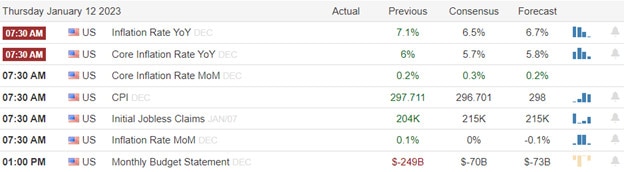

With investors anticipating better numbers in this morning’s pending CPI report, the bulls pushed higher with nervous energy as the VIX rose simultaneously. Jobless claims will be the next hurdle to cross this morning, and then Friday morning’s big bank reports will become the center of attention for the market. The coming 3-day weekend may be a welcome respite after the wild price volatility we will likely experience over the next 48 hours. But, of course, anything is possible, so be prepared for big point moves that may include quick whipsaws as the drama unfolds.

Asian markets mainly saw modest gains overnight with eyes on pending inflation data. European markets have stretched to their highest level since April 2022 on a report the eurozone may outperform the U.S. in 2023. With the highly anticipated CPI report pending, U.S. futures suggest a flat open, holding their breath, hopeful the numbers show the current FOMC rates are good enough.

Economic Calendar

Earnings Calendar

We have a few more small-cap companies reporting today, but the only notables are INFY and TSM.

News & Techncals’

Economists expect a slight decline in December’s consumer price index when it is released Thursday at 8:30 a.m. ET. The consensus forecast for CPI is for a decrease of 0.1% on a monthly basis but a 6.5% increase from the prior year, according to Dow Jones. Stocks rallied Wednesday ahead of the report on expectations the data will show a continued easing of inflation pressures and optimism that it could slow the Federal Reserve’s rate hiking.

Zeynep Ozturk-Unlu, Deutsche Bank’s chief investment officer for EMEA, said she could see Europe outperforming the U.S. in economic growth and capital markets in 2023. Other analysts also told CNBC they believe the U.S. had reached the end of a post-Global Financial Crisis rally. Moreover, some early data points look positive for the eurozone compared to the U.S.

Ubisoft shares slumped as low as 18.80 euros apiece Thursday morning, hitting their lowest level in more than seven years. Ubisoft said Wednesday it expects full-year net bookings will likely fall 10% after an earlier forecast called for a 10% increase. It’s the third gaming firm this week to issue a disappointing trading update. Devolver Digital and Frontier Developments issued separate profit warnings on Monday.

The bulls pushed higher on Wednesday, speculation that the pending CPI report will show a decline, but interestingly the VIX also rallied on another rather anemic volume day. Before the opening, we will get earnings from TSM and INFY, along with highly anticipated inflation and Jobless Claims numbers. Traders should prepare for some wild price gyrations as the market reacts. Will it be the bulls or bears inspired? We will soon find out! Though we have some Fed speakers and a 30-year bond auction, Treasury Statement, and Fed Balance Sheet later in the day, market attention will quickly shift to big bank reports happening Friday before the bell. Buckle up, it’s going to be a wild end to the trading week as we head into a 3-day weekend.

Trade Wisley,

Doug

Comments are closed.