How Do You Determine A Trend?

✅ SMS text alerts and reminders?👈

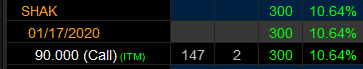

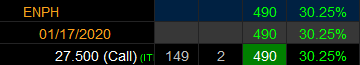

✅ At hit and Run Candlesticks, we focus on Stocks / Simple Directional Options

The market (SPY) How Do You Determine A Trend? First of all, ten traders can have ten different ways to determine a trend, and all ten can be right. (tip) A trend length must match your trading style. We can talk more about that in the trading room. Are your trendlines trending up or down? How about moving averages? I use the T-Line and the 34-EMA, go you your charts and look at the SPY with the T-Line and the 30-EMA, I see the T-Line (a faster-moving average) leading the 34-EMA down (a slower moving average).

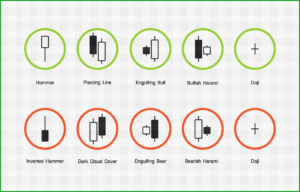

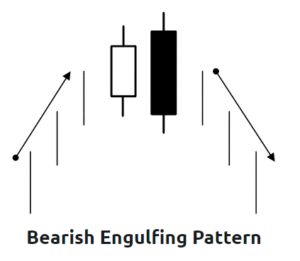

Bearish Engulf: Imagine a mountain engulfed in flames. What a sight that would be! When I picture a Bearish Engulfing pattern, I think of that imaginary mountain. Prices are rising upward, creating one half of the mountain, a black candlestick engulfing a white candlestick at the top, and then the inevitable downward movement creating the other half of the mountain. This bearish candlestick pattern is essential for investors to know, and luckily, it’s easy to identify and interpret. We’ve already discussed its bullish brother, the Bullish Engulfing pattern, so today it’s time we gave the Bear its turn. Read More About Bearish Engulfs Click Here

TThe I path Series S&P 500 VXX Short Term Futures ETN. VXX remains in a bullish stance, currently constructing a continuation pattern one we call a Pop Out Of the Box Pattern (needs a couple more candles). Above $30.30, $34.25 could be captured.

😊 Have a great trading day – Rick

Trade-Ideas

✅ For your consideration: Here are a few charts I thought should go on the watch-List, remember to trade your trade. (short) UPRO, EGHT, EHTH, MCK, AXSM, PAYS. Trade smart and wait for the QEP→ (QEP) Quality Entry Patterns). These Trade ideas are not recomendations.

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service