Relentless Push Continued

Although there appeared to be a little profit-taking into Friday’s close, the bull’s relentless push continued struggling against index price resistance levels. Last week every selloff inspired the bulls the buy, as even disappointing earnings gaps were quickly bought up as the VIX fear gauge continued to decline. With we see more of the same with the bears stirring about this morning, perhaps window dressing the month end? Or, will bears show their teeth, relieving some of the overbought conditions with an FOMC rate hike just around the corner? We will soon find out with a huge week of earnings events to keep emotions and price volatility high!

Asian markets started Monday’s session higher but finished the day mixed, even as China’s outlook improves. European indexes only see red this morning with the uncertainty of the future of central bank rate decisions. With a week of earnings and economic calendar events U.S. points to a bearish opening as we slide into the end of a bullish January run. Plan carefully and expect some wild price gyrations this week, with earnings speculation creating the high drama.

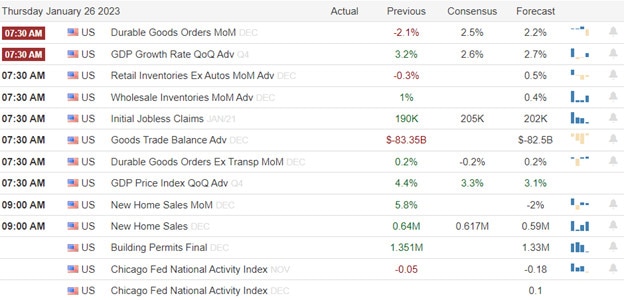

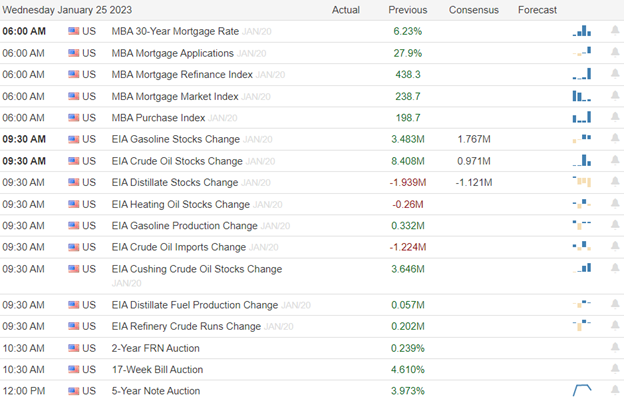

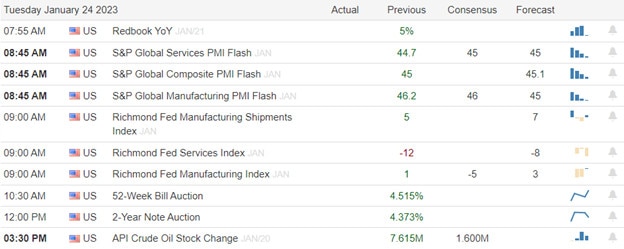

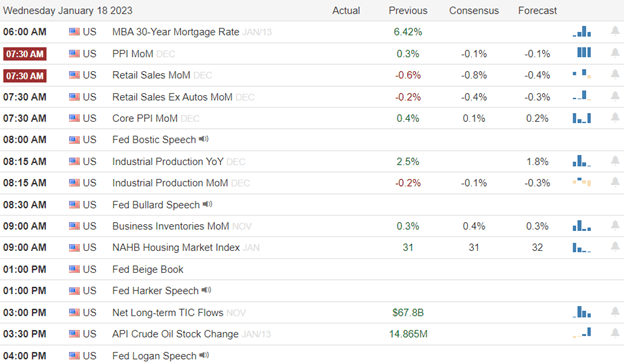

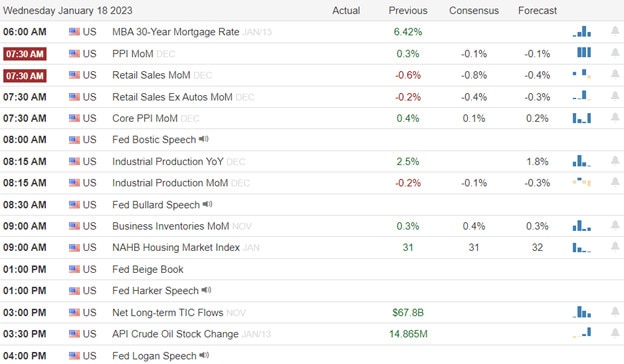

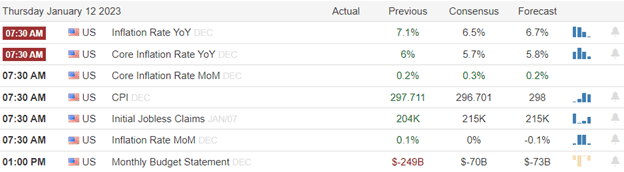

Economic Calendar

Earnings Calendar

Notable reports for Monday include ARE, CADE, BEN, GEHC, GGG, HP, JJSF, NXPI, PHG, PCH, SOFI, & WHR.

News & Technicals’

Automobile giants Renault and Nissan have agreed to a sweeping restructure of their decades-long alliance since 1999. As part of the overhaul, Renault will transfer 28.4% of Nissan shares into a French trust.

Most Adani Group companies continued to see sharp losses for a third consecutive trading session as the company released its rebuttal on short seller firm Hindenburg’s report. Adani Enterprises’ stock price remains more than 25% lower in the month to date, Refinitiv data showed. Founder and chairman Gautam Adani’s net worth fell $27.9 billion in the year to date, according to the Bloomberg Billionaires index.

Dutch health technology company Philips said it would scrap 6,000 jobs on Monday to restore its profitability. Chief Executive Officer Roy Jakobs told CNBC it was a “necessary intervention to help us to become competitive and lean in the way we go forward in the market.” The company also says a new strategy simplified organization should improve patient safety and quality and supply chain reliability.

The bull’s relentless push continued on Friday but struggled with price resistance levels softening with perhaps some profit-taking heading into the weekend. As we finish up the last couple of days of January and move into February, expect a lot of price volatility as the pace of earnings quickens with some big tech names that can move the market. We will also face a busy economic calendar that includes an FOMC rate decision on Wednesday afternoon to keep traders and investors guessing what comes next. Unfortunately, the bears seem to be stirring this morning. Still, will the early selling continue to inspire the bulls to buy as we have experienced lately, or will the bears finally relieve some of the overbought market conditions with the uncertainty of the FOMC?

Trade Wisely,

Doug