Tuesday indexes rallied into resistance levels with the bulls seemingly confident the CPI will show a decline in inflation when the data is reviled this morning. Bond yields declined and the dollar continued to fall as the T2122 indicator once again reached an overbought condition. We will soon find out if they are right but be prepared because the rest of the week could be a wild ride of volatility if the number happens to disappoint. Traders will then quickly turn their attention to the Thursday claims and PPI numbers with the big bank reports kicking off earnings season on Friday.

Overnight Asian markets closed mixed as they waited on the inflation data from India and the U.S. while still hoping the Chinese government will once again print money to backstop their failing real estate market. European markets trade green across the board with apparent confidence in the pending inflation data. U.S. futures point to a bullish open ahead of the CPI number which has the potential to inspire the bulls or the bears so be ready for some price volatility as the market reacts.

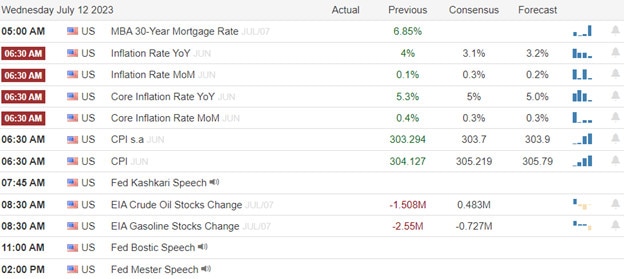

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ANGO, & MLKN.

News & Technicals’

The Biden administration is facing pressure from some lawmakers to look into the alleged misuse of taxpayer data by tax prep software companies and tech giants. According to a letter signed by Senator Elizabeth Warren and others, the tax prep companies shared personal and financial information of millions of Americans with Meta and Google, without proper consent or disclosure. The letter cited reporting from The Markup and The Verge, which exposed the data-sharing practices. The lawmakers accused both the tax prep companies and the tech firms of being “reckless” with the sensitive data and violating the privacy rights of taxpayers.

The United Auto Workers union and the three major Detroit automakers have begun formal talks on Wednesday to negotiate new labor contracts for thousands of workers. The UAW President has promised to fight hard for better wages, benefits, and working conditions for the union members, who make up a large portion of the workforce at General Motors, Ford Motor, and Stellantis. The talks come amid a global chip shortage, rising inflation, and labor unrest, which could lead to a prolonged worker’s strike that would hurt the automakers’ profits and production.

Illumina, a leading DNA sequencing company, has been hit with a record-breaking fine by the European Union regulators for violating antitrust rules. The company was fined 432 million euros ($476 million) for completing its acquisition of Grail, a cancer test developer, without getting the approval of the European Commission. The regulators had previously blocked the $7.1 billion deal, arguing that it would reduce competition and innovation in the emerging market for cancer detection tests. Illumina said it would appeal the fine and defend its acquisition.

Equities rose on Tuesday in a light volume session with investors seemingly confident that this morning’s CPI inflation report will show that inflation is easing. The buying was boosted by the bond market with the 10-year Treasury yield drifting below 4.0%. The dollar also weakened for the fourth day in a row. In Asia, markets gained in hopes of more stimulus from the government to support the failing property market. If the bulls are right then look for a bullish pop after the release of the data. If they are wrong be prepared for a substantial pullback as the T2122 indicator is already showing a significantly over-bought condition in the short term. Past that, we will have more Fed speak, Petroleum numbers, a 10-year bond auction, and the Beige Book. Keep in mind we have the kickoff of earnings season Friday with some of the big banks reporting. Buckle up the rest of the week could be a wild ride.

Trade Wisely,

Doug

Comments are closed.