The hurry up and wait low volume chop we’ve seen this week will be over once the CPI number is revealed. So, plan for premarket price volatility, likely creating an opening gap. After that, what happens next is anyone’s guess. The bulls hope this data will finally break the overhead resistance clearing the path for more upside. On the other hand, the bears hope for inspiration to defend the resistance with hopes for more market lows. Let’s hope we finally get some better volume providing directional conviction no matter what happens! Buckle up the drama is about to begin.

While we slept, Asian markets sold off as China’s inflation rose, with the Hong Kong tech selling off nearly 2%. European markets trade mixed and primarily flat, waiting on the U.S. inflation data and what it means for future FOMC actions. However, U.S. futures show the standard premarket pump-up we have seen during this relief rally, pointing to a bullish open ahead of the CPI report. Of course, after the reveal, anything is possible as traders and investors react.

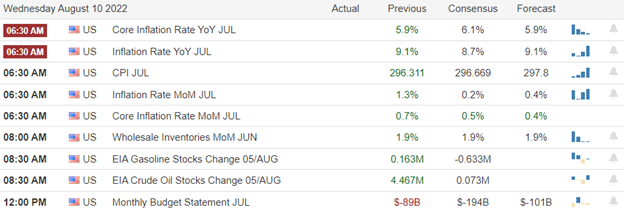

Economic Calendar

Earnings Calendar

On this hump day, we have more than 170 companies listed but less than 100 confirmed, as is usual when small-cap reports ramp up. Notable reports include AAP, BMBL, COHR, CPNG, CYBER, BROS, DIS, FOXA, FNV, JACK, MFC, MTTR, PAAS, RRGB, SONO, COOK, WEN, & WWW.

News & Technicals’

Earlier this year, the Tesla and SpaceX CEO said on social media that he had “no further TSLA sales planned” after April 28. However, after Musk’s latest stock sales were revealed, Tesla fans and promoters asked the celebrity CEO if he was done selling shares in the electric vehicle business and if he might repurchase shares in the future. Asked if he was done selling Tesla shares, Musk replied: “Yes. In the (hopefully unlikely) event that Twitter forces this deal to close and some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock.” There have been mixed messages this quarter about streaming’s growth potential. If Disney+ meets or exceeds 10 million net adds, investors bullish on streaming will sigh relief. If it falls short, investors will question if CEO Bob Chapek can hit his target of 230 million to 260 million subscribers by 2024. Coinbase’s revenue declined almost 64% in the quarter as cryptocurrency prices fell. The exchange operator lowered its full-year forecast for transacting users. Coinbase said it was trimming 18% of its headcount during the quarter. Legal and General’s CEO Nigel Wilson described the UK’s cost-of-living crisis as “a tragedy for many, many people.” The typical household is expected to spend the equivalent of £4,266 on energy each year from January. Prime Minister Boris Johnson’s spokesperson said it would be up to his successor to make decisions on the matter. Sweetgreen lowered its 2022 forecast, citing weaker sales that began around Memorial Day. The chain said it laid off 5% of its support center workforce and will downsize to a smaller office building to lower its operating expenses. Shares of the company fell about 20% after hours. Deliveroo reported a pretax loss of £147.3 million in the first six months of the year, up 54% from the same period a year ago. The U.K., food delivery firm, said it is consulting on plans to exit the Netherlands, the latest withdrawal from a major European market following its retreat from Spain and Germany. Deliveroo said it would initiate its first-ever stock buyback program, purchasing up to £75 million in shares from investors. After President Biden ratified Finland and Sweden’s NATO membership, Russia halted U.S. nuclear inspections. Treasury yields moved slightly lower in early Wednesday trading, with 2-year at 3.26%, the 5-year at 2.96%, the 10-year at 2.78%, and the 30-year at 3.00%. However, the 6-month and the 12-month bonds are now inverted over the 5,10, and 30-year bonds painting a troubling picture of recession.

Markets chopped in a narrow range Tuesday as traders and investors waited for the CPI number that could inspire the bulls or the bears, depending on the result. However, the wait is almost over, and with indexes pressed against significant overhead resistance, expect considerable premarket price volatility likely to create an opening gap. In addition, depending on the outcome, we should expect considerable movement in the U.S. dollar and bond markets, adding some volatility to commodity prices after the report. After that, a Petroleum report, a Fed Speaker, a 10-year bond auction, and a Treasury Statement round out the day. Anything is possible, so buckle up and get ready for the show!

Trade Wisley,

Doug

Comments are closed.