Precarious Technical Condition

With stock, futures mixed, the VIX elevated, we kick off the week with the indexes in a precarious technical condition. Uncertainty of the spreading new variant economic impacts, a Fed sounding more hawkish, a possible Evergande default close at hand, and more price volatility is likely to us guessing in the week ahead. While a relief rally seems possible, we can not rule out the possibility of more selling to retest recent lows. If we do rally, keep a close eye on price resistance levels for entrenched bears that are may not be as willing to give up as quickly as they have in the recent past.

Asian markets traded mixed but mostly lower overnight, with tech shares falling and a possible Evergrande default weighing on investors. On the other hand, European markets are in relief rally mode this morning, showing green across the board. With a light day of earnings and economic data, U.S. futures currently suggest a mixed open, but with an elevated VIX head fakes, whipsaws, and overnight reversals are not out of the question.

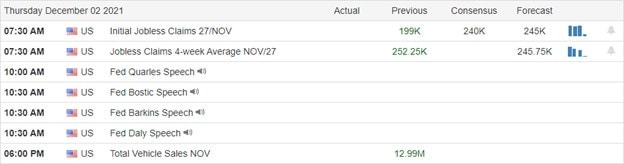

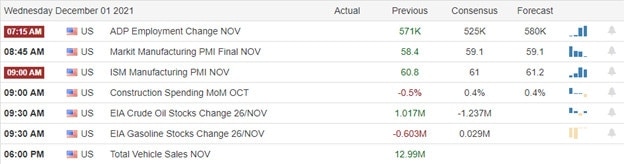

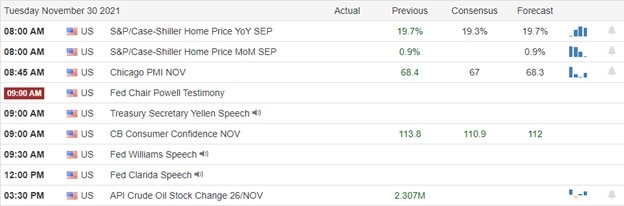

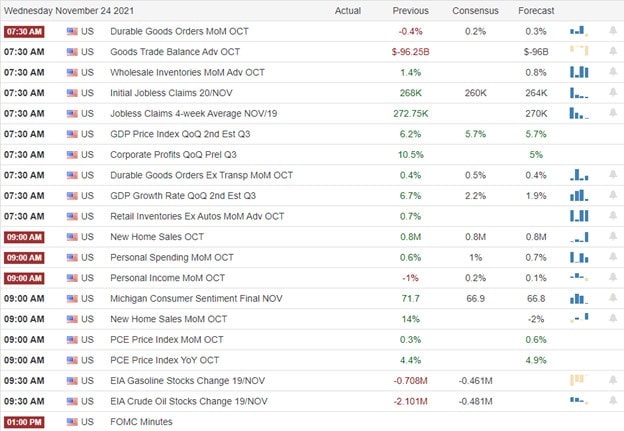

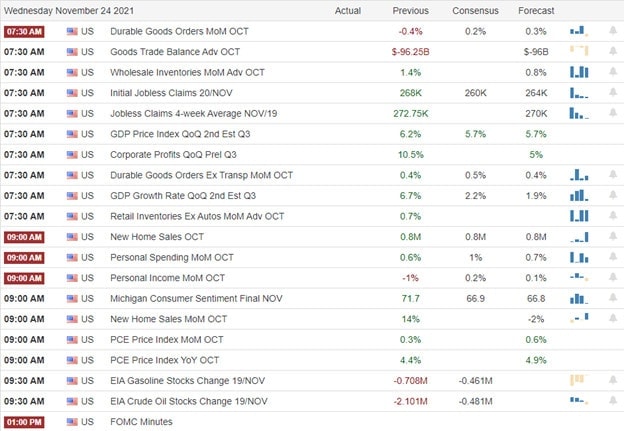

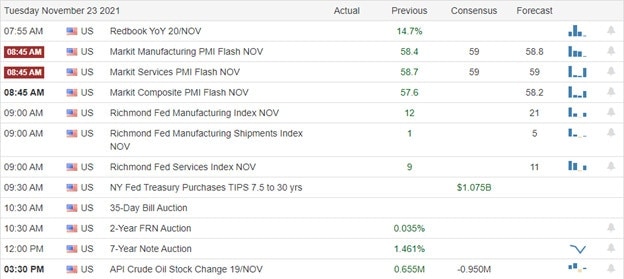

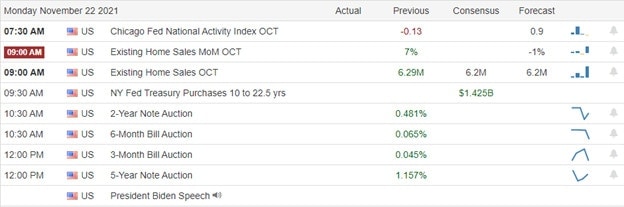

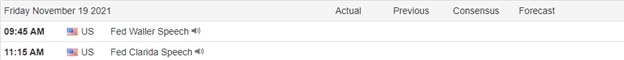

Economic Calendar

Earnings Calendar

We continue to lighten up the earnings calendar kicking off this week with just 15 companies listed and several unconfirmed. Notable reports include COUP, DLHC, HQY, MDB, & SAIC.

News and Technicals’

The Fed is likely to decide to double the pace of its taper to $30 billion a month at its December meeting, comments from Fed officials suggest. Initial discussions could also begin about when to raise interest rates and by how much next year. Fed Chair Jerome Powell, in testimony last week, supported the idea of a faster taper and made a dramatic shift when he said the big concern with another wave of the virus or new variant was inflation. Evergrande is back in the news as the shares plunge nearing default. Having made three 11th-hour coupon payments in the past two months, Evergrande again faces the end of a 30-day grace period on Monday, with dues totaling $82.5 million. But a statement on Friday saying creditors had demanded $260 million and that it could not guarantee funds for coupon repayment wiped a fifth off its stock’s value on Monday. Evergrande is grappling with over $300 billion in liabilities, meaning a disorderly collapse could ripple through the property sector and beyond. The Japanese tech giant’s Alibaba share price fell from 5201 yen ($46) to 5103 yen on the Tokyo stock market. At one point, shares fell as low as 5,062 yen, which is their lowest level since June 2020. Portfolio companies, including Alibaba, Arm, and Didi Chuxing, are all experiencing periods of uncertainty that have hit their market value. Treasury yields climb slightly in early Monday trading, with the 10-year trading up to 1.3733% and the 30-year rose to 1.7026%

We begin the week with indexes in a precarious technical condition as the Fed begins sounding more hawkish and the uncertainty of the new variant impacts as it spreads across the county. While the T2122 indicator continues to suggest a relief rally may soon occur, we can not rule out the possibility of more selling. With the VIX closing above a 30 handle on Friday, price volatility will likely remain high, making head fakes, whipsaws, and overnight reversals possible. Remember, resistance levels can harbor bear defensive lines, and it’s unlikely they will be willing to give up as quickly as they have in the recent past. Also, keep in mind the punishing price action of the last couple of weeks has stripped a lot of money from the buy-the-dip buyer’s accounts and likely diminished their tolerance for risk in the process. Finally, the possible default from Evergrande and the uncertainty of Chinese issued stocks adds another layer of uncertainty traders will have to grapple with this week.

Trade Wisely,

Doug