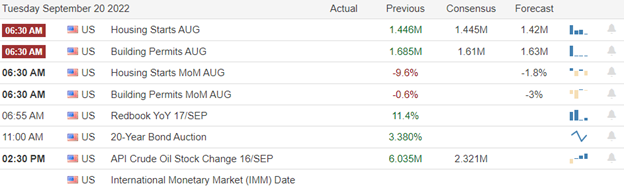

Institutional program trading triggered a sudden and sharp end-of-day rally, leaving behind hopeful bullish engulfing candles in an otherwise frustratingly choppy day. However, the uncertainty is understandable, with a sharply declining housing market index number and the pending FOMC rate decision weighing on investors’ minds. Tuesday will likely see much of the same with the Fed meeting beginning today and a Housing Starts and Permits number out before the bell. Plan for lots of chop and quick intraday whipsaws inspired by institutional algorithmic trading.

Asian markets traded in a choppy session but ended the day higher as China kept the benchmark lending rate unchanged as core inflation in Japan grew at the fastest pace in eight years. European markets trade modestly red across the board this morning in a choppy session. U.S futures look to take back some of Monday’s gains at the open at the September FOMC meeting begins. Markets hate uncertainty, so plan for another choppy price action day as we wait.

Economic Calendar

Earnings Calendar

We have just three confirmed earnings reports today, and they are not particularly notable, but they are APOG, ACB, & SFIX.

News & Technicals’

The Riksbank said monetary policy would need to be tightened further to bring inflation back to its 2% target and forecast further rises in interest rates over the next six months. “The development of inflation going forward is still difficult to assess, and the Riksbank will adapt monetary policy as necessary to ensure that inflation is brought back to the target,” it said. Ether has fallen around 15%, while bitcoin has dropped 3% since the Ethereum network underwent a huge upgrade called the merge. Ahead of the network upgrade, the price of ether roughly doubled from the year’s lows in June, far outpacing bitcoin’s gains. Investors have taken profit as the merge was primarily priced in, while concerns about further interest rate rises from the U.S. Federal Reserve have hit risk assets across the board. Ford Motor on Monday warned investors that the company expects to incur an extra $1 billion in costs during the third quarter due to inflation and supply chain issues. Ford said supply problems have resulted in parts shortages affecting roughly 40,000 to 45,000 vehicles, primarily high-margin trucks, and SUVs that haven’t been able to reach dealers. However, the automaker reaffirmed its full-year guidance, saying it expects to deliver the vehicles to dealers in the fourth quarter.

A strengthening Hurricane Fiona barreled toward the Turks and Caicos Islands on Tuesday as it threatened to strengthen into a Category 3 storm, prompting the government to impose a curfew. Forecasters said Fiona could become a major hurricane late Monday or Tuesday when it was expected to pass near the British territory. The intensifying storm kept dropping copious rain over the Dominican Republic and Puerto Rico. The Bank of Japan reportedly conducted a foreign exchange check – a move seen as a precursor for formal intervention. However, HSBC says BOJ will prioritize maintaining its yield curve control policy instead. UBS says chances of shifting away from its current monetary stance are especially low under BOJ governor Kuroda. The 2-year treasury yield reached a 15-year high in early Tuesday trading at 3.97%, with the 5-year at 3.73%, the 10-year at 3.45%, and the 30-year at 3.55%.

Monday’s price action was a not-so-surprising choppy session until a sudden surge of institutional program trading triggered a sharp end-of-day rally, leaving behind some hopeful bullish engulfing candles. Unfortunately, the surge in buying could not breach overhead resistance levels, and the uncertainty of the pending FOMC rate decision weighs on investors. The Housing index numbers disappointed, coming in substantially under consensus estimates, and continue to show a dramatic slowdown in the industry. Today begins the FOMC meeting, and we will get a reading on Housing Starts and Permits before the bell with a 20-year bond auction later in the day. Treasury yields continue to rise, fanning the flames of recession, with the 2-year hitting a fifteen-year high earlier this morning. Expect price action to remain challenging as we wait on the rate decision amidst weakening economic conditions worldwide and right here in our backyard.

Trade Wisely,

Doug

Comments are closed.