Technical Situation – Ugg

The technical situation worsened while I was hiking in South Dakota as the Dow fell below the critical psychological level of 30,000. Although the oversold condition of the T2122 indicator suggests the odds of a relief rally are strong, the strong dollar and the weakening worldwide economy will make it challenging to raise bullish sentiment. However, the hope that the 2022 lows of the SPY, QQQ, and IWM can inspire a defense by the bulls could provide some relief from the selling soon.

While we slept, the Asian markets declined across the board as currencies continued to decline against the dollar’s strength. European markets trade flat but mostly lower after the sterling fell to a record low against the dollar. The U.S. futures point to a bearish open though it has rallied substantially off overnight lows. Expect price volatility, and though the overnight rally is hopeful, remember a retest of overnight lows can often occur.

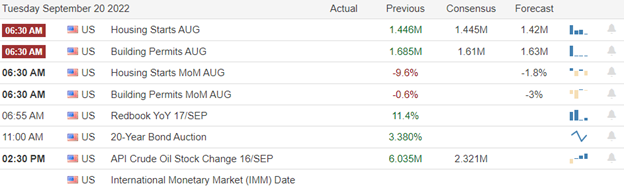

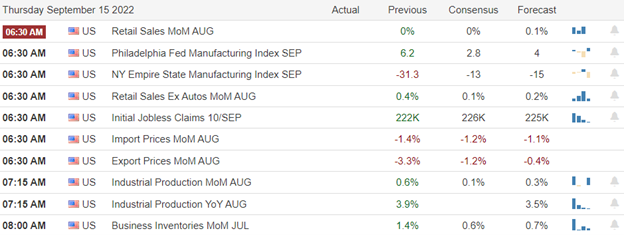

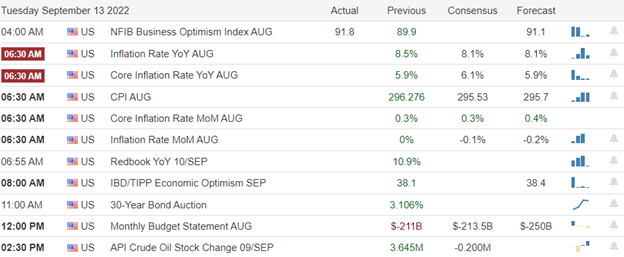

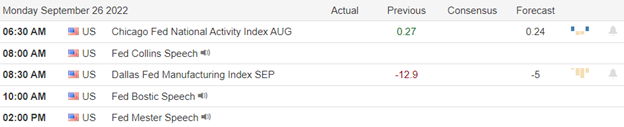

Economic Calendar

Earnings Calendar

Though we have 16 companies listed and only one confirmed report from CHG, I have to say we have no notable reports today.

News & Technicals’

Sterling’s plunge comes after last week’s announcement by the new U.K. government that it would implement tax cuts and investment incentives to boost growth. However, critics say those economic measures will disproportionately benefit the wealthy and could see the U.K. take on high debt levels at a time of rising interest rates. Brent crude fell below $85 a barrel Monday as recession fears weighed and the U.S. dollar surged. Brent futures for November settlement were trading down over 1%, around $84.92 at 8 a.m. London time. West Texas Intermediate futures also fell to trade around $77.93. Apple on Monday said it is assembling its flagship iPhone 14 in India as the U.S. technology giant looks to shift some production away from China. Apple’s main iPhone assembler Foxconn is manufacturing the devices at its Sriperumbudur factory on the outskirts of Chennai. Apple has manufactured iPhones in India since 2017, but these were usually older models. With the iPhone 14, Apple is manufacturing the latest model in its line-up at the device’s launch.

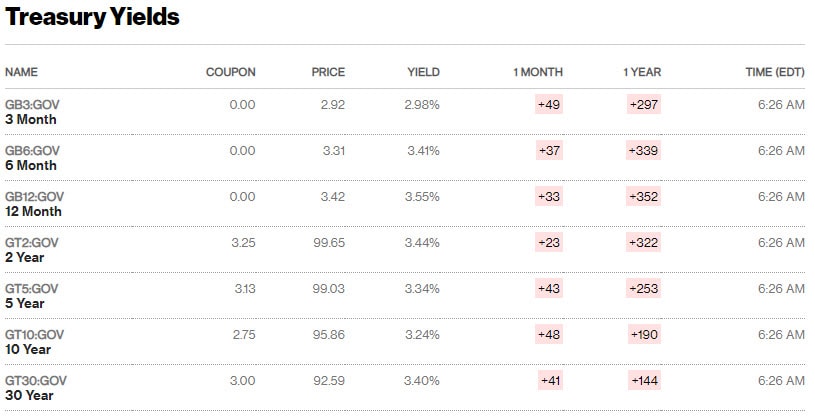

In focusing on raising interest rates to cool inflation, central banks and governments have overlooked the importance of maintaining stable currencies, said Steve Forbes, chair of Forbes Media. “The real cure is to stabilize the currency. You don’t have to make people poor to conquer inflation,” he said. The British pound briefly fell 4% to an all-time low of $1.0382 on Monday in Asia, following last week’s announcement by the new U.K. government that it would implement tax cuts and investment incentives to boost growth. Treasury yields moved higher early Monday, with the 12- month at 4.07%, the 2-year at 4.29%, the 5-year at 4.08%, the 10-year at3.77%, and the 30-year at 3.65%.

Having taken off Thursday and Friday for some time in nature to heal the soul, the technical situation continued to worsen as worldwide economies slowed. As a result, currencies fluctuated substantially overnight as the U.S. dollar continued to strengthen and the 2-year bond yield hit a fresh 15-year high early Monday morning. The Dow fell below a critical psychological level of 30,000 and set new 2022 lows. If there is some good news, the T2122 indicator indicates a relief bounce could occur at any time due to its oversold condition. Also hopeful for the bulls is the 2022 low-price support of SPY, QQQ, and IWM, which may still see a bullish defense. Though the odd of a relief rally is good, I suspect it may only serve to set up more short trading with a challenging 3rd quarter earnings season just around the corner.

Trade Wisely,

Doug