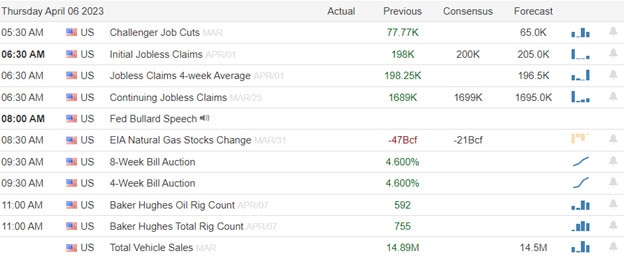

Declining private payrolls and the shrinking services sector created a chop fest on Wednesday and traders ponder the economic slowdown and if that means a recession is just around the corner. Volume was low and looking at the VIX suggests no fear even though there is a record outflow to money market funds as investors look to protect capital. We will hear Jobless Claims numbers before the bell and comments from James Bullard later this morning with pending Employment Situation numbers on Friday when the market is closed. Anything is possible by Monday morning so plan carefully.

Asian markets traded mixed overnight after a surprise move from India to hold rates steady. However, European markets want to shake off the slowing economic conditions this morning seeing green across the board. U.S. futures on the other hand suggest a mixed open ahead of potential market-moving economic data and the pending Good Friday holiday closure.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include LW, LEVI, RPM, STZ, WDFC.

News & Technicals’

Dave Burt, CEO of investment research firm DeltaTerra Capital, was one of the few skeptics who recognized the housing market was on the brink of collapse in 2007. He believes that an overlooked and unpriced climate risk could see history repeating itself. Burt said that “We think of this repricing issue as maybe a quarter of the size and magnitude of the [global financial crisis] in the aggregate but of course very, very damaging within those exposed communities.”

According to the latest projections for Social Security and Medicare, two of the three major trust funds may be insolvent in the next decade. Lawmakers may consider a host of changes to resolve those issues, from raising taxes to cutting benefits or both. Experts weigh in on what changes would be on their wish lists. Social Security’s woes largely come down to demographics. Since 2010, the program has been spending more on benefits than it has been bringing in from payroll tax revenues. By 2030, all baby boomers will be age 65 or older, according to the U.S. Census Bureau.

According to the new CNBC Supply Chain Survey, only about one-third of supply chain managers think warehouse inventories will return to normal before 2024. A little over one-quarter (27%) say companies are selling excess inventory on the secondary market because high storage prices are hitting the bottom line, with impacts to materialize in upcoming quarterly results. As expectations rise that Wall Street will revise earnings estimates lower in a weaker economy, almost half of those surveyed said the biggest inflationary pressures they are paying are warehouse costs, followed by rent and labor, and many are continuing to pass those costs on to consumers.

Wednesday’s price action was a low-volume chop fest as the declining ADP numbers and shrinking services sector added to worries of a slowing economy and possible recession. Before the market opens we will get the Jobless Claims number and will hear from James Bullard at 10 AM Eastern. Will it be enough to inspire a bullish or bearish move or will traders take the day to reduce risk ahead of the Friday Employment Situation report with the market closed for Good Friday? That raises the risk of a substantial Monday morning gap but the direction of the move is anyone’s guess so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.