With money markets flush with capital due to institutional recession warnings, the VIX dropped dramatically last week on relatively light volume. The only explanation I can come up with is that the CTA algorithms are buying up stocks, and institutions are buying the dark pools while continuing to warn retail investors of the tough times ahead. However, one thing seems inevitable with all the data coming our way in the next several weeks. Wild price fluctuations, big-point intraday whipsaws, and overnight reversals will likely make conditions challenging and dangerous for retail traders. Plan your risk carefully!

Asian markets traded mostly lower as data suggested the Chinese economy grew by 3%, and the population declined for the first time in a decade. European markets so modest declines across the board this morning. U.S. futures currently suggest a modestly lower open but could quickly change as we wait on earnings and economic data that could move the market suddenly and substantially.

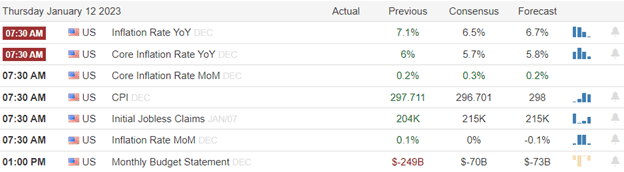

Economic Calendar

Earnings Calendar

The number of earnings ramp up this week so prepare for volatility. Notable reports include CFG, FULT, GS, IBKR, MS, PRGS, SBNY, & UAL.

News & Technicals’

Goldman will report this morning with Wall Street expecting earnings of $5.48 per share, 49% lower than a year earlier, according to Refinitiv. In addition, revenue is expected to be 14% low than a year earlier at $10.83 Billion.

China’s population declined in 2022, the National Bureau of Statistics said Tuesday. The drop was the first since the early 1960s, according to Yi Fuxian, a critic of China’s one-child policy and author of the book “Big Country With an Empty Nest.” The statistics bureau said that Mainland China’s population, excluding foreigners, fell by 850,000 people in 2022 to 1.41 billion. The country reported 9.56 million births and 10.41 million deaths in 2022.

Some 73% of CEOs think global growth will decline in the next year, according to a new survey by PwC. The survey was made up of 4,410 CEOs across 105 countries. It also showed that almost 40% believe their business will not be economically viable within a decade on current trajectories.

While volume remained low last week, the VIX dropped dramatically, suggesting no fear in the market. At the same time, economic indicators continue to suggest a recession, and money market funds are flush with capital. It would seem institutions are quietly buying in the dark pools, and their CTA algorithms are buying stocks while continuing to warn retail investors of difficult times in the year ahead. With the next several weeks chalked full of earnings reports, expect considerable price volatility despite the collapsing VIX. Add in some big market morning reports like PPI, Retail Sales, manufacturing and housing data, substantial price whipsaws, and overnight reversals should be expected. Plan carefully!

Trade Wisely,

Doug

Comments are closed.