Improved Technical Position

The surge upward in the Dow on Tuesday improved the technical position of the index as it tested its 50-day average as resistance. Unfortunately, the SPY, QQQ, and IWM still have a lot of work to do with significant technical and price resistance levels above to test the resiliency of the bulls. Moreover, expect price volatility to remain high with a jam-packed earnings calendar for the next two days, a possible market-moving CPI before the bell on Thursday.

Asian markets closed green across the board overnight, with the HSI leaning the way up 2.06%. This morning, European markets are also in rally mode, with all indexes advancing in the morning session. Ahead of a big day of earnings data, U.S. futures seem ready to shake off worries of the pending CPI report Thursday morning, pointing to bullish open across the board. However, watch for whipsaws or the possible pop and drop as we test overhead resistance levels if the hit and miss earnings results continue.

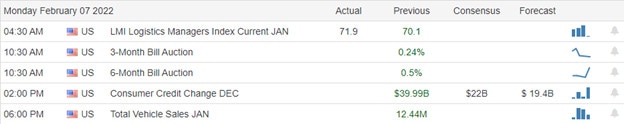

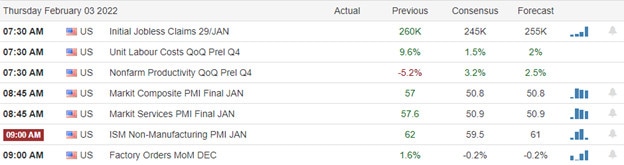

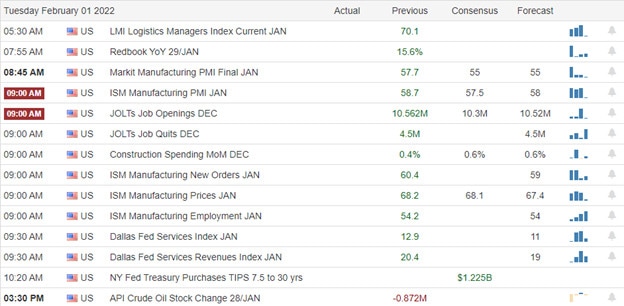

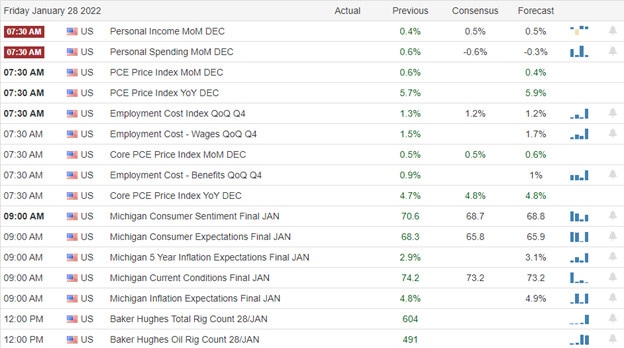

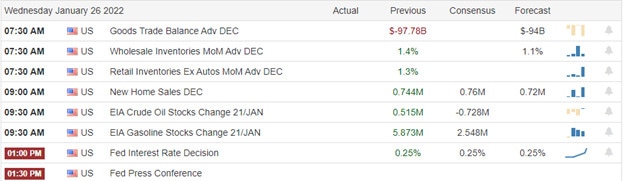

Economic Calendar

Earnings Calendar

We have a busy day on the Wednesday earnings calendar with nearly 170 confirmed reports. Notable reports include DIS, AFG, NLY, ARCC, BG, CCJ, CHEF, CME, CXW, CVS, DFX, FWRD, FOX, GSK, GBDC, HMC, IIVI, IRBT, LAD, MAT, NESA, MGM, MOH, MSI, NGL, ORLY, PAG, PPC, RDWR, SGEN, SONO, TEVA, TM, TRMB, TWLO, UBER, YUM, & ZNGA.

News and Technicals’

Facebook owner Meta closed with a market cap below $600 billion on Tuesday for the first time since May 2020. That also happens to be the number House legislators picked as the threshold for a “covered platform” in a package of competition bills aimed at Big Tech. The milestone points to one of the challenges of crafting laws that target the tech industry. Gas supplies to Europe will more likely be disrupted because of violence in the region rather than as a result of being weaponized, Dan Yergin told CNBC on Tuesday. Russia provides more than 30% of Europe’s gas, and Europe’s gas markets are linked by a network of pipelines, some of which pass through Ukraine. Although OPEC+ has decided to go ahead and return production output to 400,000 barrels per day for March, some producers could struggle to return to previous levels of production, said Yergin. WHO official Maria Van Kerkhove said the omicron subvariant BA.2 is more transmissible than BA.1, currently the dominant version of omicron worldwide, and will likely become more common. Dr. Abdi Mahamud, the WHO’s Covid incident manager, said it’s unclear whether BA.2 can reinfect people who previously had BA.1. Van Kerkhove emphasized that there’s no indication of a difference in illness severity between BA.2 and BA.1, though she noted that research is ongoing. The House passed a temporary government funding bill to prevent a shutdown later this month. The Senate plans to approve the plan by a February 18 deadline to avoid a lapse in federal funding. The bill would extend funding through March 11 and give lawmakers enough time to craft a long-term spending plan. Treasury Yields relaxed slightly in early Wednesday trading, with the 10-year dipping to 1.9216% and the 30-year declining to 2.2147%.

The Tuesday rally improved the technical position of the Dow, testing its 50-day moving average as resistance. The SPY has seesawed in a consolidation reversing its direction four days in a row as it consolidated between the technical levels of the 200 and 50-day averages. Unfortunately, the QQQ remains challenged by the overhead resistance of its 200-day average, and the IWM faces nearly a year’s worth of overhead price resistance. That said, the bulls are working hard with the help of institutions like JPM, promoting an upside rally. Earnings results remain mixed, but the next two days will be jam-packed on the earnings calendar so prepare for more price volatility and the possibility of substantial overnight gaps. Keep in mind as you plan forward, we will get a CPI number Thursday morning that could prove substantially market-moving. Also, keep an eye on overhead resistance for the entrenched bears and the possible Russian invasion of Ukraine that may upset any bullish sentiment in half a heartbeat.

Trade Wisely,

Doug