No Price Too High?

Bulls continue to run, and no price seems too high, setting new records as traders and investors hope for more federal stimulus. Today we get the latest reading on the Employment Situation, but it may not matter as we saw on Wednesday when private payrolls declined and the market soared. That said, stay focused and prepared because if a bearish move were to begin, price supports are painfully lower so, have a plan. Also, keep in mind, this could be a particularly newsy weekend on the political front.

Overnight Asian markets mostly rose, with the NIKKEI soaring 2.36%. European markets trade higher this morning, and ahead of the Employment Situation report, U.S. futures point to more record highs. Remember to take some profits after such a steep rally as we head into the weekend.

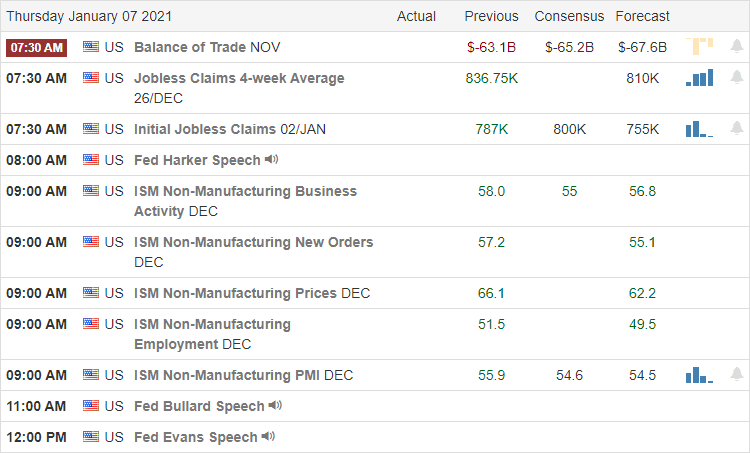

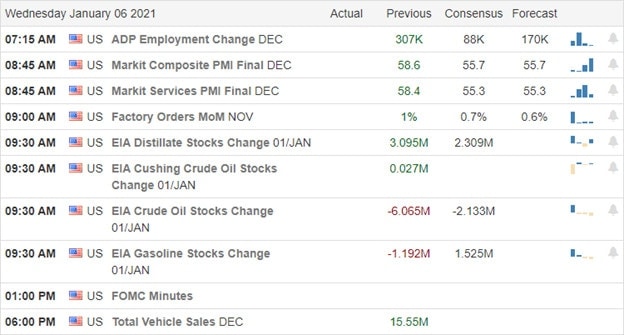

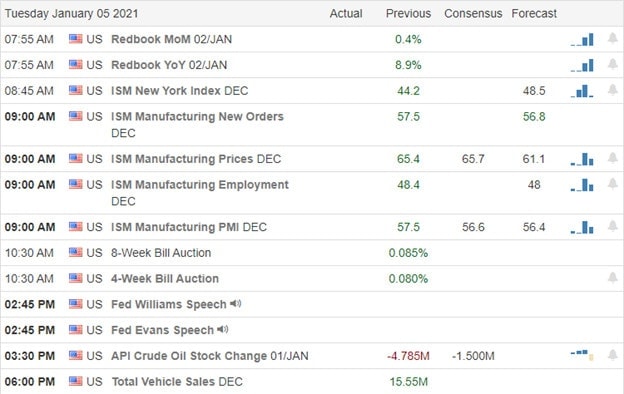

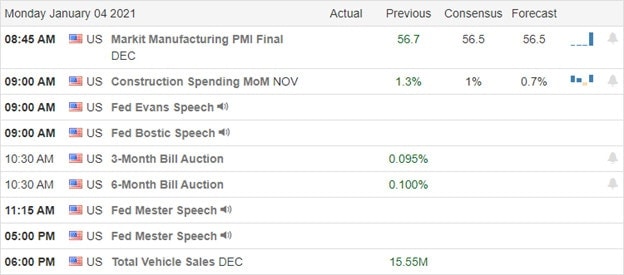

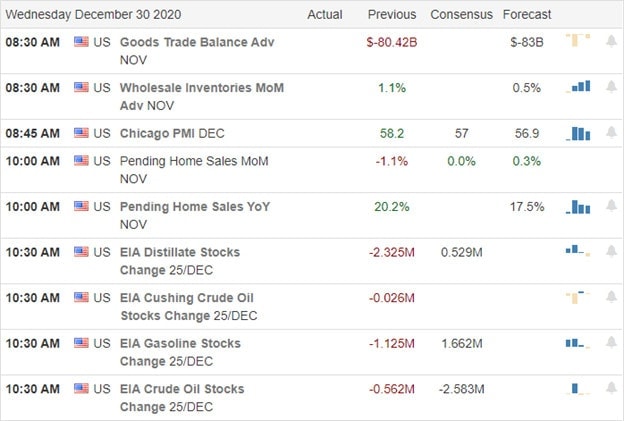

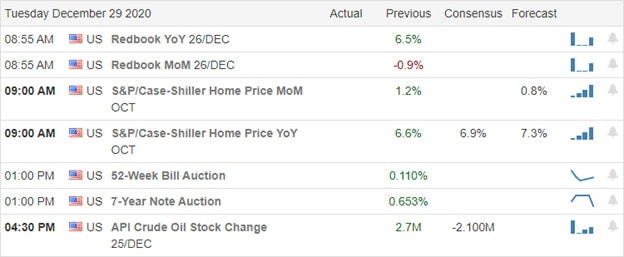

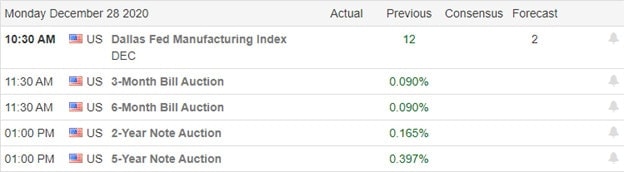

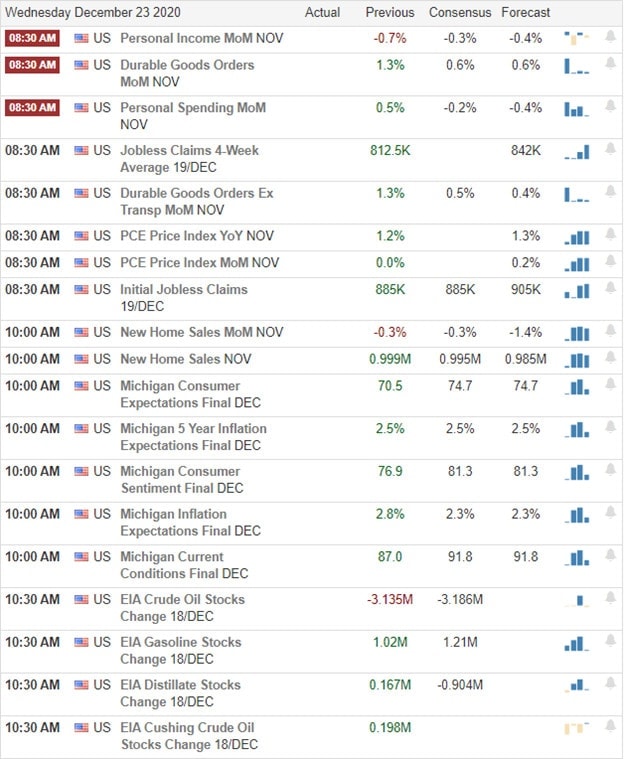

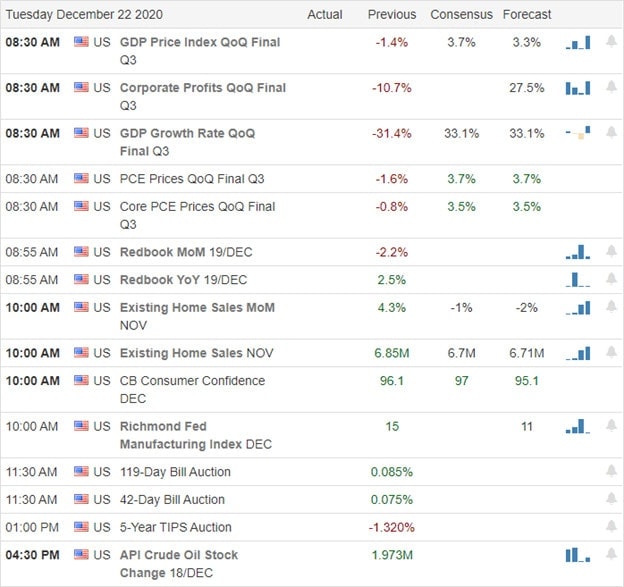

Economic Calendar

Earnings Calendar

We have had a very light day on the Friday earnings calendar with only one verified report coming from the small-cap company LEDS.

News & Technicals’

The market continued to rally after congress certified the Biden presidency. In the final days of the Trump administration, there has been a call to invoke the 25th amendment to remove him from power. Congress is also threatening the 2nd impeachment to remove the president. How these events might impact the market is anyone’s guess. As of now, the bulls seem very confident the Biden administration will put the printing presses into overdrive, adding additional federal stimulus, resulting in new market records with the Dow more than 1100 points above the Monday low. Sadly at the same time, the daily death rate from the pandemic also set a new record, topping 4000 for the first time.

A look at the index charts, and there is not much to say other than the bulls remain in control, and no price seems too high as traders and investors rush into already extended stocks. Today we will get a reading on the Employment Situation. Consensus suggests job growth declined in December due to pandemic restrictions. Still, I’m not sure that matters in this current environment as we saw on Wednesday with private payrolls falling and the Dow rallied sharply. The T2122 indicator is once again signaling a short-term overbought condition, and the VIX remains elevated above 20 handles as we continue to push higher. Stay with the trend and stay focused because a profit-taking pullback has the potential of beginning at any time and could be rather steep with not much for nearby price support.

Trade Wisely,

Doug