With the month-over-month inflation rate decline, the market celebrated, but traders should keep things in perspective. An 8.5% inflation rate is still unacceptably high, and the Fed’s 2% target means we are still in a rate-increasing cycle, and the balance sheet reductions will continue. Today we will find out if the Producer Prices also enjoyed an inflationary reduction and get the latest reading on Jobless claims. The pace of market-moving earnings reports will quickly decline during the next couple of weeks, removing some of the current wild speculation risks. Watch for clues of a pullback should the bears find inspiration from these elevated levels.

Asian markets mostly rallied overnight after the better-than-expected U.S. inflation, with Hong Kong up 2.40% at the close. However, European markets don’t seem to share in the excitement of the 8.5% inflation rate trading flat to slightly lower this morning. U.S. futures look to continue the celebration pointing to a gap up open ahead of PPI and Jobless Claims. It seems odd, but the market loves the consumer punishing 8.5% inflation. Buy, Buy, Buy!

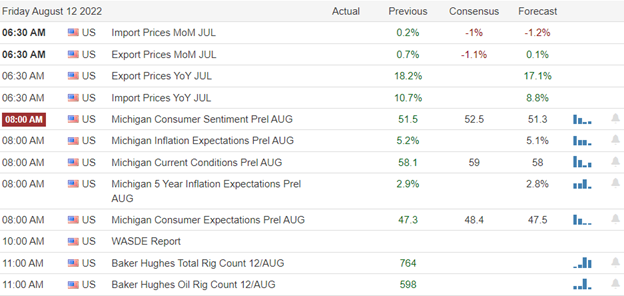

Economic Calendar

Earnings Calendar

Notable reports include AER, BIDU, BAM, GOOS, CAH, DDS, FLO, ILMN, LZ, MLCO, NIO, POSH, RIVN, RYAN, SIX, SOLO, TOST, UTZ, WRBY, WTI, & WPM.

News & Technicals’

Disney plans to raise streaming prices after the service posts a significant operating loss. The no ads service is increasing $3 per month to $10.99, with the ads service priced at $7.99 per month. A bundle of Disney+ and Hulu, both with ads, will be $9.99 per month. Analysis by CNBC shows Beijing’s new trade blocks against Taiwan affect only about 0.04% of their two-way trade. Beijing’s retaliations against U.S. House Speaker Nancy Pelosi’s visit to Taiwan earlier this month include suspensions of imports of Taiwanese citrus, frozen fish, sweets, and biscuits and exports of natural sands to Taiwan. While mainland China and Taiwan’s trade should be largely unaffected by the new measures, heightened military drills in the Taiwan Strait may delay shipments, analysts say. Deliveries of Boeing 787 Dreamliners had been paused for much of the past two years. American Airlines said it received one of its 787 planes from Boeing’s South Carolina factory. Ethereum is moving closer to adopting a proof-of-stake model for its network, which is less energy intensive than the existing proof-of-work method. The network ran its last dress rehearsal before the major upgrade, which is expected to take place next month. Treasury yields traded mixed early Thursday, with the 2-year at 3.17%, the 5-year at 2.89%, the 10-year at 2.76%, and the 30-year at 3.03%.

With inflation declining to 8.5%, the market celebrated though Fed member Evens stated rate increases would continue. While it’s good news that inflation declined month over month, the Fed’s 2% target is still a long way off though it may give the committee some breathing room to decrease their aggressive pace. Today we get the latest read on jobless claims and will find out if the PPI also enjoyed a decline in inflationary produce costs. Volume remains strangely low, so watch for clues of a pullback if the bears happen to find some inspiration.

Trade Wisely’

Doug

Comments are closed.