News of a Vote

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.

On The Calendar

We kick off this Quadruple Witching Friday Economic Calendar with the Empire State Mfg. Survey at 8:30 AM Eastern. The survey has been running very hot all year which some have warned is at unsustainable levels. Consensus sees a December decline to 18.0 vs. Novembers 19.4 reading. At 9:15 AM is Industrial Production which forecasters see gaining 0.3% in November. We have a couple of mid-day reports that are unlikely to move the market and then Treasury Internation Capital at 4:00 PM that has no forecast.

On the Earnings Calendar, we only have 12 companies reporting none of which are particularly notable. However, have a plan if you happen to own one of these companies.

Action Plan

The market found some sellers yesterday across all 4-major indexes due to the uncertainty surrounding the Tax Reform bill vote. Both the DIA and the SPY left behind bearish engulfing patterns, and I suspect many began to predict a market top placing short positions. During the evening we heard that the conference revised Tax Reform bill will likely get a vote as early today. Plenty of time for the President to sign off on before year-end assuming it passes. Consequently, the futures are responding with bullish glee and early short traders are likely to feel some pain.

Up to this point, this last rally has seen very little volatility, but I would not be surprised to see that change very soon. As we head into the weekend, I normally am more of a profit taker than one looking for additional risk. That’s not likely to change today but never say never. Price is King, and I will follow price action that sets up a good opportunity for profit.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/7b-h38wVFVg”]Morning Market Prep Video[/button_2]

Big News Day

I have to admit that I was somewhat surprised that yesterdays FOMC announcement turned out to be such a non-event. The market just yawned and saw nothing to react too. Today is another big news day with some big after the bell earnings reports tossed in for good measure. The Bulls are firmly in control buy at the end of the day yesterday price action suggested a little weariness and maybe a rest in the rally is possible. With all the news the market will have a lot to chew on and potentially react so stay on your toes. In an all bull market it’s very easy to become complacent because you can buy almost anything at anytime and the rising tide makes you money. Guard yourself against complacency by staying focused on the only thing that really matters, Price! The clues will be there if you watch and listen to the market.

I have to admit that I was somewhat surprised that yesterdays FOMC announcement turned out to be such a non-event. The market just yawned and saw nothing to react too. Today is another big news day with some big after the bell earnings reports tossed in for good measure. The Bulls are firmly in control buy at the end of the day yesterday price action suggested a little weariness and maybe a rest in the rally is possible. With all the news the market will have a lot to chew on and potentially react so stay on your toes. In an all bull market it’s very easy to become complacent because you can buy almost anything at anytime and the rising tide makes you money. Guard yourself against complacency by staying focused on the only thing that really matters, Price! The clues will be there if you watch and listen to the market.

On the Calendar

We kick off the Thursday Calendar with the weekly Jobless Claims at 8:30 AM Eastern. The after-effects of Hurricane Maria are expected to continue to impact initial claims with a rise to 239k vs. 236k. Also at 8:30 AM is the Retail Sales numbers which are expected to see the core rate rise by a solid 0.4%. To finish the 8:30 AM data dump is Import and Export Prices where forecasters see imports rising 0.7% with exports only increasing 0.3%. At 9:45 we get the PMI Composite a reading above 50 indicates manufacturing growth while a sub-50 print points to a decline. Business Inventories comes out at 10:00 AM and forecasters see a 0.1% draw-down in inventories which is considered bullish. After that, we have a few non-market-moving reports and bound announcements.

The Earnings calendar show just over 30 companies reporting today. There are several big noteworthy reports after the bell such as ADBE, COST, ORCL & JBL.

Action Plan

The strength and longevity of this current rally is a bit spooky but also very impressive. Spooky because the DIA has managed to leave behind gaps 5-days in a row, and impressive in breadth. Once again new records were set in the DIA and the SPY. A 25,000 Dow print is now only 325 points away, and the bulls seem very determined to get it there. However, with the late afternoon selling yesterday across all indexes perhaps a little rest in this bull march is possible. There is a big economic data dump today as well as several big earnings reports after the bell so the market will have a lot reaction worthy events today.

Currently, futures are once again suggesting a gap up in the Dow, and the VIX continues to register little to no fear. There is no denying that the trend is up and the bulls are in control. As a result, I will stay long and continue to look for long trades as long as that condition exists. Long ago I learned the hard way that trading my bias, predicting market turns and fighting the market was a losing business model! However, that does not mean we should be complacent and toss caution to the wind. Stay focused on price, listen to the market and be flexible enough to adapt if a change appears.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/vk5ZMfMY62Q”]Morning Market Prep Video[/button_2]

Mixed Signals

The four major indexes left behind mixed signals yesterday even as new record highs printed. Unsettled price action ahead of the FOMC is not a surprise but couple that with market highs and the uncertainty meter maxes out. Toss in a political upset that could threaten the tax reform plan, and policy going forward we could see some turbulent price action. During major news events, we lose our edge. Candle signals, price patterns, support, resistance, and trend are no match if the market becomes emotional. Please understand I’m not suggesting that it will become emotional only that the possibility exists. When we trade without an edge, it’s no different than standing at a roulette wheel betting on red or black. My focus today is on preserving profits and protecting capital rather than adding risk.

The four major indexes left behind mixed signals yesterday even as new record highs printed. Unsettled price action ahead of the FOMC is not a surprise but couple that with market highs and the uncertainty meter maxes out. Toss in a political upset that could threaten the tax reform plan, and policy going forward we could see some turbulent price action. During major news events, we lose our edge. Candle signals, price patterns, support, resistance, and trend are no match if the market becomes emotional. Please understand I’m not suggesting that it will become emotional only that the possibility exists. When we trade without an edge, it’s no different than standing at a roulette wheel betting on red or black. My focus today is on preserving profits and protecting capital rather than adding risk.

On the Calendar

The hump day Economic Calendar begins at 8:30 AM with the Consumer Price Index. Forecasters see the overall CPI rising 0.4%, with 0.2% taking out food and energy. Year-on-year, the CPI is seen rising 2.2% with the core at 1.8%. At 10:30 AM is the important EIA Petroleum Status Report that last reading showed a build in supplies and raised questions on demand. Of course what the market is really waiting for is the FOMC Announcement & forecasts at 2:00 PM. Everyone is expecting a rate increase however the forecast could be the wild card if additional rates increase are expected next year. At 2:30 will be Chairman Yellen’s final FOMC press conference.

On the Earnings Calendar we have about 30 companies reporting results, but once again I don’t see any market-moving reports. Please keep checking reporting dates!

Action Plan

Yesterday the market left behind a mix of signals, but uptrends are still intact. The DIA and the SPY both made record highs yesterday but found some sellers in the afternoon session. The SPY printed a possible topping shooting star pattern by the close day raising a little uncertainty. The QQQ’s chose to rest with a spinning top doji, and the IWM headed south with a bearish engulfing however still above support. A little uncertainty ahead of the FOMC announcement & forecasts is not that unusual, but the fact it’s happening at a market high should raise a few caution flags for today.

I’m expecting a choppy day up until the FOMC at 2:00 PM then anything is possible. Expect very fast intraday price action after the announcement with the possibility of whipsaw reversals that could continue through the press conference. I won’t rule out new trades today but will say it would be very unlikely due to the loss of edge around a new event such as the FOMC. Although the Futures have pointed to bullish to flat open, I would not be at all surprised to see some selling this morning to capture profits ahead of the unknown. If the Bears do come out to play, I will not hesitate to bank some profits.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/ytKnjDB71vE”]Morning Market Prep Video[/button_2]

Waiting for the Fed

Waiting for the Fed. After this FOMC meeting, we will likely be bidding farewell to Chairman Yellen. As her final act, she will likely leave us with an interest rate increase. That’s not a surprise the FOMC has been projecting that possibility for months now. However, there is speculation she could leave us with a nasty surprise on Wednesday in response to the Tax Reform bill. Many are thinking the FOMC could project additional interest rate increases next year as a result. Currently, they are projecting just three. Any additions could make for an interesting market reaction at tomorrow. Plan accordingly. Also, keep in mind that as the market waits for the official FOMC statement price action normally becomes light and choppy. As we reach out for new all-time highs, it would be wise to keep that in mind as you plan the path forward.

Waiting for the Fed. After this FOMC meeting, we will likely be bidding farewell to Chairman Yellen. As her final act, she will likely leave us with an interest rate increase. That’s not a surprise the FOMC has been projecting that possibility for months now. However, there is speculation she could leave us with a nasty surprise on Wednesday in response to the Tax Reform bill. Many are thinking the FOMC could project additional interest rate increases next year as a result. Currently, they are projecting just three. Any additions could make for an interesting market reaction at tomorrow. Plan accordingly. Also, keep in mind that as the market waits for the official FOMC statement price action normally becomes light and choppy. As we reach out for new all-time highs, it would be wise to keep that in mind as you plan the path forward.

On the Calendar

The beginning of the FOMC meeting tops the Economic Calendar today and will weigh on the mind of the market. At 8:30 AM Eastern is the PPI report which consensus suggests will once again show an increase of 0.3%. Food prices are also expected to show in an increase of 0.2%. We have a couple of bond auctions mid-day and then close the calendar with the Treasury Budget at 2:00 PM. I doubt that its any surprise that the deficit continues to rise now expected to top 134 Billion.

The Earnings Calendar indicates 28 companies will report earnings today with the majority of them coming after the bell. Make sure you always know about and have a plan for companies you hold that are reporting. A little effort can save you a lot!

Action Plan

Another day of record closes for the DIA and SPY as steady grind higher. The DOW is only 600 points from that big round number of 25,000. I suspect that’s a headline the market would like to see. In fact, I would bet they already have the hats and t-shirts printed in anticipation. The QQQ’s ended the day yesterday showing nice strength making a record high attempt look possible again. The Russell decided to largely take the day off and chose not to participate in the Bull Party.

This morning the Futures are once again pointing to small gap up open. The VIX- continues to fall and is once again approaching record low territory. An 8-handle print is only 34 points away which is amazing to me considering the elevation of the market. With up-trends intact on the overall market, I will continue to look for long trades with low-risk entry points. I will also stay very focused on price action looking possible reversal points as the DIA and SPY stretch out for the all-time high print. Keep in mind the FOMC meeting begins today and a slow, choppy market is often the result as we wait.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/PSNSsnXyGBg”]Morning Market Prep Video[/button_2]

Are you still trying to predict?

With the Dow Futures pointing to a gap up open and the VIX once again dropping below a 10-handle all is well in the market. Or is it? Let’s keep remember; it was just a week ago that many were calling a blow-off top! The truth is no one knows the future and thinking we can predict it is nothing more than ego trampling common sense. However, if set aside our bias focus on price and listen closely, the market will whisper clues and allow us to take calculated risks. Otherwise know as trade planning! Not just some of the time, All the Time. each and every trade! So the questions is, are you listening or are you still trying to predict? With a gap up to new market highs, the market is whispering to me to avoid chasing this morning and watchful of possible whipsaws. Also with the FOMC on Wednesday, choppy boring price action could lie ahead.

With the Dow Futures pointing to a gap up open and the VIX once again dropping below a 10-handle all is well in the market. Or is it? Let’s keep remember; it was just a week ago that many were calling a blow-off top! The truth is no one knows the future and thinking we can predict it is nothing more than ego trampling common sense. However, if set aside our bias focus on price and listen closely, the market will whisper clues and allow us to take calculated risks. Otherwise know as trade planning! Not just some of the time, All the Time. each and every trade! So the questions is, are you listening or are you still trying to predict? With a gap up to new market highs, the market is whispering to me to avoid chasing this morning and watchful of possible whipsaws. Also with the FOMC on Wednesday, choppy boring price action could lie ahead.

On the Calendar

The Economic Calendar this week kicks off at 10:00 AM Eastern with the JOLTS report. Job openings have been running very strong. In September JOLTS counted 6.093 open jobs around the country. The consensus for October sees that number increasing to 6.100 million. We round out the remainder of the calendar with bond announcements and auctions.

Ther are 18 companies on the Earnings Calendar expected to report results. A quick look and I don’t see any that is particularly notable or likely to move the market. However,r if you now one them they certainly have the power to move your account. Make sure to check as part of your daily planning.

Action Plan

Last Friday saw the both the DIA and SPY make new record high close while still below the high print. The QQQ gapped but ran into some sellers at price resistance as did the IWM. Overall the day was bullish leaving behind a lot of really good looking charts. Maybe it’s just me, but the price action seemed to lack commitment or perhaps it’s just a little tentative ahead of the FOMC this week.

Futures opened bullishly and currently seems to have strengthed that sentiment into the pre-market session. The CBOE kicked off trading in Bitcoin futures last night, and the overall market appears to be completely twitterpated by an intangible one and zero digital currency. It will certainly be interesting watch which I intend to do from the safety of the sidelines. It will not be a surprise if the market becomes slow and choppy after the morning rush today. Keep in mind the FOMC is expected to raise interest rates on Wednesday. Also be on the lookout for whipsaw price action as we test market highs.

Trade Wisely.

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/8A8sggFZSGc”]Morning Market Prep Video[/button_2]

Santa held Hostage?

During the evening the Congress passed a continuing resolution that prevents a government shut down. However, their action only extended the battle for 2-weeks. Now the question is will the hoped-for Santa Claus Rally be held, hostage by Congress? Santa held hostage, shame on you Congress! My feeble attempt at humor is simply point out that the market will likely remain sensitive to the spin out of Washington D.C. Of course, the bulls could find their inspiration in the Employment situation number to move higher, but the governmental pressure will be ever-present. Also, weighing on the mind of the market is the upcoming FOMC meeting. As for me, I will continue to focus on price action and continue to trade with the trend. However, I may trade smaller than normal positions due to the uncertainty of the new cycle.

During the evening the Congress passed a continuing resolution that prevents a government shut down. However, their action only extended the battle for 2-weeks. Now the question is will the hoped-for Santa Claus Rally be held, hostage by Congress? Santa held hostage, shame on you Congress! My feeble attempt at humor is simply point out that the market will likely remain sensitive to the spin out of Washington D.C. Of course, the bulls could find their inspiration in the Employment situation number to move higher, but the governmental pressure will be ever-present. Also, weighing on the mind of the market is the upcoming FOMC meeting. As for me, I will continue to focus on price action and continue to trade with the trend. However, I may trade smaller than normal positions due to the uncertainty of the new cycle.

On the Calendar

We begin the Friday Economic Calendar with the very important Employment Situation report at 8:30 AM Eastern. Consensus for November expects a strong showing between 184,000 and 190,000. The overall rate is seen holding at 4.1% with hourly earnings increasing 0.3%. At 10:00 AM we get a reading on Consumer Sentiment which is expected to tick higher to 98.8 vs. 98.5 last month. Wholesale Trade numbers are also at 10:00 AM with the oil rig count at 1:00 PM. Neither of which are likely to move the market.

On the Earnings Calendar, we only have 8-companies reporting. Looking through the list, I would not expect any of today’s reports to affect the overall market.

Action Plan

Yesterday’s modest bounce held some key support levels and provided some much need relief. There are a lot of charts showing bullish patterns. Now, all we need is a little more volume to build some momentum, to continue the trend. Currently, the Dow Futures are suggesting a positive option on the news from capitol hill. During the evening Congress passed a continuing resolution that avoids a Saturday shutdown of the government. Unfortunately, they only kick the can down the road two weeks. That means the budget battle will continue and the market will remain sensitive to the news. Perhaps the market will get a shot in the arm after the Employment Situation report to reinforce and inspire the bulls higher.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/JWrGekLWsCE”]Morning Market Prep Video[/button_2]

Boredom

During my years as a struggling trader, boring market periods in the market were very costly. If I was sitting in front of my computer, I felt I should be trading. I would run every scan I had ever thought of rushing to find something to trade never once considering the overall market condition. Boredom is as dangerous to a trader as the emotions of fear and greed. It would cause me to force trades or talk myself into positions I had no good reason to buy. Learning to stand aside when I had no edge was a very hard lesson to learn, and it cost me more capital than I care to admit. Always remember that you don’t have to trade every day to be successful. In fact, trading less and only when you have an edge produces better returns and a higher win/loss ratio.

During my years as a struggling trader, boring market periods in the market were very costly. If I was sitting in front of my computer, I felt I should be trading. I would run every scan I had ever thought of rushing to find something to trade never once considering the overall market condition. Boredom is as dangerous to a trader as the emotions of fear and greed. It would cause me to force trades or talk myself into positions I had no good reason to buy. Learning to stand aside when I had no edge was a very hard lesson to learn, and it cost me more capital than I care to admit. Always remember that you don’t have to trade every day to be successful. In fact, trading less and only when you have an edge produces better returns and a higher win/loss ratio.

On the Calendar

Thursday’s Economic Calendar is a full one, but there is only report with any concern for moving the market. At 8:30 AM is the Weekly Jobless Claims which is expected to remain near historic lows with even Puerto Rico numbers declining. There is a Fed Speaker at 8:30 as well but after that several non-market-moving reports.

On the Earnings Calendar, we have about 45 companies reporting their results today. Continue to build the habit of checking for reports on the stocks you currently own and those you plan to purchase. Failure to do can turn out to be a painful experience.

Action Plan

Yesterday again experience a very light day of selling in the DIA and IWM while the SPY and QQQ found some buyers at support. Overall the volume was light, and price action continues to be choppy. Unless we have a news event shake us loose, I think we should expect more choppiness today. Keep in mind the market could be waiting for the Employment Situation number on Friday or even the FOMC next week for inspiration. Another potential market driver is the pending government shutdown at midnight Saturday if Congress fails to get it’s act together.

I am continuing to prepare for new trades if we see some buyers begin to step in at support levels. However, I’m in no rush and will wait for buy signals to appear before adding risk.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/SMOPWfHzDdg”]Morning Market Prep Video[/button_2]

Where is Santa?

With the last 3-days of selling, traders are starting to wonder, Where is Santa? Gloom and doomers have been predicting the demise of the 2017 bull run all year. Now having strung together the first 3-day selling streak since August they are out in force predicting the market top has happened. Could they be right? Of course, even a broken watch is right twice a day. Before diving headlong into a pit of despair take a minute to examine the charts. The DIA and the SPY are still trending up! The QQQ’s are suggesting caution, and the IWM is holding a significant support. Also, take notice that there has been no panic selling and the VIX is not registering fear. Historically the so-called Santa Rally appears 7 to 10 days after the beginning of December. Stay focused on price it will provide us the answers.

With the last 3-days of selling, traders are starting to wonder, Where is Santa? Gloom and doomers have been predicting the demise of the 2017 bull run all year. Now having strung together the first 3-day selling streak since August they are out in force predicting the market top has happened. Could they be right? Of course, even a broken watch is right twice a day. Before diving headlong into a pit of despair take a minute to examine the charts. The DIA and the SPY are still trending up! The QQQ’s are suggesting caution, and the IWM is holding a significant support. Also, take notice that there has been no panic selling and the VIX is not registering fear. Historically the so-called Santa Rally appears 7 to 10 days after the beginning of December. Stay focused on price it will provide us the answers.

[button_2 color=”blue” align=”center” href=”https://vimeo.com/246037400″]New Member Orientation Video[/button_2]

On the Calendar

The Economic Calendar for Wednesday gets going at 8:15 AM Eastern with the ADP Employment Report. The ADP has had a rough year widely missing the actual number over and over. However, ADP was spot on in October with it 235,000 number. ADP is expecting a 186,000 print for November. Productivity and Costs will report at 8:30 AM. Forecasters see nonfarm productivity rising 3.2% with labor cost increasing 0.3%. At 10:30 we will get the EIA Petroleum Status report which has recently seen supplies declining helping to support oil prices.

We have 50 companies stepping up report earnings results today. A few of the notable reports before the bell are AEO, FRED, HRB & KLXI. After the market closes hear from AVGO, LULU, TLRD & VRNT.

Action Plan

Even though the bulls made an effort to gap the market higher at the open yesterday, ultimately profit-taking ruled the day. There was no panic just a steady stream of slow, deeply controlled selling. Yesterday the SPY registered the first 3-day selling streak since August. So does that mean the market top is in and the 2017 bull run has finally come to an end? I wouldn’t bet on that just yet because the overall trend in the daily SPY and DIA charts still show an up-trend. The QQQ’s and the IWM certainly suggest caution is warranted but at this time no clear signals of stockholders running for the doors.

The VIX barely moved yesterday and the slow, grinding selling yesterday offered no hints of panic. If Congress can actually complete one project this year (tax reform) and prevent a government closure midnight Saturday, then Santa might return! Set aside your bias and focus on the price action for clues. Listen to the market and avoid trying to predict.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/wRHINFzlSMI”]Morning Market Prep Video[/button_2]

Things that make you say Hmm?

For those of us that watch price action yesterday left us with more questions than answers. Clearly, bearish candle patterns were left behind, but the majority of the indexes are still in up-trends. Things that make you say Hmmm? As of now, only the QQQ is showing technical damage. From the candle patterns, most traders would expect a big increase in fear, but the VIX seemed only to yawn in boredom. There is an abundance of clues to suggest caution but also a sense that anything is still possible. With weighty decisions still to be made in Congress this week expect the market to be very sensitive to the news cycle. Plan your risk carefully and continue to watch for violent price moves in reaction to news events.

For those of us that watch price action yesterday left us with more questions than answers. Clearly, bearish candle patterns were left behind, but the majority of the indexes are still in up-trends. Things that make you say Hmmm? As of now, only the QQQ is showing technical damage. From the candle patterns, most traders would expect a big increase in fear, but the VIX seemed only to yawn in boredom. There is an abundance of clues to suggest caution but also a sense that anything is still possible. With weighty decisions still to be made in Congress this week expect the market to be very sensitive to the news cycle. Plan your risk carefully and continue to watch for violent price moves in reaction to news events.

On the Calendar

We kick off Tuesday’s Economic Calendar with the International Trade Report at 8:30 AM. Once again the international trade deficit is expected to widen in October. Forecasters see a 47.4 reading vs. 43.5 in September. At 9:45 there is PMI services which is not expected to move the market coming in unchanged at 54.7. Then at 10:00 AM we get the ISM Non-Mfg. Index which posted its highest score of 60.1 in October. Consensus expects this number to remain very strong only slowing to 59.0 in November. A couple of bound auctions will round out the rest of calendar.

On the Earnings Calendar, there are 38 companies reporting quarterly results. Notable are AZO, BMO, and TOL before the bell with PLAY and RH after the bell today.

Action Plan

After opening at new record highs in the DIA, SPY, and IWM profit takers took the gift of the gap and rang the register. Selling off to fill the gap obviously left behind price action candles suggesting a least a tempory top. The QQQ’s gave a half-hearted attempt to show bullishness with a gap up, but this index suffered significant technical damage. Not only did it leave behind a bearish engulfing it also printed a lower high failure.

This morning the Dow Futures are pointing to a gap up while at the same time the Nasdaq Futures suggest a gap down to a new low. Surprisingly with all the selling yesterday day the VIX didn’t register a groundswell of fear as one would have expected. The overall trends in DIA, SPY, and IWM are still up despite the bearish price action signals. So although there are a lot of clues suggesting caution only the QQQ has built a case for bearishness. Personally, I will be taking a wait and see approach without bias as to direction. I continue to expect market sensitivity to the D.C news cycle making violent price moves possible.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/2zFjKvzL_QU”]Morning Market Prep Video[/button_2]

Bulletproof?

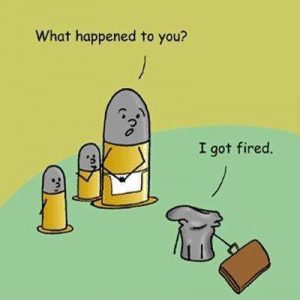

With the futures pointing to a 200 point gap up in the Dow on the back of the Tax Reform bill passage, it would seem the market is bulletproof. Even the threat of nuclear war seem to be nothing more than an annoying mosquito easily shooed away. Now the Dow has 25,000 in its cross-hairs and seems to have all the money and energy necessary to drive for that goal. However, I doubt the ascension to this plateau will be a smooth one. Friday’s full reversal intraday whipsaw may be a clue to fast and whippy price action ahead. Big price action swings could be possible as we move forward making it very challenging for swing traders. The bulls are obviously in control, but Friday’s price actions should serve as a reminder that the bears are still here and they have been waiting to eat for a long time. Plan your risk carefully.

With the futures pointing to a 200 point gap up in the Dow on the back of the Tax Reform bill passage, it would seem the market is bulletproof. Even the threat of nuclear war seem to be nothing more than an annoying mosquito easily shooed away. Now the Dow has 25,000 in its cross-hairs and seems to have all the money and energy necessary to drive for that goal. However, I doubt the ascension to this plateau will be a smooth one. Friday’s full reversal intraday whipsaw may be a clue to fast and whippy price action ahead. Big price action swings could be possible as we move forward making it very challenging for swing traders. The bulls are obviously in control, but Friday’s price actions should serve as a reminder that the bears are still here and they have been waiting to eat for a long time. Plan your risk carefully.

On the Calendar

On the First Monday of December, the Economic Calendar has a light day. At 10:00 AM we get the Factory Orders report which will likely show strength and confirm expectations for fourth-quarter manufacturing strength. After that just a few bound auctions and a nonmarket moving TD Ameritrade report.

On the earnings calendar, we have 14 companies reporting today. A quick scan of the list and I don’t see any that are particularly noteworthy unless of course, you happen to own one of them. Make sure to keep checking and remember you’re the boss. Expect the best from yourself.

Action Plan

Last Friday I suggested that the market was going to be very sensitive to the news and to prepare yourself for possible violent price moves. During the Flynn testimony, we go just that! A very fast and nasty whipsaw that looked like it had completely reversed in just 20 minutes of trading. The promise of the tax reform bill likely to pass in the Senate revered it once again as the bulls regained control.

Now that the bill has passed the bulls are running hard this morning. The Dow Futures are pointing to a gap up around 200 points and sending the charts into a parabolic territory. One would think a huge selloff should be just around the corner, but I sure would not want to be betting against the strength of this bull run. In fact, with Dow 25,000 in sight, it’s likely to attract the bulls like a moth to a flame. Continue to trade with the trend but plan carefully and avoid chasing. Expect elevated volatility with triple-digit gaps and whipsaws possible in the days ahead.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Ie3ZCLlhXOo”]Morning Market Prep[/button_2]

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.

Yesterday we saw some selling on worries the Tax Reform bill would not get finished up. This morning sentiment quickly changes as news of a vote and passage could happen as early as today. I hate politically driven markets because as retail traders our edge simply disappears into the spinning black hole of the news cycle. Futures are not pointing to a significant gap up that will put a lot of pressure on those that got short early. Let’s keep in mind that a Dow 25,000 print is not that far away so don’t expect the bulls to give up easily. Perhaps the passage of tax reform is all the fodder needed to encourage the bulls to push higher. I think the road ahead could be a bit bumpier than we have seen this week. Plan carefully and remember to take profits.