The market may struggle for energy and inspiration as we wait for Wednesday afternoon’s FOMC rate decision. We will have a few housing data points and very few notable earnings reports to inspire, so plan on some challenging price action in the next couple of days. The DIA, SPY, and QQQ have confirmed the current downtrend making new lows with the IWM lagging, trying to hold at the September lows. Unfortunately, the Friday bounce lacked the energy to test overhead resistance levels or improve the deteriorating technical conditions of the index charts.

Overnight Asian markets traded down across the board with China lowering rates and a pending Bank of Japan rate decision later this week. European markets are also seeing red this morning with all eyes on the Fed rate decision. The selling pressure continues this morning with the U.S. futures pointing to a gap down open, reversing the Friday bounce as the bear show their teeth ahead of the FOMC. Plan for challenging price action as we wait.

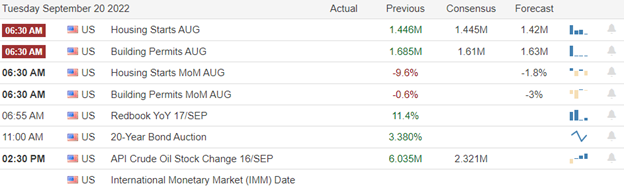

Economic Calendar

Earnings Calendar

Although we have a number of companies listed, we have just one confirmed, and it happens to be a notable AZO.

News & Technicals’

U.S. President Joe Biden said in an interview broadcast on Sunday that U.S. forces would defend Taiwan in the event of a Chinese invasion, his most explicit statement so far on the issue. Asked in a CBS “60 Minutes” interview whether U.S. forces would defend the self-ruled island claimed by China, he replied: “Yes, if there was an unprecedented attack.” Asked to comment, a White House spokesperson said U.S. policy towards Taiwan had not changed. Volkswagen targets a valuation of $70.1 billion to $75.1 billion for luxury sportscar maker Porsche. Volkswagen was expected to announce the pricing range of the Porsche IPO, planned for late September or early October, later in the evening. UBS downgraded its full-year growth forecasts from 3% to 2.7% for 2022 and from 5.4% to 4.6% for 2023. Their Zero-covid policy has essentially “stomped on human investor confidence in China,” said Mattie Bekink, China director for the Economist Intelligence Corporate Network. Goldman Sachs economists said the next key level to watch for the Chinese currency is 7.2 against the dollar.

In a bid to control domestic prices, the Indian government banned exports of broken rice and slapped a 20% export tax on several varieties of rice starting Sept. 9. The Philippines and Indonesia will be most vulnerable to the ban, according to Nomura. India accounts for approximately 40% of global rice shipments, exporting to more than 150 countries. Treasury yields held frim Monday morning with the 12-month at 3.95%, the 2-year at 3.93%, the 5-year at 3.69%, the 10-year at 3.49%, and the 30-year at 3.55%.

Friday began with a gap down, but the bulls went to work to rally back to resistance levels but lacked the energy or inspiration to get the job done. The DIA, SPY, and QQQ confirmed the current downtrend making lower lows, but the IWM stubbornly held firm at the September lows. Unfortunately, China’s weakening economy that cut rates during the night and the energy crisis in Europe combined with a pending FOMC rate increase has the bears active in the premarket this morning. Price action will likely remain challenging as we wait on the FOMC and several housing data points as the only inspiration.

Trade Wisley,

Doug

Comments are closed.