Wall of Worry

Indexes closed mostly higher on Monday with a surge in the last minutes of the day climbing a wall of worry with key inflation data just ahead and big bank earnings looming on Friday. Volume was low with prices spending most of the day in a small chop zone with the tech giants enjoying the majority of the buyer’s attention. Today we will hear from several Fed speakers with little else to as we wait on the CPI data before the bell on Wednesday. Plan for another day of hurry-up and wait while keeping an eye out for whipsaws.

Asian markets mostly rallied during the night with the Bank of Korea holding rates steady. European markets see nothing but green this morning as they resume their holiday break with mining stocks leading the way. U.S. futures suggest a modestly bullish open with Fed speakers ahead and waiting on market-moving inflation data and the kick-off of earnings season.

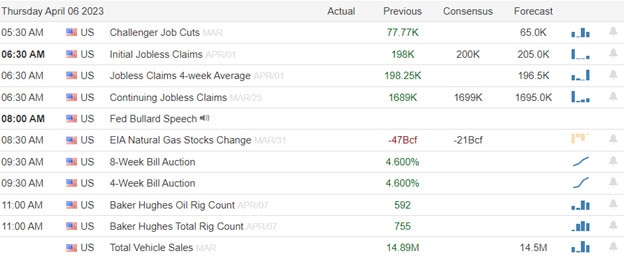

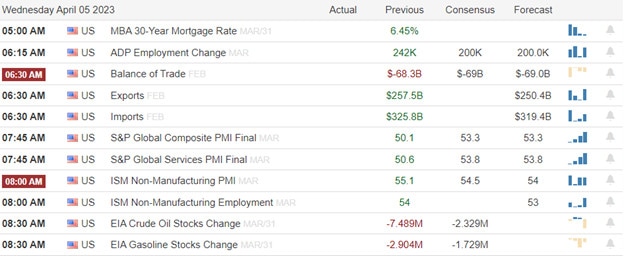

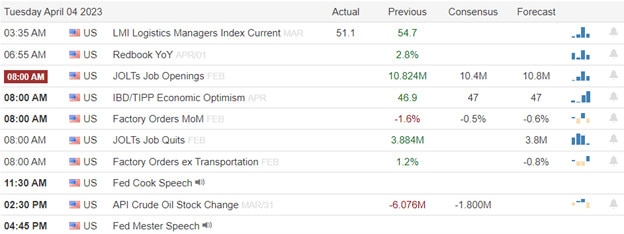

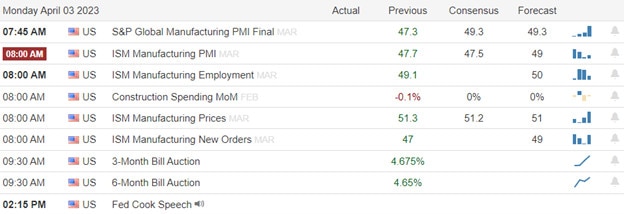

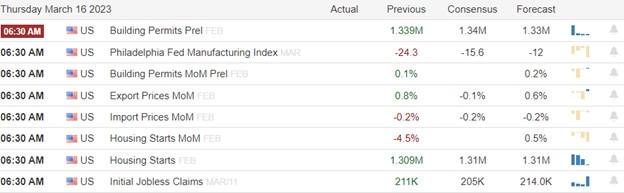

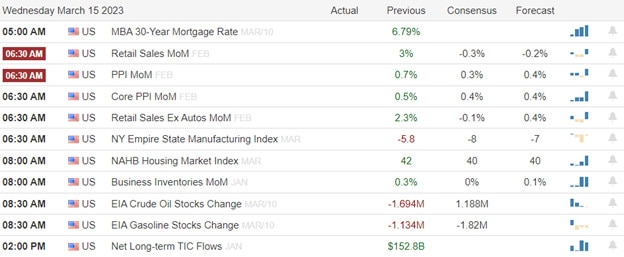

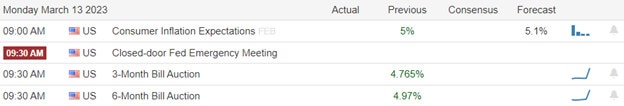

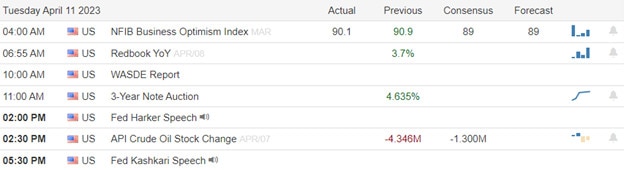

Economic Calendar

Earnings Calendar

We have a very light day as we build up to the big bank reports on Friday. Notable reports for Tuesday include ACI and KMX.

News & Technicals’

Warren Buffett recently told Nikkei that he is considering additional investment in Japan’s five major trading houses. Berkshire Hathaway has raised its stakes in all five trading houses to 7.4%. As a result, shares of Mitsubishi Corp. rose 2.1% in Japan’s afternoon trade, Mitsui & Co. gained 2.7%, and Itochu Corp climbed 3%. It seems that investors are optimistic about the future of these companies and their growth potential.

On Tuesday, Chinese regulators released draft rules designed to manage how companies develop generative artificial intelligence products like ChatGPT. The Cyberspace Administration of China’s draft measures lay out the ground rules that generative AI services have to follow, including the type of content these products are allowed to generate. For example, the content generated by AI needs to reflect the core values of socialism and should not subvert state power, according to the draft rules. It seems that China is taking steps to regulate AI development and ensure that it aligns with the country’s values and goals.

Yesterday, the stock market opened lower but then spent most of the day moving up and down around the same level climbing the wall of worry. The S&P 500 index ended up 0.1% higher and the Dow Jones Industrial Average increased by 100 points. It was a quiet start to the week as investors waited for this week’s inflation report. Short-term interest rates were slightly higher, which means that people expect the Federal Reserve to keep raising interest rates. Long-term interest rates didn’t change much because people are still unsure about how well the economy will do in the future. Plan for more of the same today as we hear from Fed members ahead of the CPI report Wednesday morning. There is little else no the earnings and economic calendars to inspire today so plan for another day of low-volume price action.

Trade Wisely,

Doug