Led By the Dow

Disappointing tech reports served only to inspire the bulls on Wednesday as they charged forward, led by the Dow surging toward its 200-day average. However, with bears attacking the QQQ by mid-afternoon, the indexes whipsawed, leaving behind possible failure patterns below the 50-day averages of the SPY and QQQ. After the economic reports of Durable Goods, GDP, and Jobless Claims that may well be ignored, all eyes will be on the reports from AAPL and AMZN. Emotions are as high, so be prepared for just about anything!

Asian market closed mixed overnight as South Korea GDP grew at its slowest pace in a year. European markets trade mostly lower this morning as investors ponder the possible ECB decision and huge earnings miss more Credit Suisse. With a massive day of data ahead, U.S. futures indicate a mixed open, with the Dow suggesting a gap-up open as the Nasdaq indicates lower after the META miss.

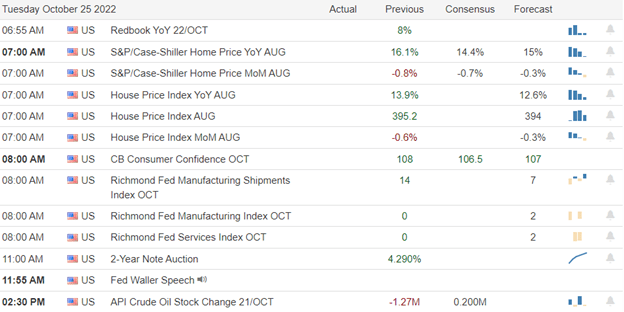

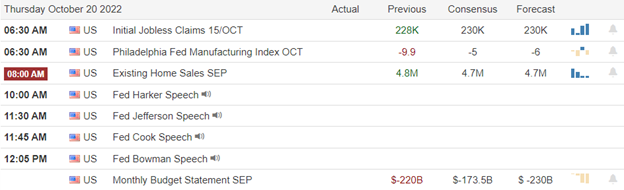

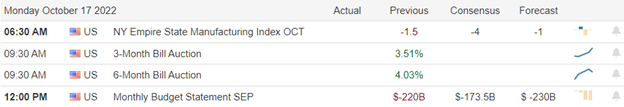

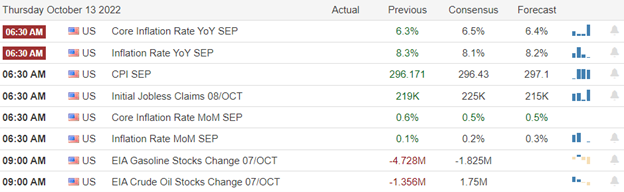

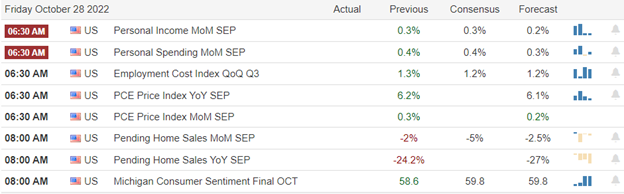

Economic Calendar

Earnings Calendar

We have our biggest day of reports this season, with nearly 190 companies listed on the earnings calendar. Notable reports include AMZN, AAPL, MO, AMT, BUD, ARES, AN, BWA, CAT, COF, COHU, CMCSA, CUBE, DECK, DXCM, EMN, FSLR, FISV, GLPI, GILD, HTZ, HON, INTC, IP, KDP, LH, LIN, MA, MCD, MRK, NOC, OSK, OSTK, PINS, RCL, SPGI, SHOP, SO, LUV, SWK, TROW, TWTR, TMUS, X, VRSN, WY, WDC, WTW, & AUY.

News & Technicals’

Meta CEO Mark Zuckerberg sounded flabbergasted at times during a call with analysts explaining his company’s long-term bets. The company said, “Reality Labs operating losses in 2023 will grow significantly year-over-year.” “I think we’re going to resolve each of these things over different periods of time, and I appreciate the patience, and I think that those who are patient and invest with us will end up being rewarded,” Zuckerberg said. The stock plunged in extended trading after losing two-thirds of its value this year.

Sluggish investment banking revenues have plagued Credit Suisse, losses relating to its business in Russia and litigation costs following a host of legacy compliance and risk management failures, most notably the Archegos hedge fund scandal. As a result, the embattled lender posted a third-quarter net loss of 4.034 billion Swiss francs ($4.09 billion), compared with analyst expectations for a loss of 567.93 million. The figure is also well below the 434 million Swiss franc profit posted for the same quarter last year.

The U.K.’s Rishi Sunak faces the challenging task of uniting his deeply divided Conservative Party if he is to succeed in his new role as prime minister. The party has grown increasingly fractured since the 2016 Brexit vote, but it stared into the precipice of oblivion in recent weeks after Liz Truss’ mini-budget led to a plummet in opinion polls. Sunak’s appointment of a “unity cabinet” gives the first glimpse of his attempts to revive the party.

The oil giant on Thursday announced a new share buyback program. It also revealed plans to increase its dividend per share by around 15% for the fourth quarter of 2022. The group’s results come soon after it was announced that CEO Ben van Beurden will step down at the end of the year after nearly a decade at the helm. Ford Motor recorded a net loss of $827 million during the third quarter. The automaker narrowly beat Wall Street’s subdued expectations for the period and guided to the lowest end of its previously forecasted earnings for the year. Ford attributed the lower-than-expected results to parts shortages affecting 40,000 to 50,000 vehicles and an extra $1 billion in unexpected supplier costs.

Led by the Dow, the indexes continued to rally Wednesday despite the disappointing performance of big tech but reversed those gains by the end of the day as the bears attacked QQQ. As a result, we see shooting star patterns left behind on index charts. The SPY and QQQ show price patterns of possible failure at their 50-day averages while the DOW continues to extend toward its 200-day, up more than 1600 points in just four trading days. Although the T2122 indicator suggests a short-term overbought condition, there is still tremendous excitement and speculation for the AAPL report after today’s bell. However, before that, we will have to deal with Durable Goods, GDP, and Jobless Claims data through economic reports have mostly been ignored this week. Plan for more volatility as the wild emotion continues.

Trade Wisley,

Doug