What do you like to do after a long day? Kick your feet up at home? Go for a run to de-stress? Head out on the town for a dinner with friends? Relax in bed with a good book and a glass of wine? Whatever your preference, I would be willing to bet that you would do something different if a Long Day candlestick appeared on your Japanese candlestick chart. One of the simplest signals around, much like a Doji, the Long Day candlestick is not particularly influential until you combine it with other candles to form a larger pattern. Nevertheless, in the right context, it can pack a punch. So today, we’re exploring its formation and meaning . . .

Long Day Candlestick

Formation

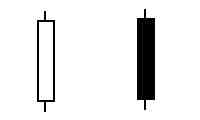

We’ve got an easy one today, folks! Not only does the Long Day candlestick consist of just one candle, but its appearance is described in its name. Quite simply, the Long Day is made up of one candle with a long body. It can be bearish (black or red in color) or bullish (white or green in color), and it may appear anywhere on a candlestick chart.

This signal is defined by its length. Although there is not a specific length that qualifies a candle as “long,” you should evaluate the candle’s length in relation to the chart as a whole. Look over the previous two to three weeks of trading to get an illustrative sample. In addition, the Long Day’s candle should completely contain the previous candlestick within the length of its real body.

Meaning

A long candlestick, as you might have guessed, represents a large price movement from the opening price to the closing price. It can occur in a variety of situations, including at the start of a trend, during the midst of a trend, or at the end of a trend. For this reason, traders don’t use the Long Day as an entry or exit point. However, if it appears as an element of a larger pattern, it may provide a strong forecast for the future. For example, you can find Long Day candlesticks within the following signals, amongst others:

- Bullish Engulfing Pattern

- Bearish Engulfing Pattern

- Bullish Harami Pattern

- Bearish Harami Pattern

- Falling Three Methods Pattern

- Rising Three Methods Pattern

- Bullish Belt Hold Pattern

- Bearish Belt Hold Pattern

As it is quite simple and flexible, the Long Day candlestick appears often. Keep an eye out for it, but remember that it holds little power on its own. It is a single candle, after all. Try to place it within a larger pattern to learn more about the investors’ sentiments and to predict what will happen next. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.