After such a long stretch of selling, the current relief rally is a welcome sight, but with significant price resistance overhead, be careful getting caught up in the enthusiasm. Anything is possible with the T2122 indicator quickly reaching an overbought condition and a week full of market-moving economic data. Keep in mind the Fed has been clear about its intentions to raise rates, and the worsening economic conditions in China and Europe should not be ignored. Long story short, enjoy the rally but try not to drink too much of the Kool-aid!

Overnight Asian markets rallied, with the tech-heavy HSI leading the bullishness up 2.69%. European markets trade green across the board this morning with a cautious eye on U.S inflation data. U.S. futures look to extend the relief rally indicating a gap up open as we wait for the CPI number Tuesday morning. With so much data coming out way, expect price volatility and watch for clues of bear activity as we near price resistance levels.

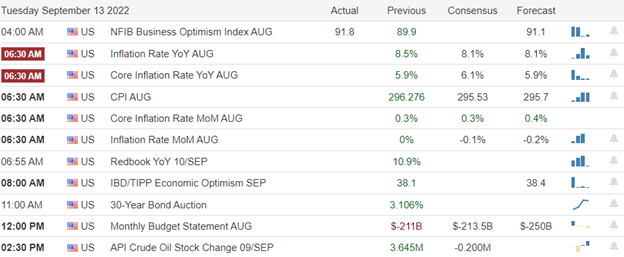

Economic Calendar

Earnings Calendar

We have a light day of earnings to kick off the new trading week with just 14 confirmed reports, most of which are very small-cap companies. So, the only notable report for today is ORCL reporting after the bell.

News & Technicals’

JPMorgan Chase has agreed to acquire a payments startup called Renovite to fend off threats from fintech firms, including Stripe and Block, CNBC has learned. While JPMorgan is often content to partner with fintechs and takes relatively small stakes in them, the bank felt that Renovite’s product was too important not to own outright, according to a JPMorgan executive. The acquisition, reported first by CNBC, is the latest in a string of recent fintech deals made under CEO Jamie Dimon. The bank has acquired at least five fintech startups since late 2020. Spending by big retailers, including Walmart and Target, is way up this year, despite big earnings declines. As a result, technology spending is a top priority, while other costs are more likely to be cut. In addition, store refreshes are a focus for some brands as new investments reflect changes in how customers shop. With expectations for sluggish consumer income to rebound in 2023, future market share is on the line. The Biden administration plans next month to broaden curbs on U.S shipments to China of semiconductors used for artificial intelligence and chipmaking tools, several people familiar with the matter said. The Commerce Department intends to publish new regulations based on restrictions communicated in letters earlier this year to three U.S. companies — KLA, Lam Research, and Applied Materials, the people said, speaking on the condition of anonymity. The letters, which the companies publicly acknowledged, forbade them from exporting chipmaking equipment to Chinese factories that produce advanced semiconductors with sub-14 nanometer processes unless the sellers obtain Commerce Department licenses. Treasury yields ticked slightly lower early Monday, with the 12-month at 3.61%, the 2-year at 3.54%, the 5-year at 3.42%, the 10-year at 3.330%, and 30-year at 3.45%.

Friday was a good day for the bulls gapping up and finding the energy to push higher to test price resistance and technical levels of the index charts. With significant overhead price resistance levels just above and a busy week of economic data that includes CPI, PPI, and Retail Sales numbers, expect considerable volatility. Although the Fed has entered its quiet period ahead of the FOMC meeting, committee members have been clear and consistent about their intentions to raise rates. As the T2122 indicator nears an overbought condition, be careful overtrading long positions and watch for clues of bear attacks. However, with so many clues of a worldwide economic weakening, it’s nice to have and enjoy the benefits of the current relief rally.

Trade Wisely,

Doug

Comments are closed.