Despite the surging oil prices that could raise inflationary pressures the rally continued on Monday as the talking heads seem to sing in the chorus for a typical spring rally as if banking concerns no longer exist. The weak PMI, ISM, and construction spending numbers also did nothing to dissuade the bulls from running. Today we have Factory Orders and the JOLTS report for the bulls or bears to find inspiration. Like yesterday keep an eye on overhead resistance and watch out for those nasty big point whipsaws.

Asian markets mostly rallied overnight with modest gains and losses as Australia’s central bank held rates steady. European markets appear to have no concern over the rising energy prices as Finland joins NATO raising the ire of Russia seeing only green across the indexes. U.S. futures are also looking to extend the bullish run with the Nasdaq joining the party and brushing off the energy cost concerns of yesterday.

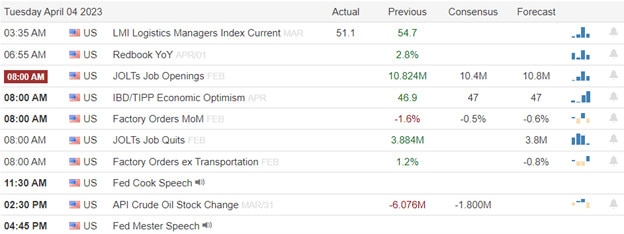

Economic Calendar

Earnings Calendar

If this looks like a repeat of yesterday it is because I accidentally used the Tuesday notables on the Monday blog. So here they are again AYI, LNN, MSM, RGP, SGH.

News & Technicals’

Jamie Dimon, the longtime CEO of JPMorgan Chase, recently commented on the latest financial shock in his annual letter. He stated that “The current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come.” However, he added that “recent events are nothing like what occurred during the 2008 global financial crisis”. The recent banking issues in the U.S. began with the collapse of Silicon Valley Bank. Regulators closed it on March 10th as depositors pulled tens of billions of dollars from the bank.

Virgin Orbit has filed for Chapter 11 bankruptcy protection in the U.S. after failing to secure a funding lifeline. This comes days after the company’s CEO Dan Hart told employees during an all-hands meeting that the company was ceasing operations “for the foreseeable future”. The company’s last mission suffered a mid-flight failure, with an issue during the launch causing the rocket to not reach orbit and crash into the ocean.

The rally continued on Monday with talking heads talking up the typical spring rally despite the surge in oil prices that impact the consumer at the pump while increasing inflation pressures for the Fed. After rising 350 points the Dow whipsawed in a quick round of selling dropping more than 150 points before slowly grinding its way back to close at the high of the day. The QQQ was the only index in the red as it acknowledged the costs of rising oil but also found buyers in the afternoon to close it well off its intraday low. The stretch to the upside continues to present a short-term overbought condition so watch resistance levels and be prepared for a possible profit-taking pullback that could begin at any time.

Trade Wisely,

Doug

Comments are closed.