With jobless claims rising, Thursday was a choppy session as we waited for the Employment Situation report before today’s bell. Predictions range from solid job growth to a rather sharp decline over the last month, 372,000. With fewer market-moving earnings reports and the indexes tucked snugly against overhead resistance, today could be the bulls or bears decide breakthrough or pullback from this critical area. As we slide into the weekend, keep in mind that next week get to find out if inflation has topped with CPI and PPI reports.

Asian closed the Friday session green across the board as Taiwan stocks shook off the intimidation of China’s military drills off their coast. However, European markets trade slightly bearish this morning, waiting on U.S. jobs numbers. With the pending Employment Situation report and a much lighter day on the earnings calendar, futures trade mixed, but anything is possible by the open. Will the overhead resistance break or hold? We will soon find out!

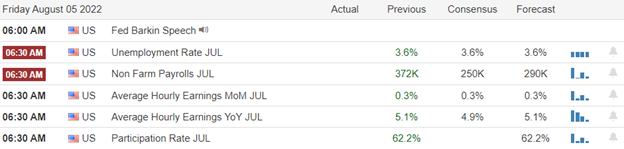

Economic Calendar

Earnings Calendar

We get to take a breath and slow the pace of reports today with about 100 companies listed and quite a few not confirmed. Notable reports include AAWW, BEP, CGC, DKNG, GOG, GT, WDC, & WOW.

News and Technicals’

China sanctions Pelosi over her trip to Taiwan, calling it an egregious provocation. In addition, political analysts have warned that Pelosi’s decision to visit Taiwan could undermine U.S.-China relations. At the 2022 Tesla shareholder’s meeting, CEO Elon Musk touched on various topics, including macroeconomics and the possibility of share buybacks. He also said Tesla aims to produce 20 million vehicles annually by 2030 and thinks this will take approximately a dozen factories, each producing 1.5 million to 2 million units annually. Musk said that the Cybertruck is still slated for next year but won’t have the same specifications and pricing that were originally given when the company unveiled the experimental pickup in 2019. AMC on Thursday said it plans to issue a dividend to all common shareholders in the form of preferred shares. The company has applied to list these preferred equity units on the New York Stock Exchange under the symbol “APE.” The company said that the new class of shares carries the same voting rights as the existing common shares. Oil prices have fallen sharply from their recent peaks, but there’s still a case for buying oil stocks, according to Bill Smead, chief investment officer at Smead Capital Management. That’s because energy prices are likely to stay high or even increase further, he told CNBC’s “Street Signs Asia” on Thursday. A reopening of China’s economy would lead to a spike in demand for energy, and supply remains tight, Smead said. India’s central bank raised key rate by 50 bps to 5.40%, with inflation above 7% and over the RBI tolerance level in Q2 and Q3, and economists see more hikes in the coming months. Treasury yields ticked slightly higher in early Friday trading Witht eh 2-year at 3.06%, the 5-year at 2.80% the 10-year at 2.70% and the 30-year at 2.97%.

The pending Employment Situation report made for an uncertain choppy Thursday session, with index prices holding against overhead resistance levels. As a result, anything is possible through the open of Friday trading. The Econoday consensus suggests a decline, but an early CNBC report said the number could be strong this month and weakening in the future. Needless to say, all the predictions are meaningless its how the market reacts to the data that matters! Plan your risk carefully as we slide into the week with CPI and PPI inflation data coming next week.

Trade Wisely,

Doug

Comments are closed.