The substantial rise in bond yields and strength in the jobs sector kept the bears active selling into the Friday close worried about what the Fed will do next. Markets hate uncertainty and with a Wednesday CPI report, PPI on Thursday with the big bank reports starting on Friday to begin 3rd quarter earnings we have a basket full of uncertainty. However, with light earnings and economic calendars both Monday and Tuesday we could see a lot of choppy price action as we wait.

Asian markets finished Monday mixed after China missed expectations in June’s inflation data. However, European markets trade modestly bullish this morning recovering some of the early losses. U.S. futures have chopped around the flatline with some trepidation as we wait for inflation data the big bank reports later this week.

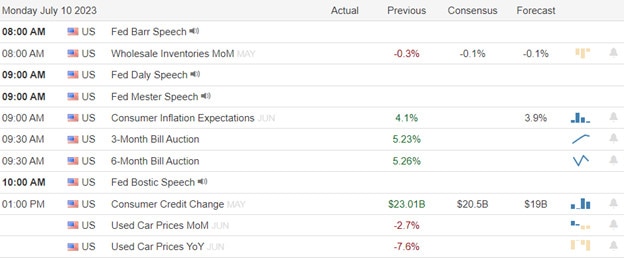

Economic Calendar

Earnings Calendar

Notable reports for Monday include PMST & WDFC.

News & Technicals’

The future of midsized banks in the US looks uncertain as they face multiple challenges in the post-pandemic economy. With interest rates rising, commercial real estate suffering, and regulators tightening their oversight, many regional banks may struggle to maintain their profitability and independence. Analysts expect a surge of consolidation in the banking sector, as half of the existing banks could be acquired by larger rivals in the next 10 years. However, some banks may be able to survive and grow by becoming acquirers themselves, according to Lazard’s new CEO Peter Orszag. The fate of these banks will become clearer as they report their second-quarter earnings this month, which are likely to show declining revenues for some of them.

Goldman Sachs predicts that India will rise to the rank of the world’s second-largest economy by 2075, surpassing the US and Japan. The main factors behind this projection are India’s large and growing population, which is expected to reach 1.6 billion by 2050, and its rapid development in innovation and technology sectors, such as software, biotechnology, and renewable energy. The investment bank also expects India to increase its capital spending and improve its labor productivity, which is currently below the global average. These reforms will boost India’s economic growth and income levels, making it a major force in the global market.

China’s economy continued to face deflationary pressures in June, as both producer and consumer prices fell below expectations. The producer price index (PPI), which measures the cost of goods at the factory gate, dropped 5.4% year-on-year, the sharpest decline in more than four years. The consumer price index (CPI), which tracks the changes in the prices of goods and services purchased by households, remained flat in June, after rising slightly in May. The fall in pork prices, which had been a key driver of inflation in the past year, contributed to the weak CPI performance. In response to the sluggish economic recovery, Chinese Premier Li Keqiang vowed to provide more policy support, especially for small and medium-sized enterprises, which are vital for job creation and growth.

The market is still focused on what the Fed will do next, and the June employment report was the main driver of Friday’s trading. Stocks ended slightly lower, as the market interpreted the job and wage numbers as strong enough to keep the Fed on track to raise rates in the near future. The bond market also showed this, with interest rates rising significantly lately adding to the uncertainty and making the bears a bit more active. With CPI and PPI numbers to deal with and the beginning of 3rd quarter earnings that will kick off this Friday with some big bank reports expect considerable pensiveness in the price action for Monday and Tuesday as we wait.

Trade Wisely,

Doug

Comments are closed.