Nasty Intraday Reversal

On Thursday, the index charts suffered some technical damage, producing a nasty intraday reversal at price resistance levels. The selloff extended into the close, leaving behind concerning candle patterns with the SPY, IWM, and QQQ closing below their 50-averages. With a lighter day of earings and economic data, will the bears find the inspiration to push on lower, or will the bulls step up to defend as we move toward the weekend? With a 5/10 and 5/30 bond inversion and a Fed signaling, aggressive rate increases expect the challenging price volatility to continue.

While we slept, Asian markets closed mostly lower, with the Nikkei leading the selling to close down 1.63%. European markets trade in the red across the board this morning due to the aggressive Fed comments. U.S. futures work to recover from overnight lows but still point to a slightly bearish open with a light day ahead of earnings and economic data. So, plan your risk carefully as we head into the uncertainty of the weekend.

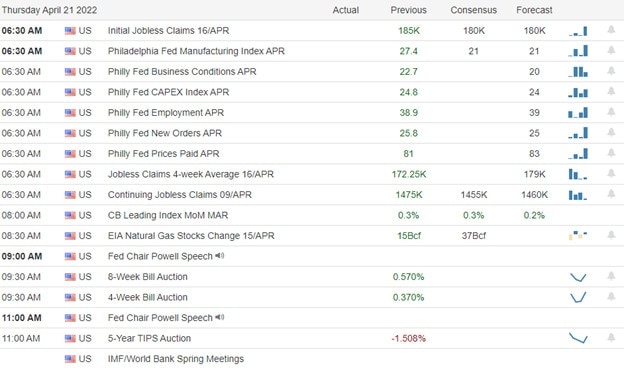

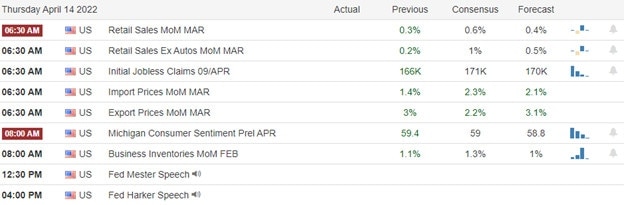

Economic Calendar

Earnings Calendar

Friday, we get a little break with fewer companies expected to report. Notable reports include AXP, CLF, GNTX, HCA, KMB, NEM, RF, SAP, SLB, & VZ.

News & Technicals’

Fed Chairman Jerome Powell on Thursday said the central bank is committed to raising rates “expeditiously” to bring down inflation. That could mean an interest rate hike of 50 basis points in May as prices rise at their fastest pace in more than 40 years. “It’s absolutely essential to restore price stability,” he added. On Thursday, the Florida legislature passed a bill seeking to dissolve a special district that allows the Walt Disney Company to act as its own government within the outer limits of Orange and Osceola counties. If Gov. Ron DeSantis signs the bill into law, the Reedy Creek special district would be dissolved effective June 1, 2023. Dissolving the district would mean Reedy Creek employees and infrastructure would be absorbed by the counties, which would then become responsible for all municipal services. Warner Bros. Discovery has decided to shut down CNN+ just weeks after it launched. CNBC reported that fewer than 10,000 people were watching CNN+ each day last week. As a result, CNN+ head Andrew Morse is leaving the company. Warner Bros. Discovery leaders spoke to hundreds of CNN+ staffers Thursday to explain the decision to shut down the service. Snap missed Wall Street expectations for profit and sales when it reported first-quarter results on Thursday after the bell. Shanghai, China’s largest city, has struggled to contain a Covid outbreak and began large-scale lockdowns in late March. In the last week, authorities announced a whitelist of 666 companies that would get priority for resumption of work. Foreign business organizations said the list is a step in the right direction, but it’s challenging to get more than half of the workers to factories due to lockdown restrictions. Treasury yields continue to rise in early Friday trading, with the 5- year rising to 3.01%, inverting over the 10-year trading at 2.93%, and the 30-year pricing at 2.96%.

Thursday was a rough day for the indexes to produce a nasty intraday reversal at price resistance levels. Investors came to grips with aggressive rate increases likely coming from the FOMC next month. Unfortunately, the SPY and IWM fell below their 50-day averages again, while the QQQ failed at its 50-day, resulting in a bearish lower low. However, with defensive sector stocks finding favor in the turmoil, the DIA remained the sole index able to hold above its 50-day. The question for today is if the bears will have the energy to follow through to the downside or if the bulls will step up to defend as we slide into the weekend. With a lighter day of earnings and economic data, directional inspiration may be challenging to come by until the big tech earnings events next week. Another troubling factor investors will have to grapple with today is the 5-year Treasury yields inverting over the ten and thirty-year bonds that often signal a recession may be on the way. Expect price volatility to remain high and watch closely as we test recent lows for support.

Trade Wisley,

Doug