Focused on Earnings

With very little data to begin the week, markets focused on earnings that ramp up today and the high hope the results can support the very extended condition of the indexes. The VIX suggests high confidence or perhaps complacency while at the same time, the T2122 indicator flashes overbought warnings in the short term. Today we have both market-moving data on earnings and economic calendars so traders should plan for the possibility of gaps, whipsaws, and considerable price volatility as the market reacts.

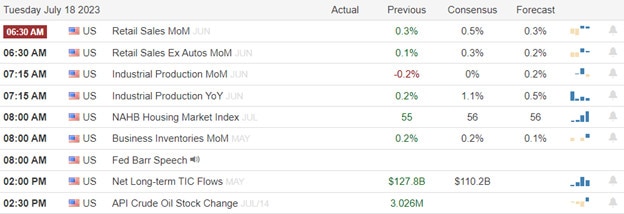

Asian markets mostly declined with only the Nikkei seeing gains up 0.32% with Hong Kong leading the selling down 2.05%. European markets are also mixed with modest moves this morning as they wait on the busy day of data ahead. U.S. futures currently suggest an uncertain open ahead of retail sales, industrial production, and a slew of earnings reports that could fuel the rally higher or inspire profit-taking if the bears find a reason to engage. Get ready for the bumpy ride ahead!

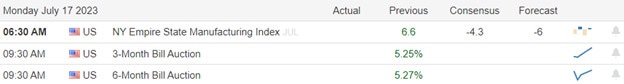

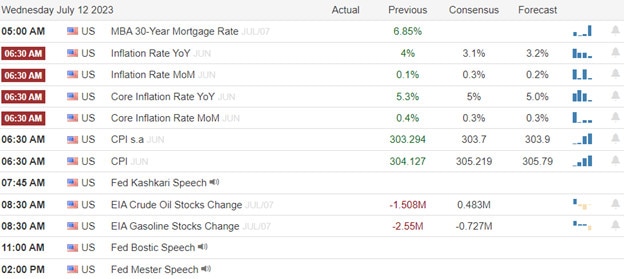

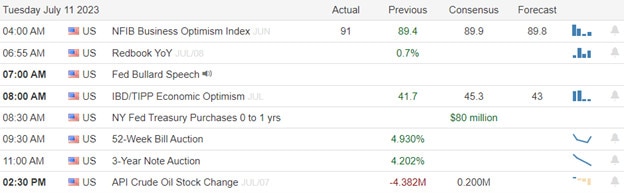

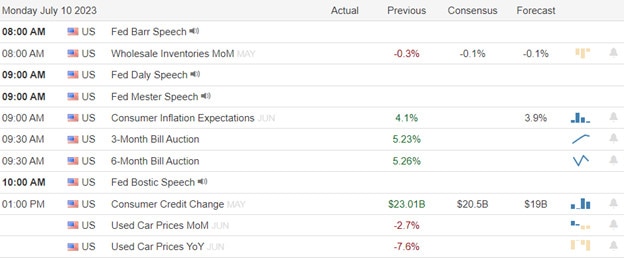

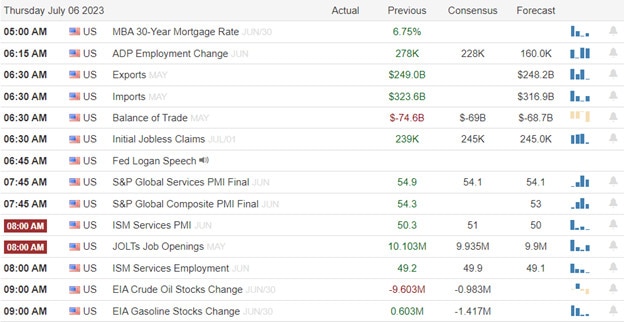

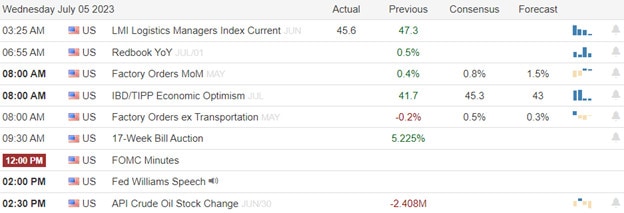

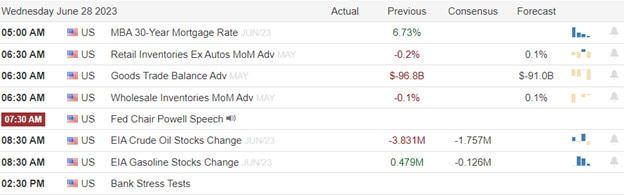

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include BAC, BK, SCHW, HAS, IBKR, JBHT, LMT, MS, NVS, OMC, PNFP, PNC, PLD, SYP, & WAL.

News & Technicals’

The latest data on inflation has given some hope to the financial markets that the worst of the price pressures may be over. However, the economy still faces many challenges, such as the high cost of energy and the sluggish housing sector. Some experts warn that the current situation may not last long and that more work is needed to ensure a sustainable recovery. The White House also acknowledged that the inflation problem is not solved yet and that it will continue to monitor the situation closely.

The CEO of Stability AI, a company that develops software using artificial intelligence, has warned that most of India’s coders are at risk of losing their jobs due to the advances in AI. He said that AI can now create software with much less human input and that this will affect different countries differently. He said that in France, for example, coders have more job security than in India, where many of them work for outsourcing firms. He predicted that most of the low-level and mid-level programmers in India will be replaced by AI in the next couple of years.

. Monday was a quiet day in terms of news and data, so the market focused on earnings and the possibilities of what comes next in the price action. The financial’s and technology sectors led the gains, along with increases in small caps. Global stocks were lower, the dollar declined with metals rising as oil declined with worries of China demand after missing growth targets. Today trades should plan for considerable price volatility as earnings ramp up with several big banks reporting before the bell. We will also have some potential market-moving economic data with Retail Sales, Industrial Production, Business Inventories, and Housing Market Index numbers to inspire the bulls or bears. Fear remains low in the VIX while the T2122 Indicator continues to flash an overbought condition which is a very interesting circumstance as earnings numbers increase.

Trade Wisely,

Doug