Too much of a good thing?

It’s always nice when we see the bulls step up and take charge breaking prices through resistance levels. However, we can sometimes have too much of a good thing moving too far to fast. I’m not suggesting that happened yesterday but, I do think its wise to consider the possibility. That means I must stay focused and flexible being very careful not to by stocks near resistance levels and watching for signs of profit taking.

It’s always nice when we see the bulls step up and take charge breaking prices through resistance levels. However, we can sometimes have too much of a good thing moving too far to fast. I’m not suggesting that happened yesterday but, I do think its wise to consider the possibility. That means I must stay focused and flexible being very careful not to by stocks near resistance levels and watching for signs of profit taking.

Let me be clear; the bulls are currently in control and the Futures suggest another bullish open is likely with the Dow gaping up more than 50 points. I am only suggesting that you set your rose-colored glasses aside and stay focused. Have a plan to protect your current profits and try to avoid chasing. The fear of missing out is a powerful emotion, but if you chase a run already extended, you’re likely to experience a painful lesson.

On the Calendar

The JOLTS report is the only potential market-moving news on the Economic Calendar today. At 10:00 AM forecasters expect a 6.700 million total jobs openings in June, showing incredible strength in labor demand. For the first time in 20 years, there are more open positions than there are unemployed looking for work! The NFIB Small Business Optimism Index @ 6:00 AM, Readbood @ 8:55 AM and bond auctions at 11:30 AM & 1:00 PM to compleate the calendar day.

On the Earnings Calendar, PEP is one of the most notable of the 15 companies expected to report today. With earnings season beginning soon make sure your checking when a company reports. Failure to do so can be a costly mistake.

Action Plan

A big day for the bulls yesterday as buyers stepped in after the morning gap pushing all four of the major indexes higher. Currently, the futures are pointing to a gap up open but be very careful not to chase. In just 3-days the Dow has rallied more than 575 points, but T2122 is suggesting a reversal or consolidation could begin at any time. Keep in mind after breaking above the 50-day average it’s pretty common for the Dow to test it as support. I am certainly not predicting bearishness or that the market will absolutely reverse today. I’m only pointing out the possibility. If the bulls have enough juice, there is no reason they couldn’t extend this bull run.

Rather than chasing the run I will be more inclined to take some profits or use this bullishness to hedge positions by selling out of the money calls. The QQQ and IWM will be very close to new record highs at the open, so it would not be out of the question to see a pause or even some profit taking. Stay focused and flexible.

Trade Wisely.

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/GCO5Kf3qDOg”]Morning Market Prep Video[/button_2]

Bullish Open

The Futures are pointing to a bullish open this morning with world markets follow US Friday rally. Political trade war rhetoric was kept to a minimum over the weekend allowing the markets to focus and follow-through on the very strong employment situation report. With the odd holiday week behind us, volumes should improve as the markets look forward to 3rd quarter earnings season kicking off this coming Friday with several big banks reporting.

The Futures are pointing to a bullish open this morning with world markets follow US Friday rally. Political trade war rhetoric was kept to a minimum over the weekend allowing the markets to focus and follow-through on the very strong employment situation report. With the odd holiday week behind us, volumes should improve as the markets look forward to 3rd quarter earnings season kicking off this coming Friday with several big banks reporting.

This morning the Dow is gaping up right into its 50-day average that could serve as resistance so it would be wise to exercise a little caution because we are not out of the woods just yet. There is no need to rush or predict, wait for proof that buyers are stepping in supporting this morning gap. There is still technical damage to repair, but the positive price action in the QQQ, SPY, and IWM are encouraging that the bulls are finding their footing.

On the Calendar

A light day on the Economic Calendar to kick off this week of trading with no expected market-moving reports. We have a Fed Speaker at 9:10 AM, three bond events between 11:00 AM & 11:30 AM, TD Ameritrade IMX at 12:30 PM with Consumer Credit at 3:00 PM closing the calendar day.

We have just nine companies reporting earnings today with the most notable being HELE coming out before the bell today.

Action Plan

We got through the weekend without increasing trade war concerns. Asian & European markets were bullish overnight following our Friday rally based on good jobs numbers and a huge improvement in the international trade deficit. As I write this mornings blog, the Dow Futures are pointing to a gap up open of more than 100 points at the open. With nothing on the Economic or Earnings calendar likely to change that a follow-through of Friday’s bullishness is likely as long as politics stay out of the news.

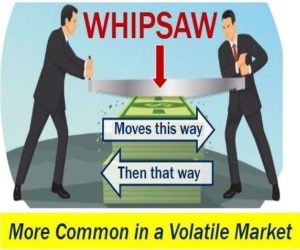

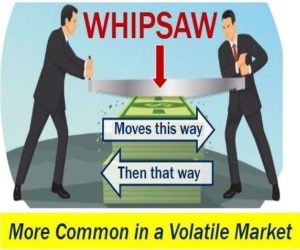

The Dow, however, presents a bit of a conundrum this morning gaping up yet still under its 50-day moving average. The exact place where a failure could occur. The SPY, QQQ, and IWM are in a far stronger pattern having held their 50-day averages and finding buyers to rally them off these key supports. Keep in mind the SPY, QQQ and IWM all have price resistance levels above to watch closely. With the Holiday week now behind us and 3rd quarter earnings beginning at the end of the week, volume should show improvement and hopefully so will daily whipsaw in prices. Although I’m hoping price action will now begin to improve, we must still exercise caution when we see pre-market gaps into resistance levels. Whipsaws and full reversals are possible. After the morning rush watch for clues that buyers are stepping in supporting the gap. Remember the old saying, fool me once shame on you, fool me twice shame on me.

Trade wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/5lUgTMXHYSg”]Morning Market Prep Video[/button_2]

Choppy Week

I don’t know about you, but I will be happy to see this choppy, week come to an end. I have spent the better part of the last 2-weeks talking about caution and avoidance of the choppy price action. That caution has proved to have been correct, but just like everyone else I’m tired of the chop and hope next will be better as traders return from extended holiday vacations.

I don’t know about you, but I will be happy to see this choppy, week come to an end. I have spent the better part of the last 2-weeks talking about caution and avoidance of the choppy price action. That caution has proved to have been correct, but just like everyone else I’m tired of the chop and hope next will be better as traders return from extended holiday vacations.

However, I plan to remain cautious into the weekend with the uncertainty of trade war rhetoric ramping up. As of yesterday, every one of our positions held unrealized gains so I will be far more focus on taking profits today than I will be about adding risk ahead of the weekend. With 3rd quarter earnings season kicking off next week the market will at least have something else other than political wrangling from which to draw inspiration.

On the Calendar

We kick off the Economic Calendar this Friday with two potentially market-moving the reports at 8:30 AM Eastern. First, consensus expects the Employment Situation report to show new job growth of 190,000 with the unemployment rate down to 3.8 percent. Hourly earnings are also moving up in June with consensus suggesting a 0.3 increase and a year-on-year rate up to 2.8 percent. The International Trade deficit is expected to narrow sharply to $43.7 with a 2.1 percent increase for exports while the imports only gained 0.2 percent. After that, we have the EIA Natural Gas Report @ 10:30 AM, the Baker-Hughes Rig Count @ 1:00 PM and Treasury STRIPS @ 3:00 PM.

A very light day on the Earnings Calendar with only three companies reporting. Keep in mind is the calm before the storm of 3rd quarter earnings which officially kicks off next week when some of the big banks report.

Action Plan

I plan to wrap up the end of this odd trading week much the same as it began with caution. Yesterday day ending on a positive note but whipped several times on anemic volume. Currently, Futures are pointing to a negative open as the market reacts to the tariff battle. Keep in mind with the Employment Situation number which comes out before the open that could quickly change.

Next Friday the 3rd quarter earnings season will get underway giving the market more to think about other than political uncertainty. Perhaps we will finally exit this choppy consolidation and pick a direction next week. Volume should improve next week as traders return from their extended holiday vacations and price action should become more deliberate without all the whipsaws. Trade war rhetoric could ramp up this weekend as both the US and China lob threats back an forth. Plan your risk into the weekend carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/-Wp3PzZqSuw”]Morning Market Prep Video[/button_2]

Whipsaws

Over the last five days of trading, we have seen the market open with significant gaps follow by whipsaws. Twice the market gaped down only to find buyers and whip back up. There were also three days when the market gaped up only to end the day lower as seller whipped prices back down. So after 100’s of points of daily travel in Dow whats the result? The Dow is up a whopping 59 points!

Over the last five days of trading, we have seen the market open with significant gaps follow by whipsaws. Twice the market gaped down only to find buyers and whip back up. There were also three days when the market gaped up only to end the day lower as seller whipped prices back down. So after 100’s of points of daily travel in Dow whats the result? The Dow is up a whopping 59 points!

So the fact that the Dow Futures are pointing to another gap of about 150 points this morning ahead of tariff increases and the FOMC minutes release should we be rushing to enter trades? Fool me once shame on you, fool me twice shame on me. Don’t allow the fear of missing out to control your trading decision, wait for better price action or wave goodbye to your capital as the market continues to chop up accounts.

On the Calendar

A busy day on the Thursday Economic Calendar. Potential market-moving reports begin at 8:15 AM with the ADP Employment Report which the consensus expects 190,000 jobs created in June but keep in mind ADP’s accuracy is very hit and miss. Weekly Jobless claims come out at 8:30 AM and forecasters expect a decline to 223,000 vs. last weeks reading of 227,000. The unforecast EIA Petroleum Status report is at 11:00 AM and last but not least is the release of the FOMC minutes at 2:00 PM. Non-market moving reports include Mortgage Applications @ 7:00 AM, Challenger Job-Cut Report @ 7:30, Consumer Confort Index & PMI Services Index @ 9:45, five Bond Announcements, Fed Balance Sheet & Money Supply @ 4:30 PM.

On the Earnings Calendar, we have only six companies reporting today that are unlikely to move the market.

Action Plan

It’s interesting that the US Futures are positive today in light of the fact that Asian markets were moved lower during the night with new tariffs set to begin tomorrow. Of course, with have seen big daily morning gaps the last several days that have proved punishing for those that chased the open. Will today be different? Only time will tell, but it would also be wise to remember that the FOMC minutes will be out at 2:00 PM today and volume could easily be anemic with traders extending their holiday vacations. It would not be at all uncommon for the market to become light and choppy as we wait for the FOMC minutes.

I intend to remain cautious particularly during the morning rush. Remember whipsaws are possible just like we have seen the last five trading days in a row. Also, keep in mind that the Big Employment Situation number will be out Friday before the market open, so another big morning gap is possible. The big question is in which direction?

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Ho9s_S8GoGs”]Morning Market Prep Video[/button_2]

Difficult Decisions.

The open of the market today is presenting traders difficult decisions. Currently, the Dow Futures suggest around a 100 point gap up at the open. Will you dive in head first on a day the market closes early ahead of a holiday shutdown? Or, will you remain cautious and risk missing out on a possible market bottom? Certainly a difficult decision amid all the political uncertainty with the new tariffs taking effect on July 6th.

The open of the market today is presenting traders difficult decisions. Currently, the Dow Futures suggest around a 100 point gap up at the open. Will you dive in head first on a day the market closes early ahead of a holiday shutdown? Or, will you remain cautious and risk missing out on a possible market bottom? Certainly a difficult decision amid all the political uncertainty with the new tariffs taking effect on July 6th.

Trading is a marathon, not a sprint and I know if the market begins a rally there will more than enough opportunity for me to make money without having to chase a gap ahead of a holiday. We could see a bullish follow through on Thursday when trading resumes, but there is no question in my mind that it could just as easily reverse producing a bearish open on Thursday. As for my decision; Instead of adding risk I will be looking to take advantage of the morning gap by taking profits and reducing my market exposure ahead of the holiday shutdown. Your difficult decision awaits, plan your choice carefully.

On the Calendar

Ther are two potential market-moving reports on this short day of trading. The Motor Vehicle Sales report according to consensus will reach a 17.0 million annualized rate in June vs. the 16.9 million units in May. At 10:00 AM Eastern Factory Orders which includes data on non-durable goods expects to come in unchanged. The Redbook comes out at 8:55 AM but is not expected to have any price impacts on the market. Keep in mind the market will close early at 1:00 PM Eastern time in observance of Independence Day and will be closed all day Wednesday.

There are only six earnings reports today and looking over the list I would say none of the reports are likely to move the market.

Action Plan

It was nice to see the Bulls battle their way back after gaping sharply lower at the open. The good news is that all the major indexes held just slightly above prior lows. The bad news is that even with the rally all the indexes lacked the energy to break above current downtrends. The trend of big morning gaps looks to continue this morning with Dow Futures suggesting a gap up around 100 points. Keep in mind even with today’s morning gap the Dow will still be about 200 points below its 50-day average. The SPY looks to recover it’s 50-day average at the open while the QQQ and IWM successfully held above this key average.

As you know, I’m always cautious about large gap opens and the fact this one is occurring just before a major holiday and a short session only increases my level of caution. Remember volume is very likely to drop significantly after the morning rush. Rather than adding new risk, I would be more inclined to take advantage of the morning bullishness to take some profits ahead of the holiday shutdown. I wish you all a fantastic holiday as we celebrate our 242nd year of Independence.

Trade wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/UIEttJEhx70″]Morning Market Prep Video[/button_2]

Trading or gambling?

With all the political uncertainty and facing a mid-week holiday are we trading or gambling. We have had almost two weeks of significant daily gaps and whipsaws, and that trend looks continue this morning with about a 150 point gap down in the Dow. Unless you believe one of the countries involved in this tariff standoff throws up there hands and says, ‘you win, we give up.”, then it would seem that the erratic price action will continue to elevate risk.

With all the political uncertainty and facing a mid-week holiday are we trading or gambling. We have had almost two weeks of significant daily gaps and whipsaws, and that trend looks continue this morning with about a 150 point gap down in the Dow. Unless you believe one of the countries involved in this tariff standoff throws up there hands and says, ‘you win, we give up.”, then it would seem that the erratic price action will continue to elevate risk.

How much of your capital are you willing to risk when there is little to edge? I know standing aside is a very hard thing to do but if your capital continues to disappear in this environment. However, if you continue doing the same thing over and over why should you expect a different result? So I ask again, are we trading or gambling?

On the Calendar

We start this Holiday week with three potential market-moving reports on the Economic Calendar. At 9:45 AM Eastern the PMI Manufacturing Index seems may be losing a bit of momentum with a June reading of 54.6 with consensus pointing to tariff effects. The ISM Mfg. Index at 10:00 AM expects a slight decline to 58.3 in June vs. the 58.7 reading in May according to forecasters. Also at 10:00 AM consensus expects an increase of 1.8 in April with the overall number to be GDP positive up 0.6 percent in May. After that, we have three bond auctions to finish up the calendar day.

Action Plan

With new tariffs kicking in and the new threat of 300 billion more out of Europe my glad I exercised caution an avoided adding new risk ahead of the weekend. The uncertainty created by daily morning gaps has created a dangerous environment for swing and position traders. Add volatility to an already short holiday week where volumes will likely be light the risks for swing traders only grows. The fact is the current market enjoinment is more akin to gambling that it is to trading.

Currently, the Dow Futures indicate a gap down of nearly 150 points wiping out all of the Friday gains. It would seem a retest of the 6/28 lows is possible, maybe even lower if that doesn’t hold as support. With uncertainty so high I I’m already light in my account, and I think it highly unlikely that will change over the course of this entire week. Considering the holiday and the large daily gaps, I have no edge. If I wanted to gamble, I would go to Vegas where they would at least bring me free drinks for giving up my edge.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/DCjnMnXDeTo%20Publish%20UPLOADING%2032%25%20About%205%20minutes%20remaining.Some%20changes%20are%20not%20yet%20saved.%20Your%20video%20is%20still%20uploading.%20Please%20keep%20this%20page%20open%20until%20it’s%20done.%20Basic%20info%20Translations%20Advanced%20settings%20%20″]Morning Market Prep Video[/button_2]

Window Dressing?

With futures pointing to a positive open and the possibility of a little end of quarter window dressing remember to consider the weekend uncertainty and coming holiday as you plan your day. Volume could quickly decline, and price action may become choppy for the next few trading days. Remember the market closes Tuesday at 1:00 PM Eastern and is closed Wednesday to celebrate the 4th of the July.

With futures pointing to a positive open and the possibility of a little end of quarter window dressing remember to consider the weekend uncertainty and coming holiday as you plan your day. Volume could quickly decline, and price action may become choppy for the next few trading days. Remember the market closes Tuesday at 1:00 PM Eastern and is closed Wednesday to celebrate the 4th of the July.

Remember to use caution and watch for the possibility of whipsaw price action with the morning gap. Carefully consider how much risk you want to carry into the weekend with the trade war uncertainty and a mid-week holiday directly after. Even the best of the entry signals may find it difficult to find the energy to follow-through.

On the Calendar

We kick off the Friday Economic Calendar at 8:30 AM Eastern with the Personal Income and Outlays report. Consensus expects a personal income & consumer spending increase of 0.4 percent in May. The overall price index expects a year-on-year rate of 2.2 percent. At 9:45 AM, the Chicago PMI, expects a strong but slightly lower June consensus at 60.1 vs. the 62.7 May reading due to rising costs and trouble filling open jobs. The Consumer Sentiment number will remain very strong according to consensus which a June reading of 99.0. To wrap up the calendar month, we have the Baker-Hughes Rig Count at 1:00 PM which is unlikely to move the market.

On the Earnings Calendar, we have 11 companies expected to report results today. The most notable of the day is STZ which report before the open bell.

Action Plan

I read a report this morning that said the Futures are rising today due to easing trade tensions. That seems unlikely to me because I’ve seen no change in the pressure applied by the White House. Today is the last trading day of June, and the last day of the 2nd quarter, so the futures rally and be attributed to the end of quarter window dressing. Whatever the reason Dow Futures are currently pointing to gap up around 100 points. As you plan for the day, remember the rules about chasing a morning gap and watch the possibility of a whipsaw.

Also, keep in mind that today is a getaway day leading into the July 4th holiday. I would not be surprised to see volume begin to fall off quickly and choppy price action to begin until we get past the 4th. It would also be wise to think about how much risk you want to carry into the weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/BluroqW0Az0″]Morning Market Prep Video[/button_2]

A Big Whipsaw

Yesterday’s price action was just downright mean and nasty serving up a big whipsaw. It’s also provided a painful lesson that trying to pick a bottom often has severe consequences for swing and position traders. The fear is missing out is a very powerful emotion that causes a lot of damage to trading accounts and crushes a traders confidence. Morning gaps are the perfect scenario for creating a fear of missing out.

Yesterday’s price action was just downright mean and nasty serving up a big whipsaw. It’s also provided a painful lesson that trying to pick a bottom often has severe consequences for swing and position traders. The fear is missing out is a very powerful emotion that causes a lot of damage to trading accounts and crushes a traders confidence. Morning gaps are the perfect scenario for creating a fear of missing out.

To avoid this in the future, a trader needs a good set of rules and the discipline to follow them. It’s the discipline that key here and much harder to master than simply writing some rules. First, avoid chasing morning gaps especially when they are opposite the overall trend. They are the perfect breeding ground for a whipsaw to occur. Wait for a trend to break and then watch for proof off follow-through price action in supporting the breakout before considering an entry. Sure you might miss a quick rally from time to time, but you also break the nasty and embarrassing habit of bottom picking.

On the Calendar

A full calendar day this Thursday but only two potential market-moving reports at 8:30 AM Eastern. GDP gets the ball rolling coming in at 2.2 percent annualized rate with Consumer sending unchanged at 1.0 percent according to consensus. The GDP price index is also expected to remain flat at 1.9 percent. Next is the Weekly Jobless Claims that are expected to continue to show strong labor demand with a reading of 220,000. Corporate Profits @ 8:30, Consumer Comfort @ 9:45, Nat. Gas Report @ 10:30, one Fed Speaker @ 10:45, Kansas City Mfg. Index @ 11:00, 4 Bound events, Farm Prices @ 3:00 PM, Fed Balance Sheet & Mondy Supply @ 4:30 PM to wrap up the day.

We have 18 companies on the Earnings Calendar today with the most notable coming in after the bell with NKE and KBR reporting.

Action Plan

With the news that the Trump tech restrictions would not be a severe as anticipated Futures staged a sharp rally just before the market open. The sudden bullishness translated into the Dow rallying nearly 200 points in the morning session. Unfortunately, the Bulls were unable to hold the gains, and the indexes suffered a nasty whipsaw creating new daily lows in all four major indexes. Traders that rushed in on the news trying to pick the bottom got punished for doing and harshly reminded that bottom picking has a costly consequence.

Currently, Futures are pointing to a modestly bullish open, but I will continue to recommend caution for any long trades until the Bulls can break the downtrends and hold them as support. If you’re already short watch for clues to take some profits but for goodness sake, don’t chase short positions this late in the move. Keep in mind the weekend is fast approaching and as political uncertainty continues to weigh heavily on the market consider how much risk your willing to carry into next week.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/tn6Pj5J-7qg”]Morning Market Prep Video[/button_2]

Pressure to Trade.

Sitting in front of your computer running scans and flipping through charts it’s easy to feel under pressure to trade. As we sift through charts in a mad dash to find a trade we often fail to remember the condition of the overall market. Currently, the market is under pressure and is in a short-term downtrend. None of the major indexes produce a buy signal yesterday, and in fact, they all remained within their downtrends, and nothing changed the cloud of uncertainty that’s weighing on the market.

Sitting in front of your computer running scans and flipping through charts it’s easy to feel under pressure to trade. As we sift through charts in a mad dash to find a trade we often fail to remember the condition of the overall market. Currently, the market is under pressure and is in a short-term downtrend. None of the major indexes produce a buy signal yesterday, and in fact, they all remained within their downtrends, and nothing changed the cloud of uncertainty that’s weighing on the market.

Patience and discipline are key qualities that all traders must possess. As your looking for trade-able charts, make sure you are assessing the overall market condition. Do you have an edge or are you a giving up your edge by forcing trades when the market is not favorable for your positions? Remember trading is a marathon, not a sprint.

On the Calendar

The Wednesday Economic Calendar gets going with market-moving reports at 8:30 AM Eastern with Durable Goods Orders. Consensus expects growth in with core capital goods orders increasing a modest 0.2 percent gain with ex-transportation numbers coming in up 0.5% in May. Also at 8:30 AM is International Trade in Goods where forecasters expect the deficit to widen to 68. Billion in May vs. the 67.3 billion reading in March. Pending Home Sales at 10:00 AM expect an increase of 0.6 percent in May but remaining overall flat for the year. Then at 10:30 AM the last market-morning report of the day comes from the un-forecast EIA Petroleum Status Index. Other than that we have Retail inventories & Wholesale Inventories @ 8:30 AM, two Fed Speakers at 11:00 AM & 12:15 PM and two Bond Auctions.

We have 20 companies on the Earnings Calendar today expected to report results. Among those reporting PAYX, MON, GIS report before the bell while RAD, PIR, and BBBY report after the close.

Action Plan

With the modest bounce in the indexes, it was tempting to forget about trade war tensions and want to buy into the dip. I continued to repeat the need for caution and as for myself added no new positions. Sadly that appears to have been the right decision with the Dow Futures pointing to another gap down of more than 100 points at the open. With a busy Economic Calendar and a few Earnings reports before the bell that could certainly improve or get worse before the open.

I will need to see more conviction from the Bulls to enter new long trades, and I will matain stick to my rules and resist chasing into short trades that have already made significant moves lower. Trading is a marathon, not a sprint and you don’t have to trade every day to be successful as a trader. Avoid anticipating or predicting bottoms and wait until price action confirms good entries. Remember cash is a position and in times of market uncertainty, it may be the best position especially if you’re an inexperienced trader.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/VODy5pIMT_w”]Morning Market Prep Video[/button_2]

An Ugly Day

Yesterday was clearly an ugly day for the market with many stocks suffering there biggest selloff this year. At the end of the day, even the strongest of the indexes suffered technical damage that will likely take weeks if not months to repair. With trade tensions still growing we can’t rule out additional shock waves occurring so trade with caution and discipline.

Yesterday was clearly an ugly day for the market with many stocks suffering there biggest selloff this year. At the end of the day, even the strongest of the indexes suffered technical damage that will likely take weeks if not months to repair. With trade tensions still growing we can’t rule out additional shock waves occurring so trade with caution and discipline.

Although an ugly day there was a silver lining in a few sectors as traders rotate toward safety. Consumer defensive, consumer staples, utilities and high dividend paying stocks are showing some positive signs, but you will have to choose carefully. Domestic companies with less exposure to tariffs vs. international companies that could experience more shock waves as trade tensions continue to grow.

On the Calendar

There are two potential market-moving reports on Tuesday’s Economic Calendar. The first is the Case-Shiller at 9:00 AM Eastern which consensus expects a gain of 0.5 percent with the year-on-year number holding 6.8 percent. Secondly, the 10:00 AM Consumer Confidence expects a steady strength of 128.1 in May according to consensus. Events not expected to move the market included Redbook @ 8:55 AM, Richmond Fed Mfg. Index & State Street Investor Confidence @ 10:00 AM, two Bond Auctions & two Fed Speakers.

The Earnings Calendar shows 13 companies reporting results today with FDS and LEN before the bell. After the bell, we will hear from JMBA and SONC.

Action Plan

After a rough day selling with all four major indexes suffering technical damage, caution an restraint should be considered. You might be thinking now is the time to jump in and pick up some deals and you might be right. However, don’t anticipate a wait for good signals of buyers stepping in before rushing into trades. Yesterday could have been an overreaction by the market, but keep in mind the uncertainty surrounding trade is far from over and the next shock wave may only be a news report away. Having broken uptrends any rally back up should be watched closely for the possibility of failure at or near price resistance levels.

There seems to be a rotation to the defensive sector, consumer staples sector, and high dividend paying stocks such as utilities as investors look for a little safety. Also, keep an eye on domestic companies as they may be less impacted by tariffs. Currently, the Dow futures are pointing to a flat to slightly bearish open. A resting day with choppy price action would not be out of the question. Better days will eventually return, but there could be a lot of very challenging days yet to come. Third quarter earnings are just 2 or 3 weeks away, but until then its likely trade war jitters will continue to be the driving force of the market.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/jJqfNtdYR74″]Morning Market Prep Video[/button_2]

It’s always nice when we see the bulls step up and take charge breaking prices through resistance levels. However, we can sometimes have too much of a good thing moving too far to fast. I’m not suggesting that happened yesterday but, I do think its wise to consider the possibility. That means I must stay focused and flexible being very careful not to by stocks near resistance levels and watching for signs of profit taking.

It’s always nice when we see the bulls step up and take charge breaking prices through resistance levels. However, we can sometimes have too much of a good thing moving too far to fast. I’m not suggesting that happened yesterday but, I do think its wise to consider the possibility. That means I must stay focused and flexible being very careful not to by stocks near resistance levels and watching for signs of profit taking.