200-Day Moving Averages

Although Monday’s economic data points to an economic decline, the bulls ignored it pushing up to test 200-day moving averages in the index charts. Volume was noticeably low yesterday, and internal indicators suggest a short-term overbought condition despite the rush to hurry up and buy something. Today’s inspiration may come from the report from HD, WMT, Housing Starts and Permits, and Industrial Production numbers. Continue to ride the bullish was as long as it lasts but keep in mind that exuberant rallies can abruptly turn, so plan carefully.

Asian markets finished the day mixed and relatively flat, with Hong Kong sliding the most, down 1.05%. However, European markets push higher, showing modest gains across the board this morning. As we wait for reports from WMT and potential market-moving economic data, U.S. trade flat to slightly bearish but anything is possible by the open of trading. Buckle up and observe as we test overhead resistance.

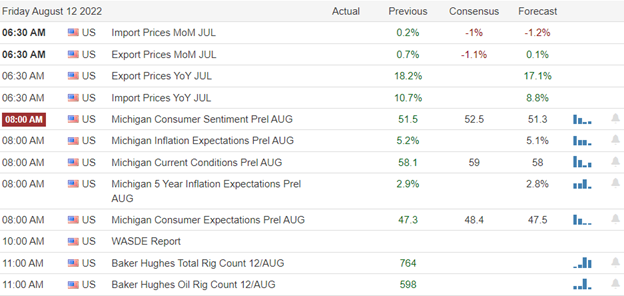

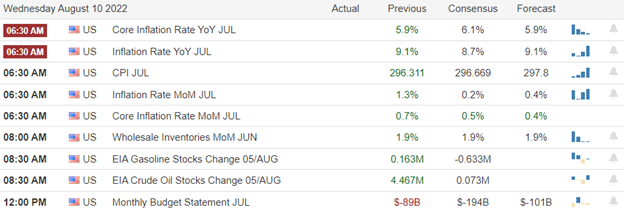

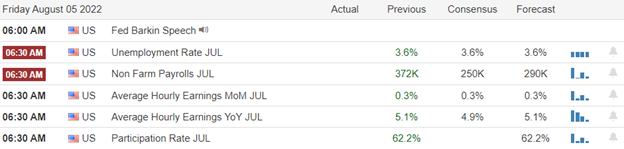

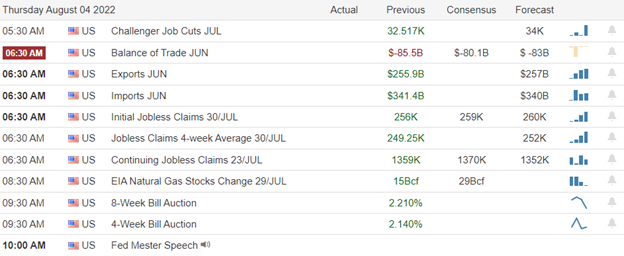

Economic Calendar

Earnings Calendar

We have less than 50 companies listed, a large number of those unconfirmed. Notable reports include HD, WMT, A, LITE, & SE.

News & Technicals’

Home Depot reported quarterly earnings and revenue that beat analyst expectations. CEO Ted Decker said the results reflect continued strength in demand for home improvement projects. Shares of Chinese food delivery giant Meituan plunged 9% on Tuesday after Reuters reported that Tencent plans to sell most of its $24 billion stake in the company. Tencent, which owns 17% of Meituan, is planning to placate domestic regulators and cash in on its eight-year-old investment, Reuters reported, citing four sources with knowledge of the matter. However, a source told CNBC that Tencent has no plans to sell its Meituan stake. Moscow is working to recalibrate its economy in the face of a barrage of international sanctions imposed by Western powers in response to the war. As a result, the Russian economy shrunk by 4% year-on-year over the second quarter, although this was less sharp than the 5% expected by analysts. Although many economists are focusing on the long-term structural threats to the Russian economy – which the government and central bank are scrambling to counter – the more immediate collapse predicted by some has not come to fruition. Apple employees who work in Santa Clara County near the company’s California headquarters have been called back to the office starting in September, where they are expected to work three times per week. The commander of the U.S. Seventh Fleet said on Tuesday that he’d seen an increase in “unsafe” aerial intercepts by Chinese military aircraft in the South China Sea region. Karl Thomas emphasized the importance of supply chains and the free flow of shipping, adding that keeping sea lanes open is the “first and foremost” mission of the Navy. Thomas said the vast majority of U.S. and Chinese aerial and naval interactions are professional and safe despite an increase in unsafe aerial interactions. Walmart has reached an exclusive deal with Paramount+ to offer the streaming service as part of its Walmart+ offering. Walmart+ subscribers will get an ad-supported Paramount+ subscription included. Paramount Global CEO Bob Bakish has set a 100 million goal for Paramount+ subscribers by 2024. Treasury yield traded flat early Tuesday, the 2-year at 3.20%, the 5-year at 2.92%, the 10-year at 2.79%, and the 30-year at 3.09%.

The bulls found inspiration to rally, testing 200-day moving averages despite the ugly manufacturing data and the downturn of the Housing Market Index. Volume was, however, noticeably low as the indexes continued to reach out for overhead resistance levels and key moving averages. At the same time, the T2122 indicator remains unbelievably overbought as traders rush to buy something, hoping not to miss the payday. Today, we have potential market-moving economic reports with the Housing Starts and Permits and Industrial Production numbers. Though earnings numbers are dwindling quickly, the reports from HD and WMT could provide substantial inspiration. Remember, exuberant rallies can turn lower abruptly, so plan your risk carefully and ride the wave as long as it lasts.

Trade Wisely,

Doug