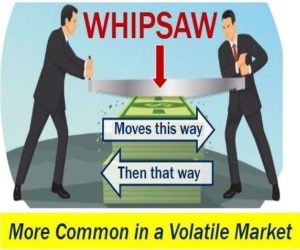

A Big Whipsaw

Yesterday’s price action was just downright mean and nasty serving up a big whipsaw. It’s also provided a painful lesson that trying to pick a bottom often has severe consequences for swing and position traders. The fear is missing out is a very powerful emotion that causes a lot of damage to trading accounts and crushes a traders confidence. Morning gaps are the perfect scenario for creating a fear of missing out.

Yesterday’s price action was just downright mean and nasty serving up a big whipsaw. It’s also provided a painful lesson that trying to pick a bottom often has severe consequences for swing and position traders. The fear is missing out is a very powerful emotion that causes a lot of damage to trading accounts and crushes a traders confidence. Morning gaps are the perfect scenario for creating a fear of missing out.

To avoid this in the future, a trader needs a good set of rules and the discipline to follow them. It’s the discipline that key here and much harder to master than simply writing some rules. First, avoid chasing morning gaps especially when they are opposite the overall trend. They are the perfect breeding ground for a whipsaw to occur. Wait for a trend to break and then watch for proof off follow-through price action in supporting the breakout before considering an entry. Sure you might miss a quick rally from time to time, but you also break the nasty and embarrassing habit of bottom picking.

On the Calendar

A full calendar day this Thursday but only two potential market-moving reports at 8:30 AM Eastern. GDP gets the ball rolling coming in at 2.2 percent annualized rate with Consumer sending unchanged at 1.0 percent according to consensus. The GDP price index is also expected to remain flat at 1.9 percent. Next is the Weekly Jobless Claims that are expected to continue to show strong labor demand with a reading of 220,000. Corporate Profits @ 8:30, Consumer Comfort @ 9:45, Nat. Gas Report @ 10:30, one Fed Speaker @ 10:45, Kansas City Mfg. Index @ 11:00, 4 Bound events, Farm Prices @ 3:00 PM, Fed Balance Sheet & Mondy Supply @ 4:30 PM to wrap up the day.

We have 18 companies on the Earnings Calendar today with the most notable coming in after the bell with NKE and KBR reporting.

Action Plan

With the news that the Trump tech restrictions would not be a severe as anticipated Futures staged a sharp rally just before the market open. The sudden bullishness translated into the Dow rallying nearly 200 points in the morning session. Unfortunately, the Bulls were unable to hold the gains, and the indexes suffered a nasty whipsaw creating new daily lows in all four major indexes. Traders that rushed in on the news trying to pick the bottom got punished for doing and harshly reminded that bottom picking has a costly consequence.

Currently, Futures are pointing to a modestly bullish open, but I will continue to recommend caution for any long trades until the Bulls can break the downtrends and hold them as support. If you’re already short watch for clues to take some profits but for goodness sake, don’t chase short positions this late in the move. Keep in mind the weekend is fast approaching and as political uncertainty continues to weigh heavily on the market consider how much risk your willing to carry into next week.

Trade Wisely,

Doug

Comments are closed.