Bulls undoubtedly in charge.

The bulls are undoubtedly in charge, or could this be irrational exuberance as the DIA and IWM leap to new record highs and states impose economic restrictions on the holidays just around the corner. One thing for sure, there seems to be no shortage of traders willing to chase prices higher with little regard to risk. The T2122 indicator indicates an extreme short-term overbought condition, so stay focused on price action for any signs of a pullback. Also, keep in the possibility of overnight reversals as you plan your risk and avoid chasing stocks already extended with the fear of missing out.

Asian markets were sharply higher overnight in reaction to signing a massive trade deal with 14 Asian countries. European markets are decidedly bullish this morning as vaccine hopes continue to inspire hopes of recovery. U. S. futures continue to leap higher as the DIA and IWM look to open at new record highs while infection rates and hospitalizations notch new records as well.

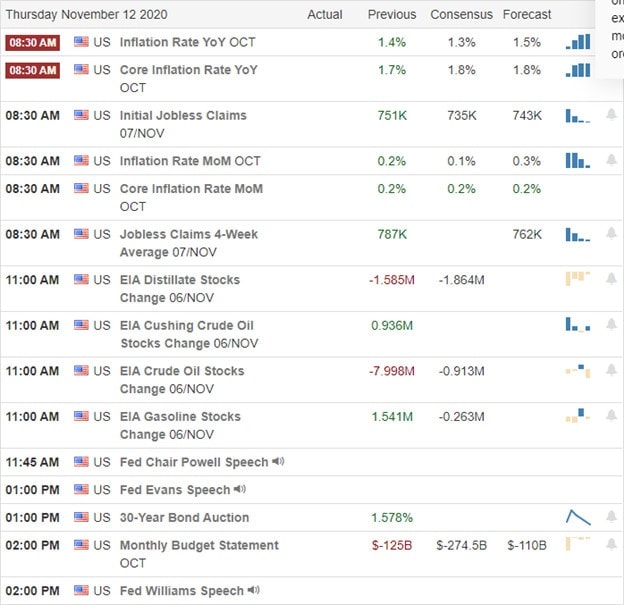

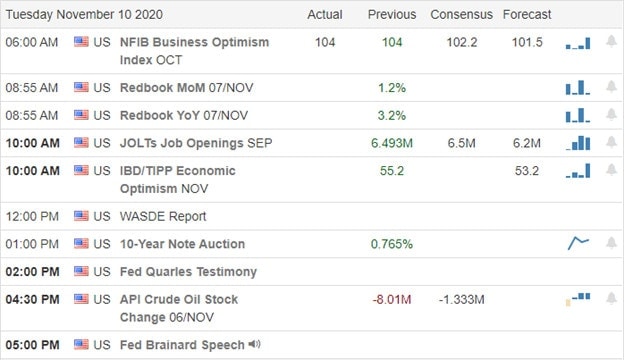

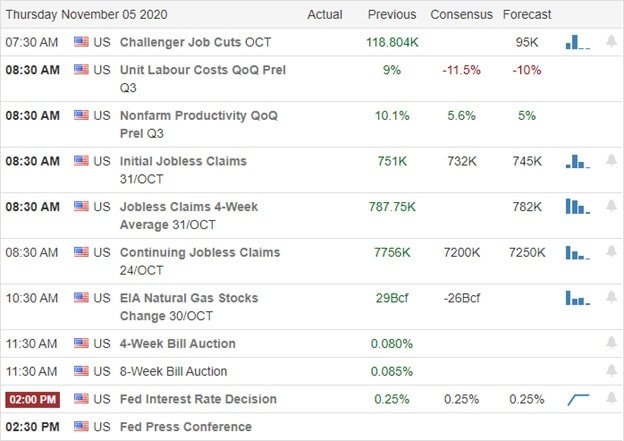

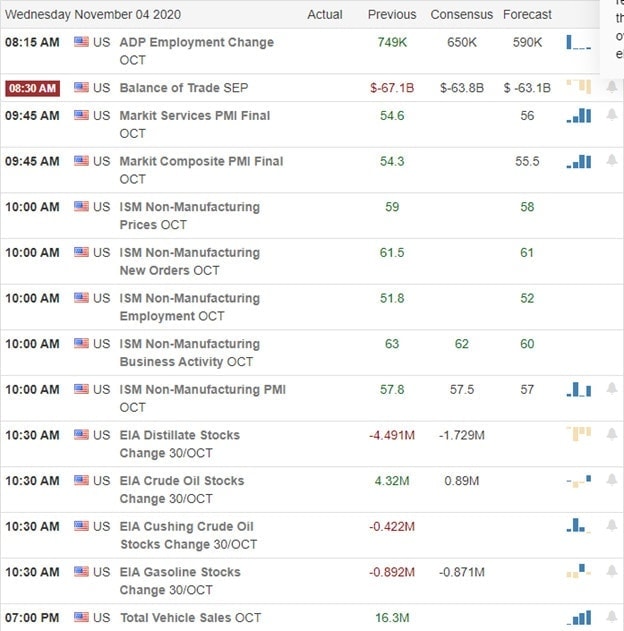

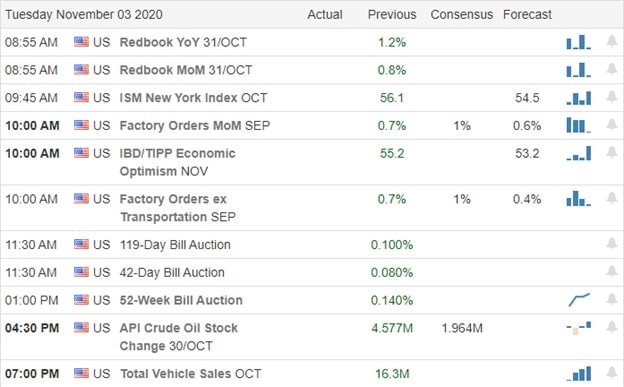

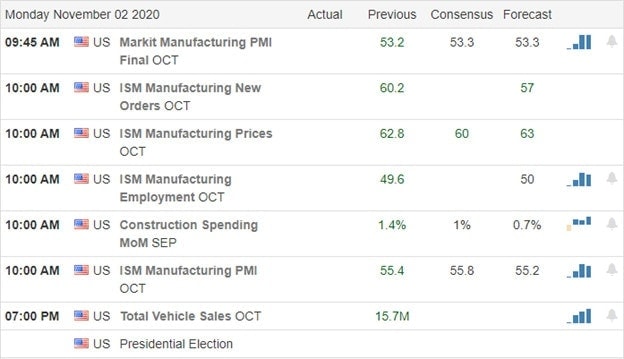

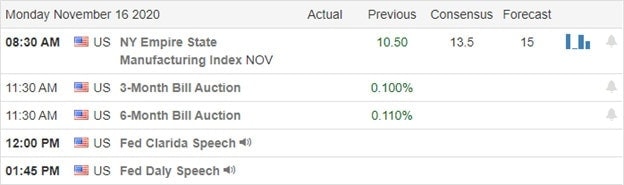

Economic Calendar

Earnings Calendar

We have a rather large week of earnings kicking it off with more than 70 companies fessing up to results this Monday. Notable reports include JD, ACM, FUV, BIDU, CSPR, GAN, KRUS, PANW, SDC, SOHU, & TSN.

News & Technicals’

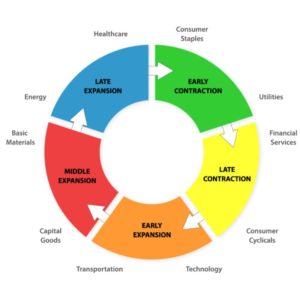

China and 14 other Asian-Pacific countries signed the world’s largest trade agreement over the weekend. According to analysts, economic benefits are modest and would take years to materialize. Texas and Washington set new Covid records this weekend as Midwest states as the Dakota’s and Nebraska set the largest daily increases per capita. As states across the country implement restrictions with severe potential economic impacts, the market continues to surge focused on the hopeful vaccines. Though some point to a possible bubble forming, it has done nothing to dissuade traders from buying up stocks even as P/E ratio’s swell and prices leap toward new record highs. How much longer that can continue is anyone’s guess but, it would be wise for traders to be mindful of the substantial risks with just a pullback to support.

Technically speaking, the indexes appear very extended, and the T2122 indicator is registering an extreme short-term overbought condition even as the futures point to another gap higher this morning. The DIA and IWM will break out to new record highs at the open today, with the SPY not far behind, assuming the futures hold on to the overnight bullishness. Plan your risk carefully as price volatility remains high in this wildly energetic and emotionally charged news-driven environment.

Trade Wisely,

Doug