More Technical Damage

The selling on Friday created more technical damage as the DIA and QQQ joined the IWM below their 50-day averages. However, the DIA and SPY still hope they can avoid dipping below the Dec. 1st low. Unfortunately, follow-through selling this morning will officially create lower lows in the QQQ and IWM and likely dampen the spirit of the buy-the-dip buyers who will feel the pain of another gap down today. The highly hyped and hoped-for Santa rally looks to have been stolen by the Grinchy new variant and its possible economic impacts. Expect volume to drop quickly this week as traders head out for holiday plans.

Asian market closed red across the board as pandemic worries intensified. European markets are also decidedly bearish, with the FTSE leading the bears down 1.96% this morning as restrictions expand. Ahead of a light day of earnings and economic data, U.S. futures point to a nasty gap down to begin this holiday-shortened week. So, buckle up and get ready for a dose of volatility in the open.

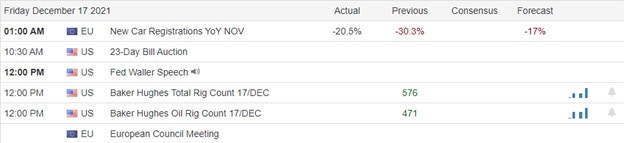

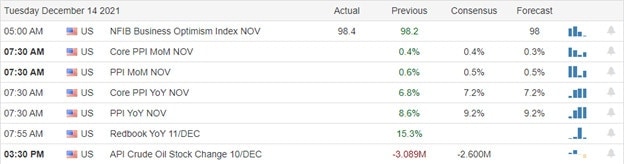

Economic Calendar

Earnings Calendar

Kicking off a holiday-shortened week, we have 14 companies listed with a few unconfirmed. Notable reports include CCL, MU, NIKE, & BLDE.

News & Technicals’

The Netherlands entered full lockdown from Sunday until mid-January, leaving only supermarkets and essential shops open. In the U.K., government ministers are also refusing to rule out further restrictions over Christmas as cases skyrocket. President Joe Biden’s Chief Medical Officer Anthony Fauci said on Sunday that it was clear omicron was already “raging through the world.” However, modern said that its currently authorized booster could “boost neutralizing antibody levels 37-fold higher than pre-boost levels,” which it described as reassuring. However, it also said that a double dose of the booster shot — 100 micrograms, rather than the approved 50 micrograms — was significantly more effective. Sen. Joe Manchin, a conservative Democrat, said Sunday he won’t support the Biden administration’s “Build Back Better” plan. Manchin’s decision will likely kill the $1.75 trillion social spendings and climate policy bill as it is now. Democrats need Manchin’s vote in the 50-50 Senate, plus a tie-breaker from Vice President Kamala Harris. Treasury Yields traded lower in early Monday trading, with the 10-year slipping to 1.3716% and the 30-year falling to 1.7897%.

The selling on Friday added more technical damage to the index charts, with the QQQ, IWM, and now the DIA trading below their 50-day averages. Central bank changes and the rapidly spreading pandemic variant may have ended the hope of a Santa Clause rally this year. Heavy selling in Asia and Europe suggests the short holiday weeks ahead could see challenging price action. Once again, the buy-the-dip buyers will feel the sting of disappointment with futures pointing to a substantial gap lower. The QQQ and the IWM look to open lower than the December 1st lows, but the DIA and SPY still cling to hope a lower low can be avoided. Keep in mind volume will likely decline throughout the week as traders head out for holiday plans. Moring price volatility could easily slip quickly into low volume choppy price action unless otherwise inspired by news events.

Trade Wisely,

Doug