production rate demands for 737 MAX jets. (BA and the FAA declined to comment to Reuters on the announcement.)

In stock legal and governmental news, on Wednesday, Reuters reported that sources tell it the FTC will rule on its antitrust investigation of the XOM acquisition of PXD for $60 billion within days. Later, the Wall Street Journal reported that the FTC is planning to approve the deal, but will prohibit the PXD CEO from joining the board of XOM as a condition of approval. After the close, CMCSA stopped broadcasting Bally Sports channels. This puts the bankruptcy restructuring of a SBGI subsidiary (Diamond Sports) at risk of collapse. At the same time, Bloomberg reported that US bank regulators are discussing finalizing bank capitalization rules by as soon as August. After the close, JPM made a filing that indicated it expects bank assets in Russia to be seized by that country. (The filing did not specify the dollar value of the bank’s assets in Russia.)

After the close, AFL, AIG, AXS, BHE, CHRW, CWH, CVNA, CTSH, CW, DLX, EBAY, ENSG, EXPI, FLSR, FNV, GIL, HST, MGM, MYRG, PAYC, PGRE, PPC, PTC, QRVO, QCOM, SEB, SCI, SFM, TTEK, VMI, VICI, VTR, ZG, and Z all reported beats on both the revenue and earnings lines. Meanwhile, ACHC, ALL, BBSI, BV, BZH, CTVA, DVN, ES, HLF, THG, MRO, MET, MOS, SUM, and UGI missed on revenue while beating one earnings. On the other side, AFG, AWK, CAR, CF, DASH, GFL, KMPR, MAA, MKL, and TROX beat on revenue while missing on earnings. However, ALB, ANSS, BALY, CMPR, CODI, NVST, ETSY, JAZZ, CNXN, MUSA, RHP, SIGI, and TWI missed on both the top and bottom lines. It is worth noting that BHE, MPWR, SFM, and TTEK raised their guidance. At the same time, QRVO and ZG lowered forward guidance.

Overnight, Asian markets were mixed, Hong Kong (+2.50%) was by far (by 1.6%) the biggest mover on the day. On the other side, Shenzhen (-0.90%) and Taiwan (-0.85%) paced the losers on a day where six exchanges were green and six red. In Europe, we see a similar picture taking shape at midday with seven of 15 bourses in the green. The CAC (-0.73%), DAX (+0.08%), and FTSE (+0.39%) lead the region on volume as Norway (-0.88%) has made the biggest move in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a solidly green start to the day. The DIA implies a +0.48% open, the SPY is implying a +0.71% open, and the QQQ implies a +0.93% open at this hour. At the same time, 10-year bond yields have dropped to 4.602% and Oil (WTI) is up 0.43% to $79.38 per barrel in early trading.

The major economic news scheduled for Thursday includes March Exports, March Imports, March Trade Balance, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q1 Nonfarm Productivity, and Q1 Unit Labor Cost (all at 8:30 a.m.), March Factory Orders (10 a.m.), and Fed Balance Sheet (4:30 p.m.). The major earnings reports scheduled for before the open include AGCO, ATUS, AME, APA, APG, APO, APTV, MT, ARES, ARW, BHC, BAX, BCE, BDX, BDC, BWA, BTSG, BRKR, CNQ, CAH, CHD, CI, CNK, CNHI, CIGI, COP, CMI, XRAY, DBD, D, DRVN, DNB, ENOV, NVRI, EXC, ULCC, HWM, HII, NSIT, ICE, IQV, IRM, ITRI, ITT, JHG, K, KTB, LNC, LIN, MCO, MUR, NFG, NVO, ONEW, OGN, PH, PATK, PBF, BTU, PTON, PENN, PNW, PBI, PWR, REGN, RXO, SABR, SNDR, SEE, SHEL, SO, SWK, TRGP, TFX, TRI, UPBD, VAL, VSTS, VMC, W, WEN, WCC, WRK, XYL, ZBH, and ZTS. Then, after the close, AES, ALHC, AEE, AMGN, AAPL, ACA, BECN, SQ, BKNG, BFAM, CIVI, COIN, ED, CTRA, DVA, DLR, DKNG, EOG, WTRG, EXPE, FND, FTNT, GDDY, HOLX, HUN, ILMN, IR, LYV, MTZ, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PTVE, PXD, POST, RGA, REZI, RKT, RYAN, SEM, SM, SWN, TXRH, X, and WSC report.

In economic news later this week, on Friday, April Avg. Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, April Unemployment Rate, April S&P Global Services PMI, April S&P Global Composite PMI, ISM Non-Mfg. Employment, ISM Non-Mfg. PMI, ISM Non-Mfg. PMI Price Index, and Fed Member Williams speaks.

In terms of earnings reports later this week, on Friday, ADNT, AXL, AMRX, BEPC, BEP, CBOE, CBRE, GTLS, LNG, CRBG, FLR, FYBR, GPRE, HSY, KOP, MGA, NMRK, NVT, PAA, PAGP, TRP, TAC, TRMB, and XPO report.

So far this morning, MT, BDX, BWA, BTSG, BRKR, CHD, CI, CNK, CNHI, ENOV, NVRI, ULCC, GEL, GVA, HWM, ICFI, IQV, IRM, ITT, KTB, LAMR, MCO, MUR, NVO, PBF, PBI, PWR, SWK, TFX, TRI, UPBD, VNT, W, XYL, ZBH, and ZTS all reported beats on both the revenue and earnings lines. Meanwhile, AME, APTV, BCE, CAH, COP, XRAY, LIN, RXO, SHEL, WEN, and WRK all missed on revenue while beating on earnings. On the other side, ACDVF, APO, and EXC beat on revenue while missing on earnings. However, ARES, PENN, REGN, and WCC missed on both the top and bottom lines. It is worth noting that CI raised its forward guidance.

In miscellaneous news, on Wednesday, GS strategists told clients that the single-stock options volume decline prior to the start of earnings season signaled weakness in stocks. However, the report says that this volume has now stabilized and even shows a modest increase, which GS says indicates that the market has an appetite to buy the weakness in equity prices. (In other words, “buy the dip” is still in play.) Meanwhile, BestEx Research that roughly one-third of all S&P 500 stock trades happen in the last 10 minutes of the trading session. This is up significantly from the 27% happening in those minutes found in the company’s 2021 study.

In other news, the US Treasury and State Departments issued hundreds of sanctions related to targeting the Russian invasion of Ukraine. This included 20 companies in China and Hong Kong. Unsurprisingly, a spokesman for the Chinese embassy in Washington said Beijing firmly opposes what he called the US’s “illegal unilateral sanctions.” Meanwhile, in Japan, the Yen jumped 3% against the Dollar late in the US session. This has led to broad speculation that the Bank of Japan has intervened for the second time this week. Finally, in late-breaking news, PTON announced it will lay off 15% of its staff and the CEO will step down.

With that background, it looks as if the Bulls have rethought yesterday’s late selloff and are looking to gap all three major index ETFs higher. All three opened just under their T-line (8ema) but are printing small, indecisive, white-bodied candles after that gap. The SPY, DIA, and QQQ all remain just below their T-line (8ema). So, the short-term trend is now bearish but under pressure from the Bulls. Meanwhile, the mid-term remains bearish. The longer-term market remains Bullish but under pressure. In terms of extension, none of the three major index ETFs is extended below their T-line. At the same time, the T2122 indicator is now in the lower-end of its mid-range. So, both sides have room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, all 10 are in the green this morning with the biggest dog NVDA (+1.75%) out front leading the way higher. Keep in mind that we still have the April Jobs Report on Friday morning. So, after the rethink of Fed reaction we may see an afternoon drift waiting for those Friday morning numbers.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service